Estimated Value: $218,000 - $280,000

3

Beds

2

Baths

1,640

Sq Ft

$151/Sq Ft

Est. Value

About This Home

This home is located at 27184 N 2400 East Rd, Odell, IL 60460 and is currently estimated at $248,026, approximately $151 per square foot. 27184 N 2400 East Rd is a home located in Livingston County with nearby schools including Odell Grade School and Pontiac High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 4, 2019

Sold by

Shaw Bryan L and Shaw Kathryn M

Bought by

Clay Adam R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$198,000

Outstanding Balance

$174,090

Interest Rate

4.1%

Mortgage Type

VA

Estimated Equity

$73,936

Purchase Details

Closed on

Dec 3, 2014

Sold by

John W John W and Broquard Wesley W

Bought by

Shaw Bryal L and Shaw Kathryn M

Purchase Details

Closed on

Jun 21, 2011

Sold by

Ioerger Stave D and Ioerger Willa J

Bought by

Morse John W and Broquard Wesley W

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$138,400

Interest Rate

4.54%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Clay Adam R | $198,000 | Fidelity National Title Ins | |

| Shaw Bryal L | $173,000 | -- | |

| Morse John W | $173,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Clay Adam R | $198,000 | |

| Previous Owner | Morse John W | $138,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,158 | $78,429 | $7,870 | $70,559 |

| 2023 | $4,703 | $71,624 | $7,187 | $64,437 |

| 2022 | $4,748 | $70,797 | $7,187 | $63,610 |

| 2021 | $4,607 | $68,735 | $6,978 | $61,757 |

| 2020 | $4,640 | $68,055 | $6,909 | $61,146 |

| 2019 | $4,820 | $64,629 | $6,561 | $58,068 |

| 2018 | $4,659 | $58,890 | $7,098 | $51,792 |

| 2017 | $4,359 | $54,177 | $6,530 | $47,647 |

| 2016 | $4,204 | $51,158 | $6,166 | $44,992 |

| 2015 | $4,332 | $51,937 | $6,260 | $45,677 |

| 2013 | $3,616 | $40,684 | $6,688 | $33,996 |

Source: Public Records

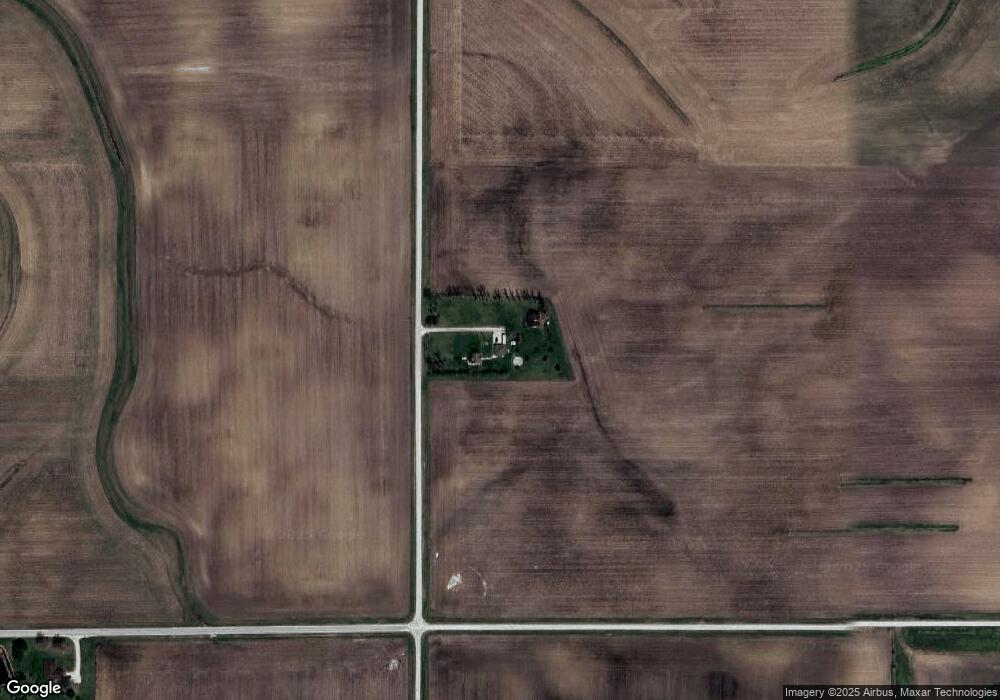

Map

Nearby Homes

- 22998 E 2800 Rd N

- 506 Boxelder St

- 313 E George St

- 200 N Front St

- 8 Fraher Dr

- 205 W Henry St

- 25033 E 3000 North Rd

- 307 W Elk St

- 21416 E 2300 North Rd

- 25435 E 3100 North Rd

- 000 Lincoln St

- 403 W James St

- 207 W Williams St

- 305 Prospect Ave

- 311 W Chippewa St

- 113 W Delaware St

- 502 S Union St

- 212 E Chippewa St

- 206 W Seminole St

- 124 W Seminole St