28323 Emerald Oaks Magnolia, TX 77355

Estimated Value: $665,000 - $1,405,000

--

Bed

1

Bath

5,291

Sq Ft

$222/Sq Ft

Est. Value

About This Home

This home is located at 28323 Emerald Oaks, Magnolia, TX 77355 and is currently estimated at $1,173,261, approximately $221 per square foot. 28323 Emerald Oaks is a home located in Montgomery County with nearby schools including Magnolia Elementary School, Magnolia Sixth Grade Campus, and Magnolia Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 6, 2003

Sold by

Gold Leaf Homes Inc

Bought by

White Donald Gene and White Patsy Ruth

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$445,000

Outstanding Balance

$205,730

Interest Rate

5.96%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$967,531

Purchase Details

Closed on

Feb 3, 2003

Sold by

White Donald G and White Patsy R

Bought by

Gold Leaf Homes Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$417,369

Interest Rate

5.9%

Purchase Details

Closed on

Mar 6, 2002

Sold by

Jack Frey Properties Inc

Bought by

White Donald and White Patsy

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| White Donald Gene | -- | -- | |

| Gold Leaf Homes Inc | -- | -- | |

| White Donald | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | White Donald Gene | $445,000 | |

| Previous Owner | Gold Leaf Homes Inc | $417,369 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $12,567 | $1,278,050 | -- | -- |

| 2024 | $12,086 | $1,161,864 | -- | -- |

| 2023 | $12,086 | $1,056,240 | $529,950 | $670,050 |

| 2022 | $16,944 | $960,220 | $323,490 | $699,190 |

| 2021 | $16,225 | $872,930 | $314,070 | $558,860 |

| 2020 | $18,353 | $906,900 | $314,070 | $592,830 |

| 2019 | $17,375 | $862,730 | $314,070 | $566,430 |

| 2018 | $14,953 | $784,300 | $192,040 | $592,260 |

| 2017 | $16,631 | $784,300 | $192,040 | $592,260 |

| 2016 | $17,727 | $836,000 | $192,040 | $643,960 |

| 2015 | $16,071 | $826,090 | $192,040 | $634,050 |

| 2014 | $16,071 | $759,400 | $192,040 | $567,360 |

Source: Public Records

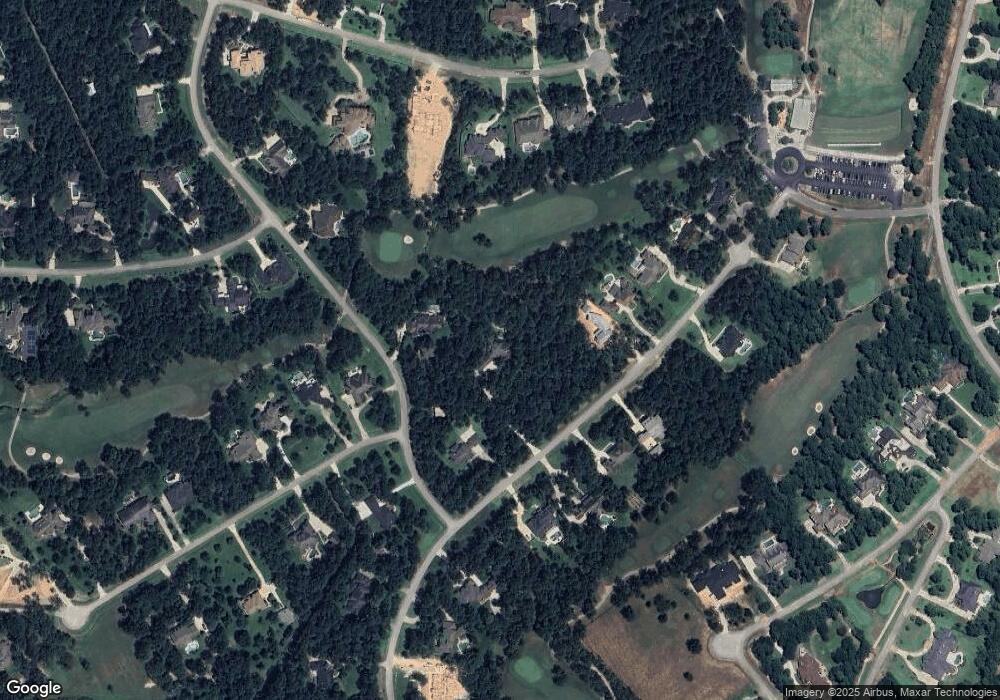

Map

Nearby Homes

- 28322 Meadow Forest

- 37432 Clubhouse Ln

- 28242 Forest Green Dr

- TBD Fm 1774 Rd

- 18742 Mink Lake Dr

- 28733 Lakeside Green

- Resolution 3K Plan at Waterford Run - Clayton

- Colossal Plan at Waterford Run - Clayton

- The Jackson Plan at Waterford Run - Jessup

- Crazy Eights Plan at Waterford Run - Clayton

- 18631 Mink Lake Dr

- 24569 Fm 1488

- 28523 Beth Marie

- 28543 Beth Marie

- 28046 Crossway Oaks

- 28028 Crossway Oaks

- 16715 Frosted Evergreen Ct

- 28208 Nichols Sawmill Rd

- 29010 Legacy Ct

- 28103 Hitching Rack Ln

- 37622 Meadowwood Green

- 28403 Emerald Oaks

- 37602 Meadow Wood

- 28275 Emerald Oaks

- 28293 Eagle Cove

- 28413 Emerald Oaks

- 28423 Emerald Oaks

- 28332 Emerald Oaks

- 28322 Emerald Oaks

- 28283 Eagle Cove

- 28342 Emerald Oaks

- 37603 Meadowwood Green

- 28283 Eagle Cove

- 28312 Emerald Oaks

- 28402 Meadow Forest

- 37722 Meadowwood Green

- 28412 Meadow Forest

- 28433 Emerald Oaks

- 28273 Eagle Cove

- 28272 Canyon View