2784 Chateau Cir S Unit 44 Columbus, OH 43221

Estimated Value: $229,964 - $256,000

2

Beds

2

Baths

1,088

Sq Ft

$224/Sq Ft

Est. Value

About This Home

This home is located at 2784 Chateau Cir S Unit 44, Columbus, OH 43221 and is currently estimated at $243,491, approximately $223 per square foot. 2784 Chateau Cir S Unit 44 is a home located in Franklin County with nearby schools including Tremont Elementary School, Jones Middle School, and Upper Arlington High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 30, 2015

Sold by

Steffan Joyce

Bought by

Finelli Taryn B

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,400

Outstanding Balance

$79,098

Interest Rate

4.08%

Mortgage Type

New Conventional

Estimated Equity

$164,393

Purchase Details

Closed on

Jun 15, 2004

Sold by

Johnson Ernest E

Bought by

Steffan Joyce

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$108,000

Interest Rate

5.5%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 21, 1981

Bought by

Johnson Ernest E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Finelli Taryn B | $125,000 | Golden Title | |

| Steffan Joyce | $123,000 | Stewart Tit | |

| Johnson Ernest E | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Finelli Taryn B | $100,400 | |

| Previous Owner | Steffan Joyce | $108,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,915 | $67,620 | $23,100 | $44,520 |

| 2023 | $3,866 | $67,620 | $23,100 | $44,520 |

| 2022 | $3,615 | $51,740 | $9,420 | $42,320 |

| 2021 | $3,200 | $51,740 | $9,420 | $42,320 |

| 2020 | $3,172 | $51,740 | $9,420 | $42,320 |

| 2019 | $2,872 | $41,410 | $7,530 | $33,880 |

| 2018 | $2,635 | $41,410 | $7,530 | $33,880 |

| 2017 | $2,849 | $41,410 | $7,530 | $33,880 |

| 2016 | $2,416 | $36,540 | $6,510 | $30,030 |

| 2015 | $2,414 | $36,540 | $6,510 | $30,030 |

| 2014 | $2,417 | $36,540 | $6,510 | $30,030 |

| 2013 | $1,411 | $40,600 | $7,245 | $33,355 |

Source: Public Records

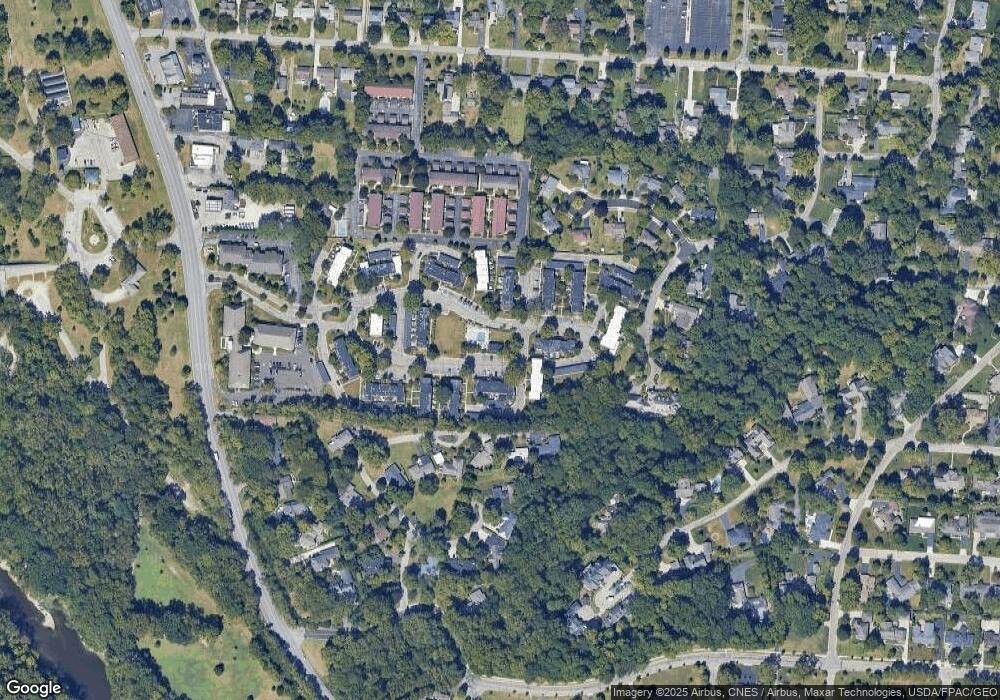

Map

Nearby Homes

- 2782 Chateau Cir S Unit 45

- 2785 Chateau Cir Unit 69

- 3190 Kioka Ave

- 2729 Eastcleft Dr

- 3163 S Dorchester Rd

- 2438 Sherwood Villa Unit 5

- 2594 Scioto View Ln Unit 2594

- 2370 Zollinger Rd

- 2979 Avalon Rd

- 3278 Brookview Way Unit 4

- 3161 Avalon Rd

- 2380 Quarry Trails Dr

- 2424 Quarry Trails Dr

- 2512 Quarry Trails Dr

- 2368 Quarry Trails Dr

- 2456 Quarry Trails Dr

- 2698 Shrewsbury Rd

- 2227 Zollinger Rd

- 2745 Cranford Rd

- 2443 Shrewsbury Rd

- 2782 Chateau Cir S

- 2782 Chateau Cir S Unit Carpo

- 2786 Chateau Cir S Unit 43

- 2788 Chateau Cir S

- 2788 Chateau Cir S Unit 42

- 2780 Chateau Cir S Unit 46

- 2790 Chateau Cir S

- 2809 Chateau Cir S Unit 35

- 2811 Chateau Cir

- 2811 Chateau Cir Unit 36

- 2811 Chateau Cir S

- 2811 Chateau Cir S Unit 36

- 2797 Chateau Cir Unit 51

- 2813 Chateau Cir S

- 2813 Chateau Cir S Unit 4

- 2795 Chateau Cir Unit 50

- 2793 Chateau Cir

- 2793 Chateau Cir Unit 49

- 2791 Chateau Cir Unit 48

- 2815 Chateau Cir S Unit 38