2703 14th Ct Unit 2 Palm Harbor, FL 34684

Estimated Value: $224,314 - $276,000

2

Beds

3

Baths

1,344

Sq Ft

$191/Sq Ft

Est. Value

About This Home

This home is located at 2703 14th Ct Unit 2, Palm Harbor, FL 34684 and is currently estimated at $257,329, approximately $191 per square foot. 2703 14th Ct Unit 2 is a home located in Pinellas County with nearby schools including Lake St. George Elementary School, Countryside High School, and Palm Harbor Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 31, 2002

Sold by

Nelson Todd D

Bought by

Novotnak Lorraine

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$88,350

Outstanding Balance

$37,609

Interest Rate

5.99%

Estimated Equity

$219,720

Purchase Details

Closed on

Oct 31, 1996

Sold by

Maida Kenneth and Maida Carol

Bought by

Nelson Todd D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$52,000

Interest Rate

8.15%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Novotnak Lorraine | $93,000 | Liberty Title Agency | |

| Nelson Todd D | $65,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Novotnak Lorraine | $88,350 | |

| Previous Owner | Nelson Todd D | $12,000 | |

| Previous Owner | Nelson Todd D | $57,750 | |

| Previous Owner | Nelson Todd D | $52,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $764 | $79,802 | -- | -- |

| 2023 | $764 | $77,478 | $0 | $0 |

| 2022 | $723 | $75,221 | $0 | $0 |

| 2021 | $737 | $73,030 | $0 | $0 |

| 2020 | $740 | $72,022 | $0 | $0 |

| 2019 | $737 | $70,403 | $0 | $0 |

| 2018 | $735 | $69,090 | $0 | $0 |

| 2017 | $738 | $67,669 | $0 | $0 |

| 2016 | $741 | $66,277 | $0 | $0 |

| 2015 | $709 | $65,816 | $0 | $0 |

| 2014 | $707 | $65,294 | $0 | $0 |

Source: Public Records

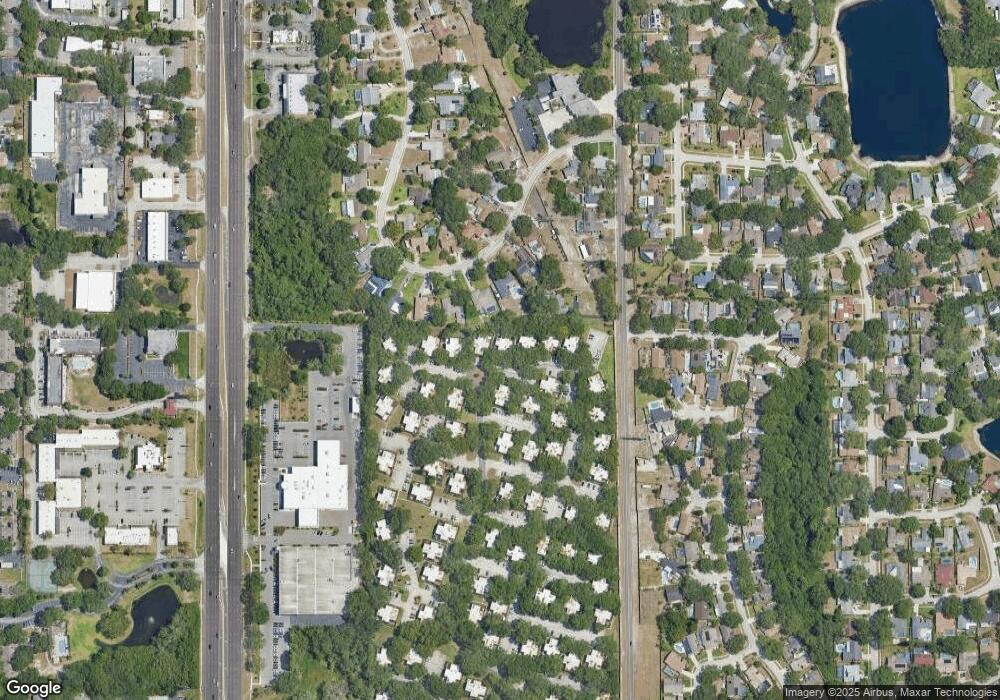

Map

Nearby Homes

- 2727 14th Ct

- 251 Dunbridge Dr

- 2712 12th Ct

- 2725 11th Ct

- 2706 11th Ct

- 2722 11th Ct Unit 50A

- 2716 11th Ct

- 2611 6th Ct

- 2702 5th Ct

- 2601 2nd Ct

- 2605 2nd Ct

- 4765 Lake Valencia Blvd W

- 105 Dunbridge Dr

- 2626 2nd Ct

- 632 Channing Dr

- 4907 Parson Brown Ln

- 2826 Kavalier Dr

- 674 Channing Dr

- 712 1st Ct

- 4936 Mineola Place