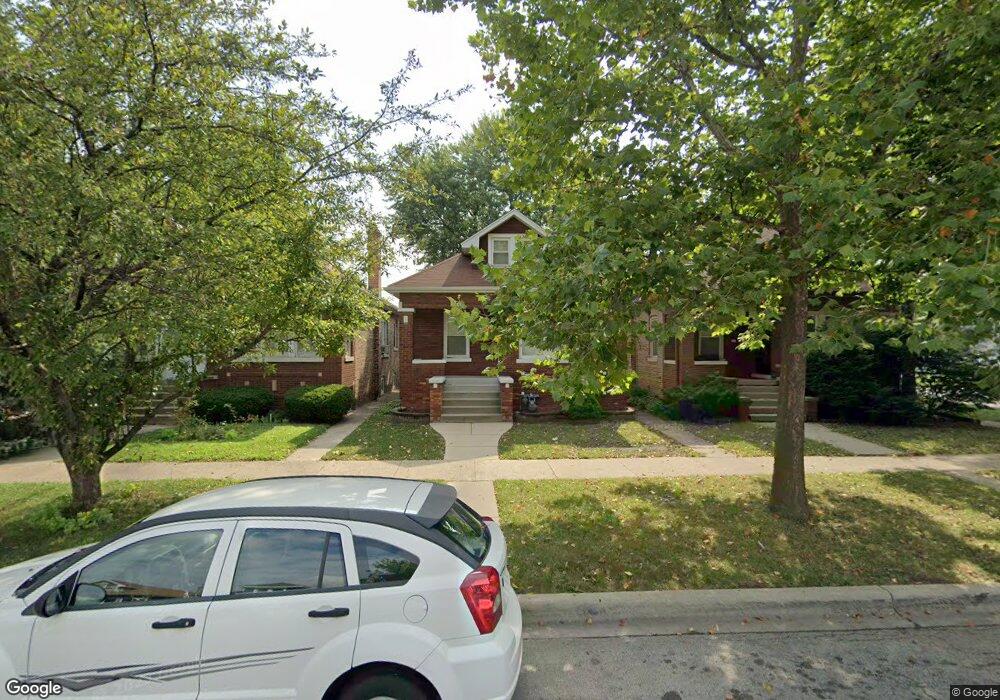

2745 Euclid Ave Berwyn, IL 60402

Estimated Value: $284,000 - $327,000

3

Beds

2

Baths

910

Sq Ft

$331/Sq Ft

Est. Value

About This Home

This home is located at 2745 Euclid Ave, Berwyn, IL 60402 and is currently estimated at $300,857, approximately $330 per square foot. 2745 Euclid Ave is a home located in Cook County with nearby schools including Charles E. Piper School, Freedom Middle School, and J. Sterling Morton High School West.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 24, 2006

Sold by

Alvarez Luis and Alvarez Norma

Bought by

Espinoza Rosa

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$183,200

Outstanding Balance

$113,606

Interest Rate

7.87%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$187,251

Purchase Details

Closed on

Dec 28, 2001

Sold by

Cabanban David A and Cabanban Catherine

Bought by

Alvarez Luis and Alvarez Norma

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$160,550

Interest Rate

7.07%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Espinoza Rosa | $229,000 | Ticor Title Ins Co 2002 | |

| Espinoza Rosa | $229,000 | Ticor Title Ins Co 2002 | |

| Alvarez Luis | $169,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Espinoza Rosa | $183,200 | |

| Closed | Espinoza Rosa | $183,200 | |

| Previous Owner | Alvarez Luis | $160,550 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,844 | $18,782 | $4,594 | $14,188 |

| 2023 | $4,739 | $23,000 | $4,594 | $18,406 |

| 2022 | $4,739 | $13,851 | $4,031 | $9,820 |

| 2021 | $4,637 | $13,850 | $4,031 | $9,819 |

| 2020 | $4,478 | $13,850 | $4,031 | $9,819 |

| 2019 | $3,908 | $12,101 | $3,656 | $8,445 |

| 2018 | $3,676 | $12,101 | $3,656 | $8,445 |

| 2017 | $3,789 | $12,101 | $3,656 | $8,445 |

| 2016 | $2,724 | $8,779 | $3,000 | $5,779 |

| 2015 | $2,617 | $8,779 | $3,000 | $5,779 |

| 2014 | $3,464 | $11,017 | $3,000 | $8,017 |

| 2013 | $3,121 | $11,190 | $3,000 | $8,190 |

Source: Public Records

Map

Nearby Homes

- 2722 Euclid Ave

- 2623 Euclid Ave

- 2718 East Ave

- 2716 Grove Ave

- 6908 26th St

- 6840 29th Place

- 3019 Wesley Ave

- 3027 Oak Park Ave

- 6535 26th Place

- 3031 Oak Park Ave

- 3027 Clarence Ave

- 6733 31st St

- 6453 28th St

- 6444 27th St

- 6921 26th St

- 6444 28th Place

- 2516 Kenilworth Ave

- 2508 Kenilworth Ave

- 2716 Ridgeland Ave Unit 7

- 2436 Grove Ave

- 2743 Euclid Ave

- 2747 Euclid Ave

- 2741 Euclid Ave

- 2739 Euclid Ave

- 2737 Euclid Ave

- 2746 Wesley Ave

- 2742 Wesley Ave

- 2748 Wesley Ave

- 2740 Wesley Ave

- 2735 Euclid Ave

- 2738 Wesley Ave

- 2736 Wesley Ave

- 2731 Euclid Ave

- 2746 Euclid Ave

- 2744 Euclid Ave

- 2748 Euclid Ave

- 2740 Euclid Ave

- 2734 Wesley Ave

- 2738 Euclid Ave

- 2729 Euclid Ave