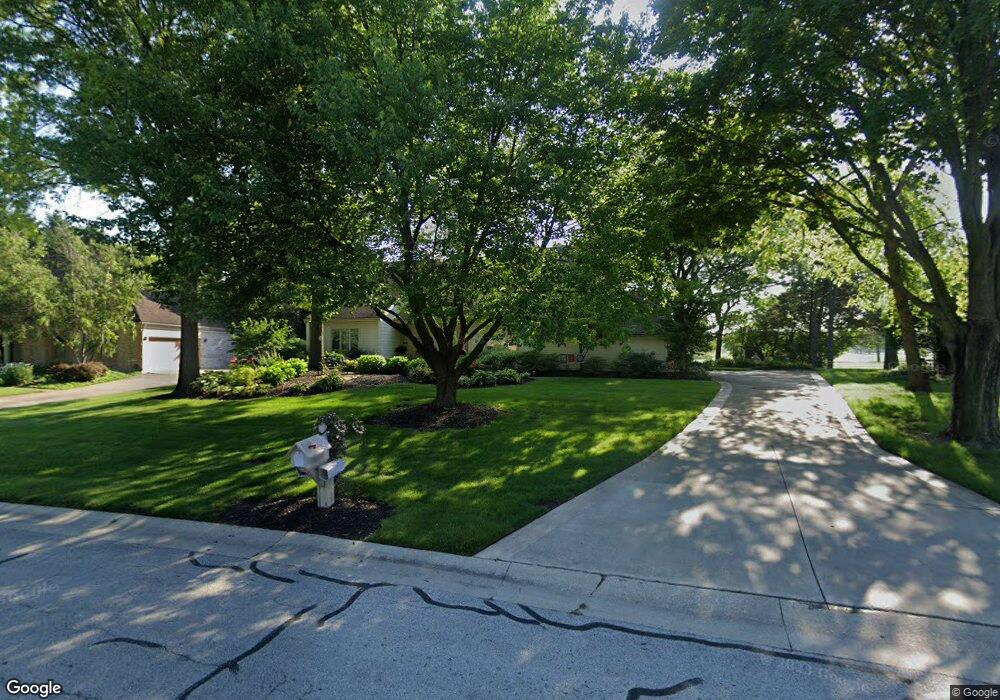

2807 W Course Rd Maumee, OH 43537

Estimated Value: $390,000 - $488,000

4

Beds

3

Baths

2,954

Sq Ft

$149/Sq Ft

Est. Value

About This Home

This home is located at 2807 W Course Rd, Maumee, OH 43537 and is currently estimated at $439,441, approximately $148 per square foot. 2807 W Course Rd is a home located in Lucas County with nearby schools including Holloway Elementary School, Springfield Middle School, and Springfield High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 31, 2016

Sold by

Oravecz Emma J

Bought by

Oravecz Emma J and The Emma J Oraecaz Linging Trsut

Current Estimated Value

Purchase Details

Closed on

Feb 12, 2009

Sold by

Oravecz George V

Bought by

Oravecz Emma J

Purchase Details

Closed on

Oct 30, 1998

Sold by

Oravecz Virginia J and Oravecz George V

Bought by

Oravecz George

Purchase Details

Closed on

Sep 18, 1991

Purchase Details

Closed on

Apr 3, 1991

Sold by

Oravecz G J and V J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Oravecz Emma J | -- | None Available | |

| Oravecz Emma J | -- | Attorney | |

| Oravecz George | -- | -- | |

| -- | -- | -- | |

| -- | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,729 | $167,335 | $40,635 | $126,700 |

| 2023 | $7,403 | $116,865 | $31,570 | $85,295 |

| 2022 | $7,433 | $116,865 | $31,570 | $85,295 |

| 2021 | $6,985 | $116,865 | $31,570 | $85,295 |

| 2020 | $6,538 | $100,520 | $26,355 | $74,165 |

| 2019 | $6,384 | $100,520 | $26,355 | $74,165 |

| 2018 | $6,011 | $100,520 | $26,355 | $74,165 |

| 2017 | $5,693 | $85,015 | $24,220 | $60,795 |

| 2016 | $5,745 | $242,900 | $69,200 | $173,700 |

| 2015 | $5,735 | $242,900 | $69,200 | $173,700 |

| 2014 | $5,122 | $81,730 | $23,280 | $58,450 |

| 2013 | $5,122 | $81,730 | $23,280 | $58,450 |

Source: Public Records

Map

Nearby Homes

- 7040 Country Creek Rd

- 7070 Country Creek Rd

- 6945 Garden Rd

- 2945 Byrnwyck W

- 6696 Embassy Ct Unit C11

- 6731 Garden Rd Unit 6731

- 6649 Mill Ridge Rd

- 6705 Garden Rd Unit 6705

- 6652 Sue Ln

- 6640 Salisbury Rd

- 120 William Grace Way

- Lot 122 William Grace Way

- 6856 Morningdew Blvd

- 6661 Brick Yard Ct

- 7439 Lock Mill Ct

- 3321 Butz Rd

- 3360 Stillwater Blvd

- 3223 Estuary Place

- 6959 Pilliod Rd

- 6608 W Meadows Ln

- 7020 Country Creek Rd

- 2815 W Course Rd

- 7030 Country Creek Rd

- 2825 W Course Rd

- 2812 W Course Rd

- 7027 Country Creek Rd

- 2826 W Course Rd

- 2835 W Course Rd

- 7041 Country Creek Rd

- 7042 Willowyck Rd

- 7050 Country Creek Rd

- 2845 W Course Rd

- 7119 Holly Springs Ct

- 7053 Country Creek Rd

- 7052 Willowyck Rd

- 7031 Willowyck Rd

- 7060 Country Creek Rd

- 7065 Country Creek Rd

- 7041 Willowyck Rd

- 6985 Fenwyck Rd