28516 Seashell Ct Wesley Chapel, FL 33545

Estimated Value: $286,161 - $321,000

--

Bed

2

Baths

1,229

Sq Ft

$249/Sq Ft

Est. Value

About This Home

This home is located at 28516 Seashell Ct, Wesley Chapel, FL 33545 and is currently estimated at $305,540, approximately $248 per square foot. 28516 Seashell Ct is a home located in Pasco County with nearby schools including Quail Hollow Elementary School, Thomas E. Weightman Middle School, and Wesley Chapel High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 9, 2024

Sold by

Pages Robert G

Bought by

Pages Robert G and Pages Lisa Faye

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$111,000

Outstanding Balance

$107,492

Interest Rate

5.99%

Mortgage Type

New Conventional

Estimated Equity

$198,048

Purchase Details

Closed on

Feb 27, 2019

Sold by

Pages Robert G and Pages Faye W

Bought by

Pages Robert G and Pages Jimmie Faye Ward

Purchase Details

Closed on

May 9, 2002

Sold by

Metcalf Tami S

Bought by

Pages Robert G and Pages Faye W

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$91,755

Interest Rate

7.18%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 17, 2000

Sold by

Windward Homes Inc

Bought by

Metcalf Tami S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$103,057

Interest Rate

7.96%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Pages Robert G | $100 | Servicelink | |

| Pages Robert G | -- | Attorney | |

| Pages Robert G | $102,000 | -- | |

| Metcalf Tami S | $103,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Pages Robert G | $111,000 | |

| Previous Owner | Metcalf Tami S | $91,755 | |

| Previous Owner | Metcalf Tami S | $103,057 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,152 | $265,928 | $51,353 | $214,575 |

| 2024 | $4,152 | $269,392 | $44,713 | $224,679 |

| 2023 | $3,913 | $187,770 | $0 | $0 |

| 2022 | $3,184 | $218,902 | $37,353 | $181,549 |

| 2021 | $2,769 | $165,854 | $33,495 | $132,359 |

| 2020 | $2,566 | $156,028 | $27,681 | $128,347 |

| 2019 | $2,390 | $144,984 | $27,681 | $117,303 |

| 2018 | $2,242 | $139,247 | $27,681 | $111,566 |

| 2017 | $1,999 | $111,649 | $27,681 | $83,968 |

| 2016 | $1,864 | $108,021 | $27,681 | $80,340 |

| 2015 | $1,758 | $100,019 | $27,681 | $72,338 |

| 2014 | $1,501 | $79,650 | $23,721 | $55,929 |

Source: Public Records

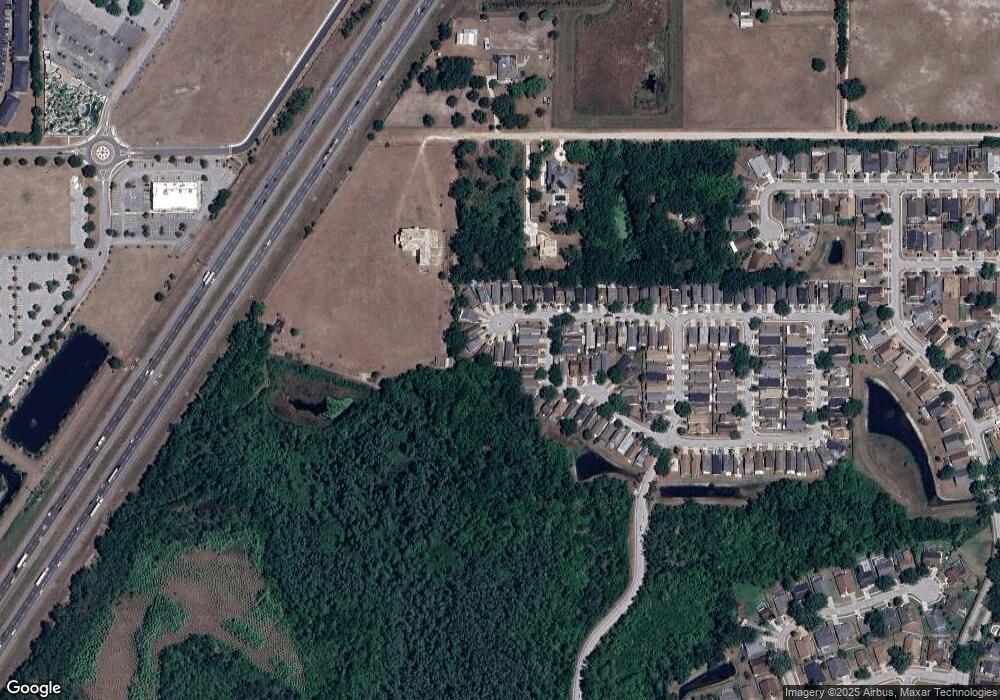

Map

Nearby Homes

- 5518 Birch River Trail

- 33668 Elm Hill Branch

- 33716 Elm Hill Branch

- 7727 Bronze Oak Dr

- 28536 Tupper Rd

- 6051 White Sails Dr

- 6038 Wesley Brook Dr

- 28616 Tupper Rd

- 6142 Caroline Dr

- 6760 Quail Hollow Blvd

- 6101 Old Pasco Rd

- 5933 Carina Trace

- 5454 Saddlebrook Way Unit 2

- 5434 Saddlebrook Way Unit 3

- 6218 Bridleford Dr

- 5808 Carina Trace

- 6554 Gentle Ben Cir

- 32226 Eldorado Canyon Loop

- 2518 Chapel Oak Bend

- 29318 Whipporwill Ln

- 28518 Seashell Ct

- 28514 Seashell Ct

- 28512 Seashell Ct

- 28510 Seashell Ct

- 6135 Sand Key Ln

- 6139 Sand Key Ln

- 6131 Sand Key Ln

- 6143 Sand Key Ln

- 6127 Sand Key Ln

- 28509 Seashell Ct

- 6123 Sand Key Ln

- 6119 Sand Key Ln

- 28521 Seashell Ct

- 28517 Seashell Ct

- 28515 Seashell Ct

- 28513 Seashell Ct

- 28511 Seashell Ct

- 6115 Sand Key Ln

- 6124 Sand Key Ln

- 28525 Seashell Ct