268 County Road 4372 Decatur, TX 76234

Estimated Value: $710,732 - $802,000

--

Bed

1

Bath

3,108

Sq Ft

$243/Sq Ft

Est. Value

About This Home

This home is located at 268 County Road 4372, Decatur, TX 76234 and is currently estimated at $756,366, approximately $243 per square foot. 268 County Road 4372 is a home located in Wise County with nearby schools including Boyd Elementary School, Boyd Middle School, and Boyd High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 27, 2023

Sold by

Smitheal Robert W and Smitheal Marla S

Bought by

Niemuth Rodney and Niemuth Elizabeth

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$580,000

Outstanding Balance

$567,148

Interest Rate

6.96%

Mortgage Type

New Conventional

Estimated Equity

$189,218

Purchase Details

Closed on

Nov 15, 2018

Sold by

Dodson Nancy and Dodson Michael J

Bought by

Smitheal Robert W and Smitheal Maria S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$412,775

Interest Rate

4.7%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 13, 2016

Sold by

Dodson Bill

Bought by

Dodson Nancy J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Niemuth Rodney | -- | Title Forward | |

| Smitheal Robert W | -- | None Available | |

| Dodson Nancy J | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Niemuth Rodney | $580,000 | |

| Previous Owner | Smitheal Robert W | $412,775 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,444 | $529,052 | $30,594 | $498,458 |

| 2024 | $5,444 | $534,686 | $27,032 | $507,654 |

| 2023 | $6,423 | $537,721 | $0 | $0 |

| 2022 | $4,534 | $363,303 | $0 | $0 |

| 2021 | $4,534 | $444,500 | $178,840 | $265,660 |

| 2020 | $4,301 | $420,050 | $168,580 | $251,470 |

| 2019 | $4,556 | $418,370 | $168,580 | $249,790 |

| 2018 | $84 | $122,290 | $118,030 | $4,260 |

| 2017 | $85 | $95,210 | $90,900 | $4,310 |

| 2016 | $89 | $77,090 | $72,780 | $4,310 |

| 2015 | -- | $72,690 | $68,270 | $4,420 |

| 2014 | -- | $5,120 | $640 | $4,480 |

Source: Public Records

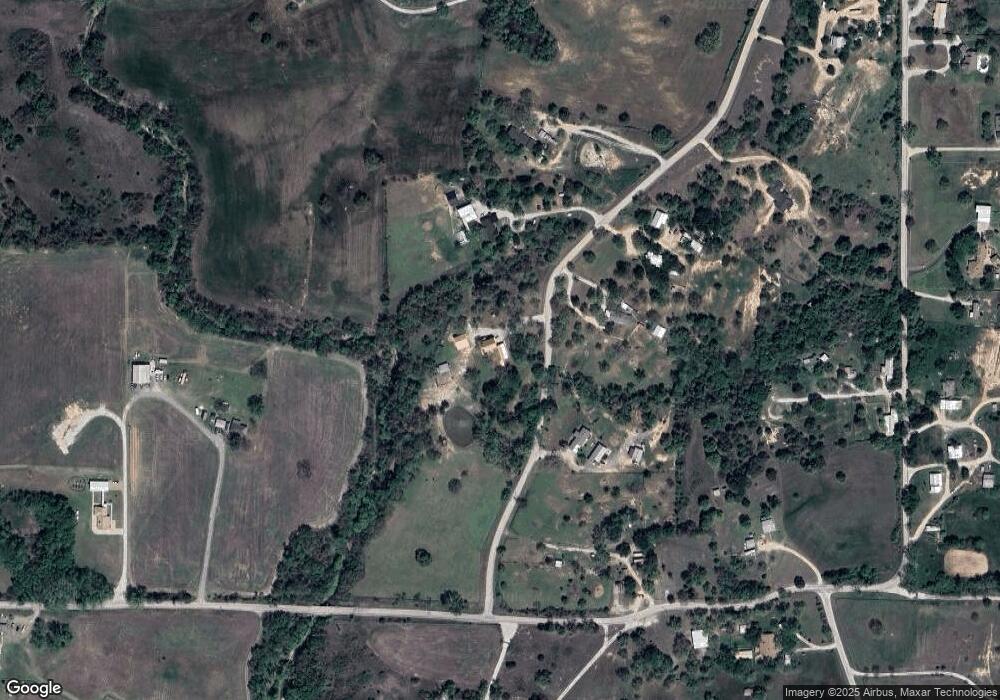

Map

Nearby Homes

- 177 Private Road 4394

- 2150 County Road 4371

- 2160 County Road 4371

- 0 County Road 4371

- 540 County Road 4470

- 360 County Road 4358

- 000 County Road 4360

- 265 County Road 4374

- 5549 S Fm 730

- 941 County Road 4270

- 149 Highgate Ct

- 120 Parkview Ln

- 132 Parkview Ln

- Caleb Plan at Highland Oaks

- Camden Plan at Highland Oaks

- Carson Plan at Highland Oaks

- Caitlyn Plan at Highland Oaks

- Connor Plan at Highland Oaks

- Caitlyn II Plan at Highland Oaks

- Catherine Plan at Highland Oaks

- 268 County Road 4372

- 223 County Road 4372

- 208 County Road 4372

- 178 County Road 4372

- 311 County Road 4372

- 1564 County Road 4371

- 1564 County Road 4371

- 1782 County Road 4371

- 1782 County Road 4371

- 1356 Cr-4371

- 1462 County Road 4371

- 1356 County Road 4371

- 108 County Road 4377

- 25ACRE County Road 4371

- 1806 County Road 4371

- 1594 County Road 4371

- 1475 County Road 4371

- 1523 County Road 4371

- 117 County Road 4372

- 117 County Road 4372