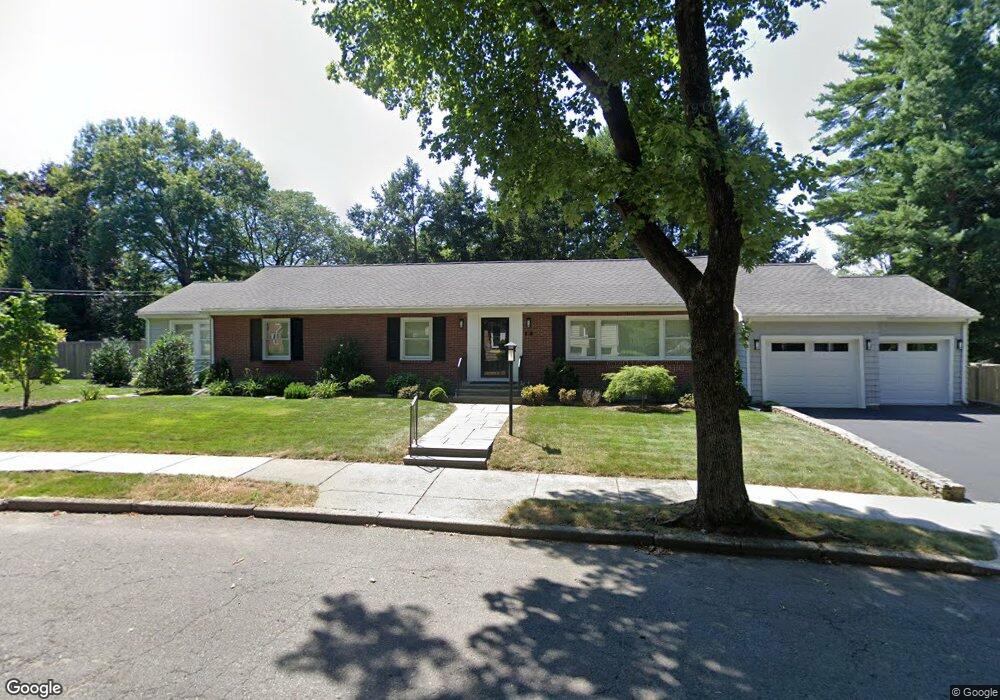

27 Judith Rd Newton Center, MA 02459

Newton Centre NeighborhoodEstimated Value: $1,620,000 - $1,876,000

3

Beds

3

Baths

2,093

Sq Ft

$848/Sq Ft

Est. Value

About This Home

This home is located at 27 Judith Rd, Newton Center, MA 02459 and is currently estimated at $1,775,142, approximately $848 per square foot. 27 Judith Rd is a home located in Middlesex County with nearby schools including Mason Rice Elementary School, Charles E Brown Middle School, and Newton North High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 2, 2015

Sold by

Majewski Gerald L

Bought by

Gerald L Majewski Ft and Majewski Gerald L

Current Estimated Value

Purchase Details

Closed on

Nov 20, 2014

Sold by

Majewski Elizabeth A

Bought by

Elizabeth A Majewski F

Purchase Details

Closed on

Aug 31, 2009

Sold by

Wiesen Joel Peter

Bought by

Majewski Gerald L and Majewski Elizabeth A

Purchase Details

Closed on

Aug 26, 1997

Sold by

Rosenberg Ronald

Bought by

Wiesen Joel P and Wiesen Laura J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$210,000

Interest Rate

7.42%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gerald L Majewski Ft | -- | -- | |

| Majewski Gerald L | -- | -- | |

| Elizabeth A Majewski F | -- | -- | |

| Majewski Elizabeth A | -- | -- | |

| Majewski Gerald L | $700,000 | -- | |

| Wiesen Joel P | $392,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Wiesen Joel P | $50,000 | |

| Previous Owner | Wiesen Joel P | $210,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $13,500 | $1,377,600 | $1,290,700 | $86,900 |

| 2024 | $13,054 | $1,337,500 | $1,253,100 | $84,400 |

| 2023 | $12,274 | $1,205,700 | $965,300 | $240,400 |

| 2022 | $11,745 | $1,116,400 | $893,800 | $222,600 |

| 2021 | $11,332 | $1,053,200 | $843,200 | $210,000 |

| 2020 | $10,995 | $1,053,200 | $843,200 | $210,000 |

| 2019 | $10,685 | $1,022,500 | $818,600 | $203,900 |

| 2018 | $10,170 | $939,900 | $735,700 | $204,200 |

| 2017 | $9,860 | $886,700 | $694,100 | $192,600 |

| 2016 | $9,431 | $828,700 | $648,700 | $180,000 |

| 2015 | $8,992 | $774,500 | $606,300 | $168,200 |

Source: Public Records

Map

Nearby Homes

- 54 Garland Rd

- 1114 Beacon St Unit 106

- 1114 Beacon St Unit 203

- 1114 Beacon St Unit 111

- 1114 Beacon St Unit 206

- 1114 Beacon St Unit 104

- 1114 Beacon St Unit 207

- 61 Lakeview Ave

- 887 Commonwealth Ave

- 26 Wilson Cir Unit 26

- Lots 2 & 3 Chapin Rd

- Lot 3 Chapin Rd

- Lot 2 Chapin Rd

- 28 Wilson Cir Unit 28

- 32 Wilson Cir Unit 32

- 34 Morton Rd

- 956 Walnut St Unit 4

- 956 Walnut St Unit 7

- 956 Walnut St Unit 6

- 3 Cedar St