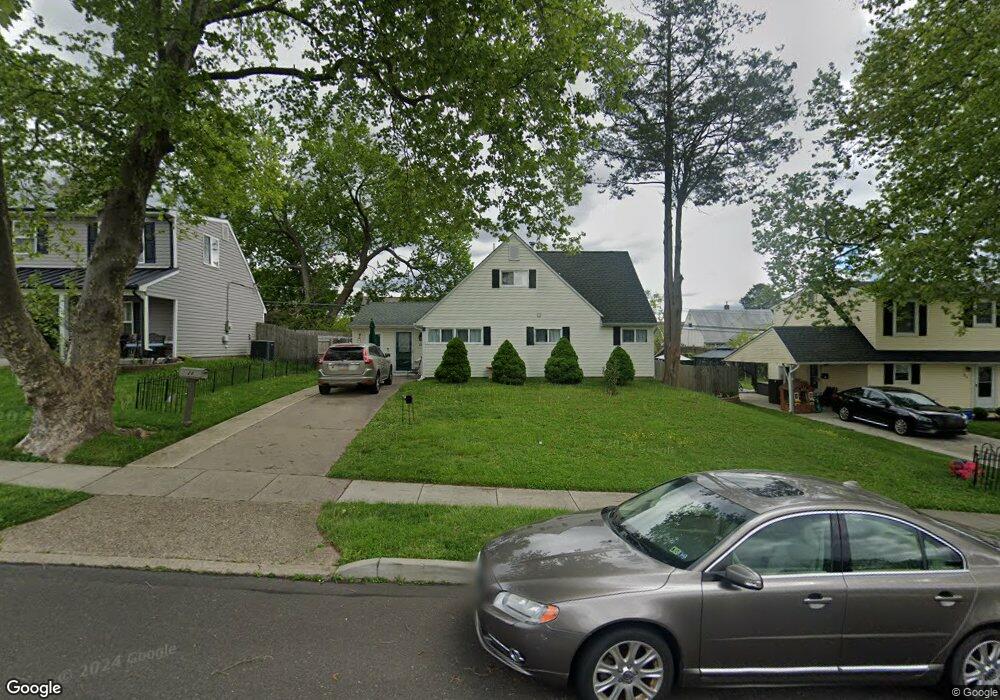

28 Azalea Ln Levittown, PA 19055

Appletree Hill NeighborhoodEstimated Value: $342,000 - $377,000

4

Beds

3

Baths

1,200

Sq Ft

$299/Sq Ft

Est. Value

About This Home

This home is located at 28 Azalea Ln, Levittown, PA 19055 and is currently estimated at $358,741, approximately $298 per square foot. 28 Azalea Ln is a home located in Bucks County with nearby schools including Truman Senior High School and Hope Lutheran School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 20, 2010

Sold by

Us Bank National Association

Bought by

Menchhofer Bernard G and Menchhofer Robin G

Current Estimated Value

Purchase Details

Closed on

Apr 30, 2010

Sold by

Kurt Bekir and Kurt Fatma

Bought by

Us Bank National Association

Purchase Details

Closed on

May 26, 2006

Sold by

Pierce Charles A

Bought by

Kurt Fatma and Kurt Bekir

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$28,050

Interest Rate

6.25%

Mortgage Type

Stand Alone Second

Purchase Details

Closed on

Aug 10, 2005

Sold by

Pierce Charles A and Pierce Patricia M

Bought by

Pierce Charles A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Menchhofer Bernard G | $131,000 | None Available | |

| Us Bank National Association | $1,158 | None Available | |

| Kurt Fatma | $187,000 | None Available | |

| Pierce Charles A | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Kurt Fatma | $28,050 | |

| Previous Owner | Kurt Fatma | $149,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,511 | $16,610 | $4,200 | $12,410 |

| 2024 | $4,511 | $16,610 | $4,200 | $12,410 |

| 2023 | $4,478 | $16,610 | $4,200 | $12,410 |

| 2022 | $4,478 | $16,610 | $4,200 | $12,410 |

| 2021 | $4,478 | $16,610 | $4,200 | $12,410 |

| 2020 | $4,478 | $16,610 | $4,200 | $12,410 |

| 2019 | $4,461 | $16,610 | $4,200 | $12,410 |

| 2018 | $4,389 | $16,610 | $4,200 | $12,410 |

| 2017 | $4,322 | $16,610 | $4,200 | $12,410 |

| 2016 | $4,322 | $16,610 | $4,200 | $12,410 |

| 2015 | $3,078 | $16,610 | $4,200 | $12,410 |

| 2014 | $3,078 | $16,610 | $4,200 | $12,410 |

Source: Public Records

Map

Nearby Homes

- 316 Crabtree Dr

- 28 Rainbow Ln

- 24 Robin Hill Ln

- 58 Rocky Pool Ln

- 2 Red Maple Ln

- L:108 Cypress Ave

- 24 Chestnut Ln

- 11 Crimson King Ln

- 23 Crabtree Dr

- 179 Crabtree Dr

- 525 Nel Dr

- 28 Outlook Ln

- 560 Fernwood Ln

- 22 Myrtle Ln

- L235.17 Edgely Rd

- 514 Drexel Rd

- 744 Fairbridge Dr

- 27 Good Ln

- 29 Graceful Ln

- 524 Ehret Rd