Estimated Value: $184,000 - $241,000

--

Bed

--

Bath

891

Sq Ft

$234/Sq Ft

Est. Value

About This Home

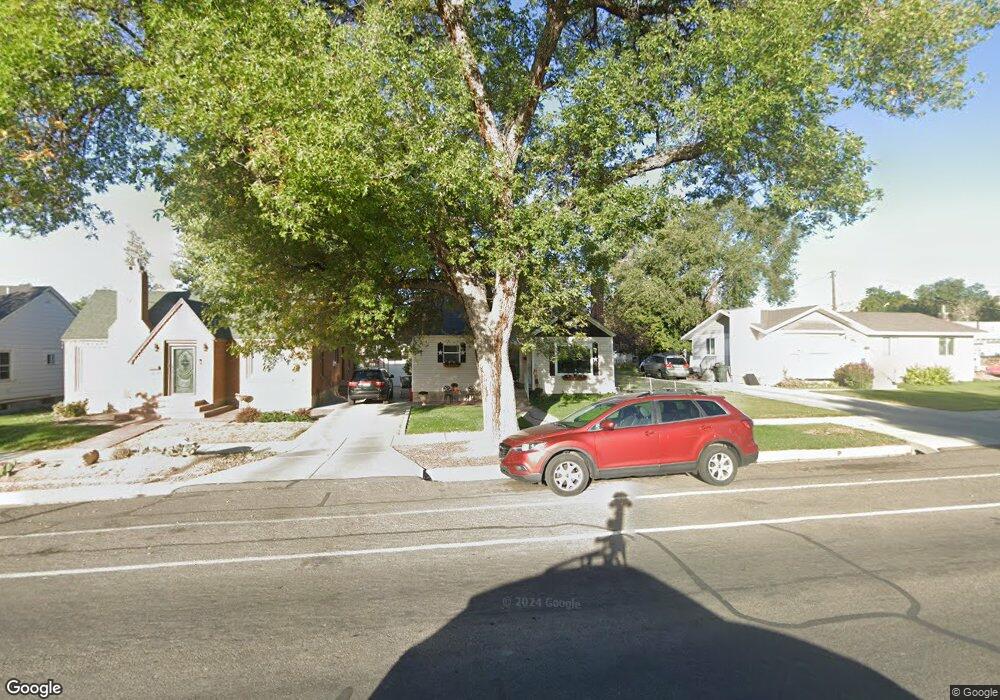

This home is located at 271 N 400 E, Price, UT 84501 and is currently estimated at $208,697, approximately $234 per square foot. 271 N 400 E is a home located in Carbon County with nearby schools including Castle Heights School, Mont Harmon Junior High School, and Carbon High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 30, 2013

Sold by

Milovich Nicholas P

Bought by

Milovich Nicholas P and Milovich Miranda

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$127,551

Outstanding Balance

$89,666

Interest Rate

3.38%

Mortgage Type

New Conventional

Estimated Equity

$119,031

Purchase Details

Closed on

Jun 4, 2008

Sold by

Teuscher Chris L and Teuscher Dee Dee A

Bought by

Teuscher Chris L and Gomez Teuscher Dee Dee A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$125,352

Interest Rate

6%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Milovich Nicholas P | -- | Professional Title Services | |

| Milovich Nicholas P | -- | Professional Title Services | |

| Teuscher Chris L | -- | South Eastern Utah Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Milovich Nicholas P | $127,551 | |

| Previous Owner | Teuscher Chris L | $125,352 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $799 | $65,800 | $10,226 | $55,574 |

| 2024 | $960 | $79,930 | $10,725 | $69,205 |

| 2023 | $1,189 | $105,540 | $12,393 | $93,147 |

| 2022 | $1,238 | $98,591 | $10,304 | $88,287 |

| 2021 | $1,068 | $132,064 | $15,744 | $116,320 |

| 2020 | $1,049 | $65,105 | $0 | $0 |

| 2019 | $936 | $60,881 | $0 | $0 |

| 2018 | $906 | $60,135 | $0 | $0 |

| 2017 | $895 | $60,135 | $0 | $0 |

| 2016 | $807 | $60,135 | $0 | $0 |

| 2015 | $807 | $60,135 | $0 | $0 |

| 2014 | $802 | $60,135 | $0 | $0 |

| 2013 | -- | $49,197 | $0 | $0 |

Source: Public Records

Map

Nearby Homes