28 Monarch Ct Pagosa Springs, CO 81147

Estimated Value: $969,384 - $1,074,000

4

Beds

2

Baths

3,719

Sq Ft

$273/Sq Ft

Est. Value

About This Home

This home is located at 28 Monarch Ct, Pagosa Springs, CO 81147 and is currently estimated at $1,013,596, approximately $272 per square foot. 28 Monarch Ct is a home located in Archuleta County with nearby schools including Pagosa Springs Elementary School, Pagosa Springs Middle School, and Pagosa Springs High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 13, 2005

Sold by

Asay William Scott and Asay Kristy

Bought by

Isberg Karl E and Isberg Kathleen B

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$260,000

Outstanding Balance

$135,284

Interest Rate

5.61%

Mortgage Type

New Conventional

Estimated Equity

$878,312

Purchase Details

Closed on

Dec 3, 2003

Sold by

Ford Jackie L

Bought by

Asay William Scott and Asay Kristy

Purchase Details

Closed on

Dec 6, 2002

Sold by

Ford James R

Bought by

Ford Jackie L

Purchase Details

Closed on

Mar 25, 1988

Sold by

Fpi

Bought by

Hardy Larry

Purchase Details

Closed on

Nov 19, 1987

Sold by

Hardy Larry

Bought by

Ford James R and Ford Jacki

Purchase Details

Closed on

Jul 2, 1977

Sold by

Eic

Bought by

Jayroe

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Isberg Karl E | $340,000 | Colorado Land Title Co | |

| Asay William Scott | $255,000 | -- | |

| Ford Jackie L | -- | -- | |

| Hardy Larry | $10,500 | -- | |

| Ford James R | $12,000 | -- | |

| Jayroe | $10,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Isberg Karl E | $260,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,996 | $56,140 | $5,070 | $51,070 |

| 2023 | $2,996 | $56,140 | $5,070 | $51,070 |

| 2022 | $1,715 | $33,340 | $1,560 | $31,780 |

| 2021 | $1,860 | $34,300 | $1,610 | $32,690 |

| 2020 | $1,916 | $34,680 | $1,790 | $32,890 |

| 2019 | $1,890 | $34,680 | $1,790 | $32,890 |

| 2018 | $1,764 | $30,590 | $1,150 | $29,440 |

| 2017 | $1,547 | $30,590 | $1,150 | $29,440 |

| 2016 | $1,315 | $27,600 | $1,030 | $26,570 |

| 2015 | -- | $27,600 | $1,030 | $26,570 |

| 2014 | -- | $24,890 | $1,060 | $23,830 |

Source: Public Records

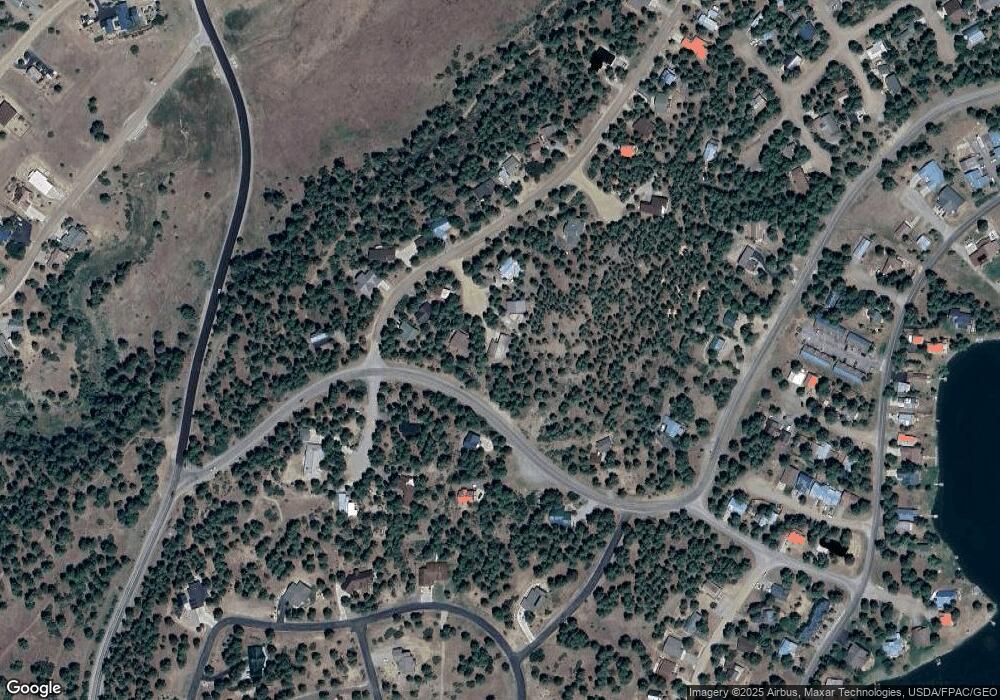

Map

Nearby Homes

- 698 Monument Ave

- 142 Capitan Cir

- 81 Oxbow Cir

- 1318 Cloud Cap Ave

- 18 Balfour Ct

- 233 Sweetwater Dr

- 151 Escobar Ave

- 25 Ermine Ct

- 32 Ermine Ct

- 77 Fisher Ct

- 1288 Antelope Ave

- 1338 Antelope Ave

- 276 Capitan Cir

- 78 Heather Place

- 279 Capitan Cir

- 40 Laurel Dr

- 46 Carefree Place

- 95 Enchanted Place

- 8 Caballero Dr

- 338 Escobar Ave

- 25 Monarch Ct

- 0 Monarch Ct

- 26 Monarch Ct

- 1022 Aspenglow Blvd

- 17 Monarch Ct

- 924 Monument Ave

- 8 Monarch Ct

- 954 Monument Ave

- 986 Aspenglow Blvd

- 20 Stone Ct

- 931 Aspenglow Blvd

- 980 Aspenglow Blvd

- 9 Moffat Ct

- 877 Monument Ave

- 48 Stone Ct

- 903 Monument Ave

- 849 Monument Ave

- 956 Aspenglow Blvd

- 961 Monument Ave

- 831 Monument Ave