2715 10th Ct SE Olympia, WA 98501

Estimated Value: $604,000 - $630,342

4

Beds

3

Baths

2,495

Sq Ft

$248/Sq Ft

Est. Value

About This Home

This home is located at 2715 10th Ct SE, Olympia, WA 98501 and is currently estimated at $619,086, approximately $248 per square foot. 2715 10th Ct SE is a home located in Thurston County with nearby schools including Madison Elementary School, Reeves Middle School, and Avanti High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 11, 2009

Sold by

Adarmes Demitri A and Adarmes Carolyn J

Bought by

Helsley Colin S and Helsley Heidi L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$260,000

Outstanding Balance

$168,481

Interest Rate

5.09%

Mortgage Type

New Conventional

Estimated Equity

$450,605

Purchase Details

Closed on

Sep 26, 2005

Sold by

Tronie Corp

Bought by

Adarmes Demitri A and Adarmes Carolyn J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$245,600

Interest Rate

5.72%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Helsley Colin S | $325,000 | Chicago Title Company | |

| Adarmes Demitri A | $307,000 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Helsley Colin S | $260,000 | |

| Previous Owner | Adarmes Demitri A | $245,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,961 | $548,700 | $142,700 | $406,000 |

| 2023 | $5,961 | $570,000 | $139,900 | $430,100 |

| 2022 | $5,305 | $538,000 | $83,900 | $454,100 |

| 2021 | $4,851 | $444,000 | $72,200 | $371,800 |

| 2020 | $4,877 | $375,700 | $83,900 | $291,800 |

| 2019 | $4,421 | $366,100 | $72,200 | $293,900 |

| 2018 | $4,577 | $337,300 | $51,800 | $285,500 |

| 2017 | $4,213 | $334,050 | $52,050 | $282,000 |

| 2016 | $3,851 | $322,100 | $51,400 | $270,700 |

| 2014 | -- | $305,200 | $53,400 | $251,800 |

Source: Public Records

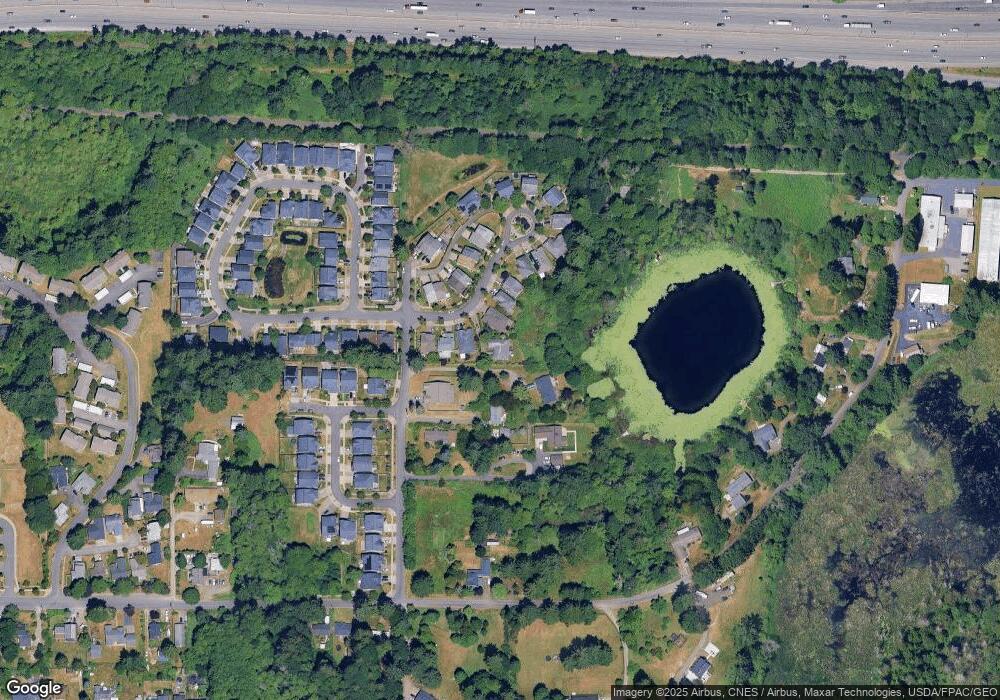

Map

Nearby Homes

- 2730 10th Ct SE

- 2528 10th Ct SE

- 1305 Dayton St SE

- 1103 Creekwood Ct SE

- 818 Burr Rd SE Unit 25

- 2221 15th Ave SE

- 1541 Amethyst St SE

- 509 Dehart Dr SE

- 1816 Chipman St SE Unit A&B

- 1812 Amhurst St SE

- 1820 Chipman St SE Unit A&B

- 1910 van Epps St SE

- 3014 21st Ave SE

- 120 Pattison St NE

- 1720 Wilson St SE

- 2418 22nd Ave SE

- 334 Devoe St NE

- 2323 Olympia Ave NE

- 2306 Boulevard Rd SE

- 2517 Prospect Ave NE

- 2723 10th Ct SE

- 2711 10th Ct SE

- 2727 10th Ct SE

- 2707 10th Ct SE

- 2731 10th Ct SE

- 2703 10th Ct SE

- 1218 Smith St SE

- 2720 10th Ct SE

- 1212 Smith St SE

- 2710 10th Ct SE

- 2735 10th Ct SE

- 2726 10th Ct SE

- 2706 10th Ct SE

- 1228 Smith St SE

- 2739 10th Ct SE

- 2734 10th Ct SE

- 2736 10th Ct SE

- 2649 10th Ct SE

- 1048 Smith St SE

- 1206 Smith St SE