28 Highland Meadows Cir Unit 8 Highland Heights, KY 41076

Estimated Value: $158,000 - $175,000

2

Beds

2

Baths

1,081

Sq Ft

$154/Sq Ft

Est. Value

About This Home

This home is located at 28 Highland Meadows Cir Unit 8, Highland Heights, KY 41076 and is currently estimated at $166,754, approximately $154 per square foot. 28 Highland Meadows Cir Unit 8 is a home located in Campbell County with nearby schools including Donald E. Cline Elementary School, Campbell County Middle School, and Campbell County High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 13, 2009

Sold by

Laber Stephen C

Bought by

Elfers Emily A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$74,277

Outstanding Balance

$47,255

Interest Rate

5.14%

Mortgage Type

FHA

Estimated Equity

$119,499

Purchase Details

Closed on

Sep 6, 2006

Sold by

Townley Jessica R and Townley Kristin K

Bought by

Presson Kimberly K and Catherine M Drake Testamentory Trust

Purchase Details

Closed on

Dec 1, 1999

Sold by

Baker Richard

Bought by

Hall Cynthia A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$75,092

Interest Rate

7.94%

Mortgage Type

FHA

Purchase Details

Closed on

Nov 1, 1996

Sold by

Chambers Michael T

Bought by

Drake John C and Drake Catherine

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$27,000

Interest Rate

8.5%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Elfers Emily A | $80,000 | None Available | |

| Presson Kimberly K | -- | None Available | |

| Hall Cynthia A | $76,900 | -- | |

| Drake John C | $66,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Elfers Emily A | $74,277 | |

| Previous Owner | Hall Cynthia A | $75,092 | |

| Previous Owner | Drake John C | $27,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,327 | $108,100 | $0 | $108,100 |

| 2023 | $1,297 | $108,100 | $0 | $108,100 |

| 2022 | $1,196 | $91,900 | $0 | $91,900 |

| 2021 | $1,196 | $91,900 | $0 | $91,900 |

| 2020 | $1,208 | $91,900 | $0 | $91,900 |

| 2019 | $1,043 | $80,000 | $0 | $80,000 |

| 2018 | $1,050 | $80,000 | $0 | $80,000 |

| 2017 | $1,036 | $80,000 | $0 | $80,000 |

| 2016 | $999 | $80,000 | $0 | $0 |

| 2015 | $1,014 | $80,000 | $0 | $0 |

| 2014 | $990 | $80,000 | $0 | $0 |

Source: Public Records

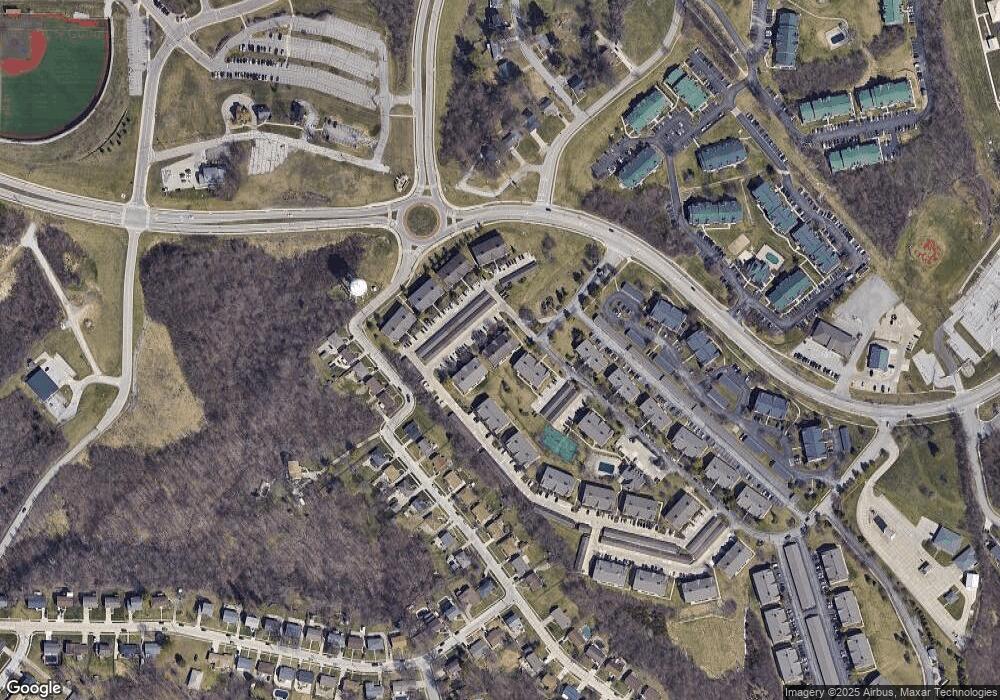

Map

Nearby Homes

- 29 Highland Meadows Cir Unit 7

- 32 Highland Meadows Cir Unit 2

- 22 Highland Meadows Cir Unit 10

- 15 Meadow Ln Unit 11

- 2 Malibu Dr

- 126 Ridge Hill Dr

- 344 Deepwoods Dr

- 387 Deepwoods Dr

- 377 Deepwoods Dr

- 1002 Monterey Ln

- 546 Fawn Run Dr

- 208 Ridge Hill Dr

- 233 Sunset Dr

- 98 Bon Jan Ln

- 495 Pooles Creek Rd

- 0 Rd

- 0 Stevens Hill Lot #4 Rd

- 0 Stevens Hill Lot #5 Rd

- 0 Stevens Hill Lot #3 Rd

- 109 Stonyridge Drive Lot #7

- 28 Highland Meadows Cir Unit 7

- 28 Highland Meadows Cir Unit 6

- 28 Highland Meadows Cir Unit 10

- 28 Highland Meadows Cir Unit 5

- 28 Highland Meadows Cir Unit 2

- 28 Highland Meadows Cir Unit 1

- 28 Highland Meadows Cir Unit 9

- 28 Highland Meadows Cir Unit 3

- 28 Highland Meadows Cir Unit 11

- 28 Highland Meadows Cir Unit 12

- 28 Highland Meadows Cir Unit 4

- 28 Highland Meadows Cir

- 28 Highland Meadows Dr Unit 28-8

- 28 Highland Meadows Dr Unit 7

- 28 Highland Meadows Dr Unit 28-9

- 28 Highland Meadows Dr Unit 9

- 28 Highland Meadows Dr

- 28 Highland Meadows Dr Unit 1

- 28 Highland Meadows Dr Unit 6

- 28 Highland Meadows Circle #12