281 W Castine Way Beecher, IL 60401

Estimated Value: $329,000 - $358,000

4

Beds

3

Baths

2,417

Sq Ft

$144/Sq Ft

Est. Value

About This Home

This home is located at 281 W Castine Way, Beecher, IL 60401 and is currently estimated at $348,213, approximately $144 per square foot. 281 W Castine Way is a home located in Will County with nearby schools including Beecher Elementary School, Beecher Junior High School, and Beecher High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 25, 2021

Sold by

Johnson Cornelia N

Bought by

Kellum Tiffany Marlo and Kellum Andre Gerard

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$234,671

Outstanding Balance

$212,742

Interest Rate

2.7%

Mortgage Type

FHA

Estimated Equity

$135,471

Purchase Details

Closed on

Aug 27, 2007

Sold by

Montalbano Builders Inc

Bought by

Johnson Cornelia N and Johnson Fred

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$250,570

Interest Rate

6.72%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kellum Tiffany Marlo | $239,000 | Atg | |

| Johnson Cornelia N | $254,500 | Chicago Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kellum Tiffany Marlo | $7,920 | |

| Open | Kellum Tiffany Marlo | $234,671 | |

| Previous Owner | Johnson Fred | $225,377 | |

| Previous Owner | Johnson Fred | $255,482 | |

| Previous Owner | Johnson Fred | $254,328 | |

| Previous Owner | Johnson Cornelia N | $250,570 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $7,855 | $99,970 | $20,579 | $79,391 |

| 2023 | $7,855 | $90,610 | $18,652 | $71,958 |

| 2022 | $6,597 | $83,098 | $17,106 | $65,992 |

| 2021 | $7,470 | $77,014 | $15,854 | $61,160 |

| 2020 | $7,293 | $71,808 | $14,782 | $57,026 |

| 2019 | $7,022 | $67,501 | $13,895 | $53,606 |

| 2018 | $5,467 | $63,381 | $13,047 | $50,334 |

| 2017 | $5,314 | $61,190 | $12,596 | $48,594 |

| 2016 | $5,428 | $61,190 | $12,596 | $48,594 |

| 2015 | $5,207 | $60,524 | $12,459 | $48,065 |

| 2014 | $5,207 | $56,366 | $12,585 | $43,781 |

| 2013 | $5,207 | $58,874 | $13,145 | $45,729 |

Source: Public Records

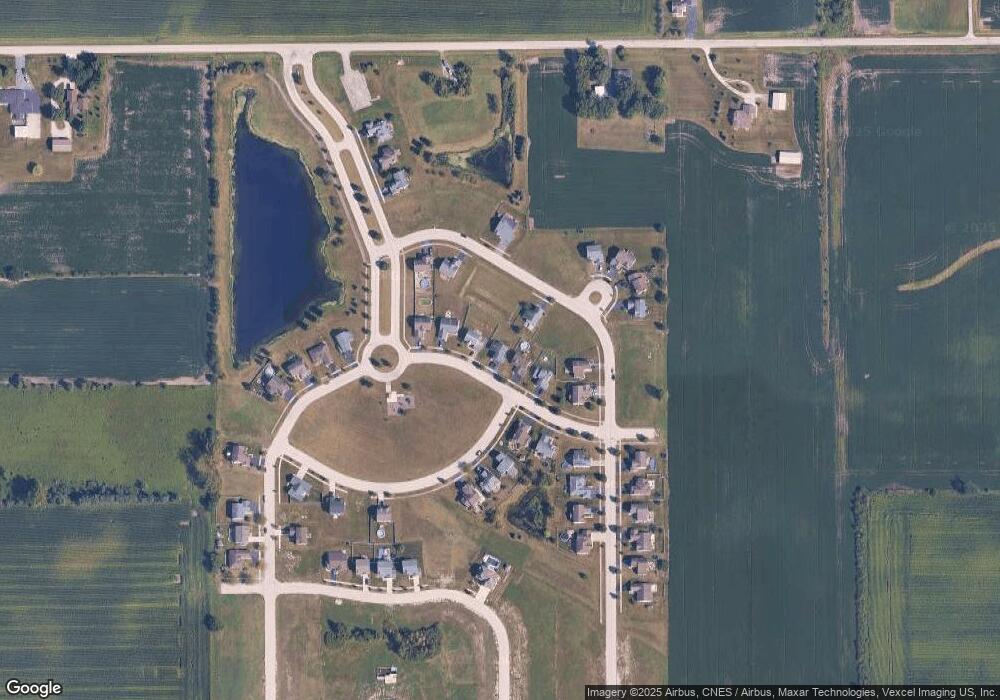

Map

Nearby Homes

- 325 Hunters Dr

- 1663 Sawgrass Ln

- 1665 Fox Hound Trail

- 401 Hunters Dr

- 1661 Rolling Pass

- 1670 Rolling Pass

- 1651 Rolling Pass

- 1660 Rolling Pass

- 1641 Rolling Pass

- 1650 Rolling Pass

- 1665 Woodbury Bend

- 1631 Rolling Pass

- 1640 Rolling Pass

- 284 Quail Hollow Dr

- 000 W Eagle Lake Rd

- 152 Woodbridge Ln

- The Waterside Plan at Hunter's Chase - Hunters Chase

- The Tiffany Plan at Hunter's Chase - Hunters Chase

- The Sutton Plan at Hunter's Chase - Hunters Chase

- The Sommerset Plan at Hunter's Chase - Hunters Chase

- 281 Castine Way

- 279 Castine Way

- 285 Castine Way

- 280 Monhegan Ave

- 269 W Castine Way

- 269 Castine Way

- 291 Castine Way

- 1928 Monhegan Ave

- 299 Castine Way

- 268 Castine Way

- 1920 Monhegan Ave

- 294 Monhegan Ave

- 266 Castine Way

- 298 W Monhegan Ave

- 1897 Merrimack Ln

- 289 W Monhegan Ave

- 298 Monhegan Ave

- 1997 W Cutler Ct

- 1904 Monhegan Ave

- 1893 Merrimack Ln