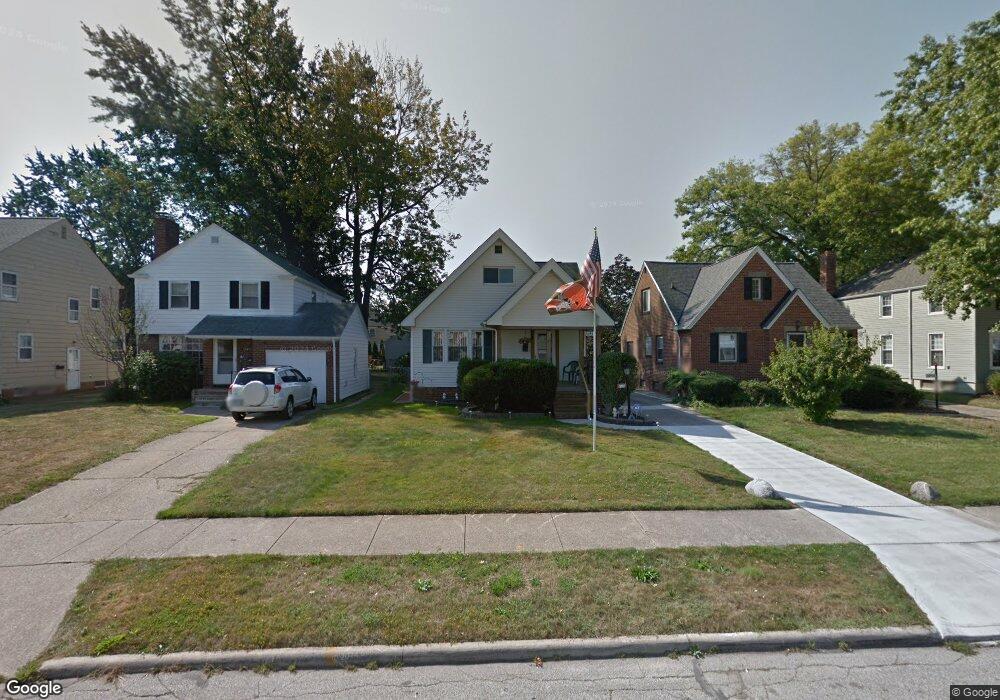

26430 Oriole Ave Euclid, OH 44132

Estimated Value: $132,515 - $158,000

3

Beds

1

Bath

1,312

Sq Ft

$113/Sq Ft

Est. Value

About This Home

This home is located at 26430 Oriole Ave, Euclid, OH 44132 and is currently estimated at $148,879, approximately $113 per square foot. 26430 Oriole Ave is a home located in Cuyahoga County with nearby schools including Shoreview Elementary School, Euclid High School, and Ss. Robert & William Catholic School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 27, 2002

Sold by

Mccloskey Rosemary P

Bought by

Mccloskey Stephen M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$67,000

Outstanding Balance

$28,600

Interest Rate

6.54%

Estimated Equity

$120,279

Purchase Details

Closed on

Sep 30, 1998

Sold by

Rochford Constance Bieshada

Bought by

Mccloskey Rosemary P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$69,750

Interest Rate

6.98%

Purchase Details

Closed on

Jul 1, 1992

Sold by

Bieshada Alfred E and Bieshada Kathryn A

Bought by

Bieshada Alfred

Purchase Details

Closed on

Jan 1, 1975

Bought by

Bieshada Alfred E and Bieshada Kathryn A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mccloskey Stephen M | $83,800 | -- | |

| Mccloskey Rosemary P | $77,500 | Enterprise Title Agency Inc | |

| Bieshada Alfred | -- | -- | |

| Bieshada Alfred E | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mccloskey Stephen M | $67,000 | |

| Closed | Mccloskey Rosemary P | $69,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,065 | $44,450 | $8,330 | $36,120 |

| 2023 | $2,672 | $30,770 | $6,340 | $24,430 |

| 2022 | $2,612 | $30,770 | $6,340 | $24,430 |

| 2021 | $2,908 | $30,770 | $6,340 | $24,430 |

| 2020 | $2,759 | $26,530 | $5,460 | $21,070 |

| 2019 | $2,480 | $75,800 | $15,600 | $60,200 |

| 2018 | $2,473 | $26,530 | $5,460 | $21,070 |

| 2017 | $2,649 | $23,460 | $4,520 | $18,940 |

| 2016 | $2,654 | $23,460 | $4,520 | $18,940 |

| 2015 | $5,390 | $23,460 | $4,520 | $18,940 |

| 2014 | $5,390 | $23,460 | $4,520 | $18,940 |

Source: Public Records

Map

Nearby Homes

- 26471 Shoreview Ave

- 26230 Oriole Ave

- 26171 Shoreview Ave

- 405 E 262nd St

- 26471 Farringdon Ave

- 26351 Farringdon Ave

- 415 E 266th St

- 355 E 262nd St

- 27101 Zeman Ave

- 27190 Shoreview Ave

- 635 E 261st St

- 25650 Shoreview Ave

- 440 E 271st St

- 712 E 266th St

- 461 E 271st St

- 325 E 257th St

- 640 E 261st St

- 26430 Drakefield Ave

- 25671 Farringdon Ave

- 327 E 255th St

- 26450 Oriole Ave

- 26400 Oriole Ave

- 26480 Oriole Ave

- 26378 Oriole Ave

- 26500 Oriole Ave

- 26451 Mallard Ave

- 26431 Mallard Ave

- 26461 Mallard Ave

- 26401 Mallard Ave

- 26381 Mallard Ave

- 26530 Oriole Ave

- 26471 Mallard Ave

- 26431 Oriole Ave

- 26451 Oriole Ave

- 26501 Mallard Ave

- 26351 Mallard Ave

- 26401 Oriole Ave

- 26481 Oriole Ave

- 26320 Oriole Ave

- 26550 Oriole Ave