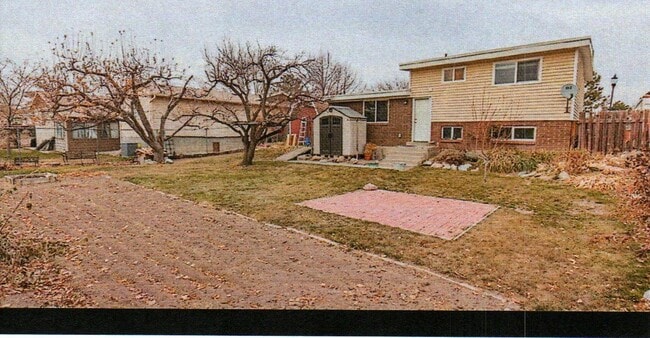

2799 W 7550 S West Jordan, UT 84084

About This Home

Looking for a comfy, updated place to call home? This one’s got it all! Recently remodeled with new hardwood floors, fresh bathrooms, a finished basement, and modern upgrades throughout.

Highlights:

5 bedrooms, 2 bathrooms — plenty of space for everyone

New hardwood floors that look amazing

Brand new furnace and A/C + smart thermostat to keep you comfy year-round

Newly finished basement — great for a family room, game room, or home office

Washer & dryer included (no more laundromat runs!)

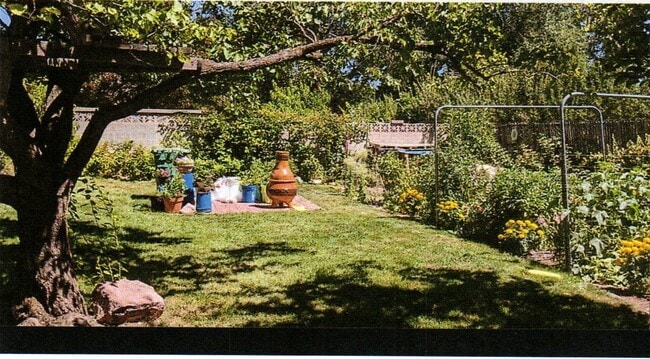

Big backyard with a garden area, and fruit trees

Partially fenced for privacy and pets

Located in a quiet, friendly neighborhood close to parks, schools, and shopping. Easy access to main roads and commuter routes.

If you’re looking for a clean, cozy, and move-in-ready home with tons of charm, this is it! Send a message to schedule a tour — this one’s going to go fast!

Map

- 2886 W 7550 S

- 7642 S 2700 W

- 7721 Sunset Cir

- 2624 W 7530 S

- 7604 S Autumn Dr

- 2573 Jordan Meadows Ln

- 7361 S 2700 W

- 7647 S 2500 W

- 3165 W 7720 S

- 2510 W Jordan Meadows Ln

- 7942 S 2800 W

- 3066 W Linton Dr

- 2386 W 7680 S

- 7987 S 2980 W

- 7966 Linton Dr

- 7993 S 2760 W

- 7968 S 2700 W

- 7611 S Springbrook Dr

- 3354 W 7800 S

- 3422 Briar Dr

- 7769 S 1920 W

- 3448 W 8200 S

- 8464 S 2700 W Unit 8464 S 2700 W

- 2812 W 8580 S

- 8958 Wilroy Rd

- 8524 S 2700 W

- 3916 W 7965 S

- 3851 W Cobble Ridge Dr

- 3818 W Castle Pines Way

- 3354 W Jordan Line Pkwy

- 3283 W Jordan Line Pkwy

- 3361 W Jordan Line Pkwy

- 6885 S Redwood Rd

- 7028 S Cherry Leaf Dr

- 8641 S 3640 W Unit Upstairs

- 1658 W 8430 S

- 8771 S Jordan Valley Way

- 7711 S 1240 W

- 8781 S 3680 W

- 3748 W Lewisport Dr