2863 Twelve Oaks Dr Unit 1 Charlotte, MI 48813

Estimated Value: $227,943 - $259,000

2

Beds

2

Baths

1,137

Sq Ft

$212/Sq Ft

Est. Value

About This Home

This home is located at 2863 Twelve Oaks Dr Unit 1, Charlotte, MI 48813 and is currently estimated at $241,486, approximately $212 per square foot. 2863 Twelve Oaks Dr Unit 1 is a home located in Eaton County with nearby schools including Parkview Elementary School, Charlotte Upper Elementary School, and Charlotte Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 5, 2024

Sold by

Foress Condra E

Bought by

Houseman Alicia M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Outstanding Balance

$145,260

Interest Rate

5.99%

Mortgage Type

New Conventional

Estimated Equity

$96,226

Purchase Details

Closed on

Jun 14, 2005

Sold by

Swope Edward F and Swope Rhonda M

Bought by

Foress Condra E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$47,000

Interest Rate

5.82%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Jun 13, 2003

Sold by

Woolner Kathleen

Bought by

Swope Edward F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$105,600

Interest Rate

3.12%

Mortgage Type

Unknown

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Houseman Alicia M | $217,500 | Transnation Title | |

| Houseman Alicia M | $217,500 | Transnation Title | |

| Foress Condra E | $142,000 | First American | |

| Swope Edward F | $132,000 | Midstate Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Houseman Alicia M | $150,000 | |

| Closed | Houseman Alicia M | $150,000 | |

| Previous Owner | Foress Condra E | $47,000 | |

| Previous Owner | Swope Edward F | $105,600 | |

| Closed | Swope Edward F | $13,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,117 | $104,300 | $0 | $0 |

| 2024 | $800 | $100,350 | $0 | $0 |

| 2023 | $762 | $91,850 | $0 | $0 |

| 2022 | $1,871 | $84,200 | $0 | $0 |

| 2021 | $1,781 | $68,900 | $0 | $0 |

| 2020 | $1,757 | $76,600 | $0 | $0 |

| 2019 | $1,733 | $80,500 | $0 | $0 |

| 2018 | $1,692 | $66,650 | $0 | $0 |

| 2017 | $1,631 | $61,100 | $0 | $0 |

| 2016 | -- | $59,950 | $0 | $0 |

| 2015 | -- | $57,300 | $0 | $0 |

| 2014 | -- | $58,625 | $0 | $0 |

| 2013 | -- | $58,950 | $0 | $0 |

Source: Public Records

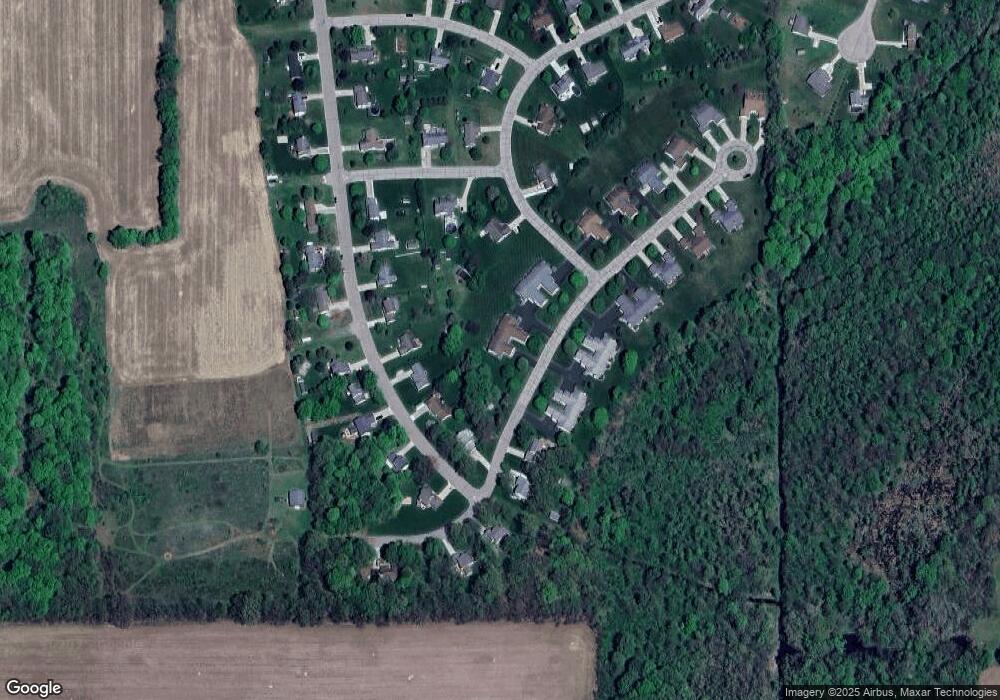

Map

Nearby Homes

- 2848 Lone Pine Trail

- 1074 Eaton Green Dr

- 1339 Flanders Rd

- 2278 Narrow Lake Rd

- 2632 Narrow Lake Rd

- 2335 Guernsey Dr

- 3341 Fieldberry Ln

- 882 Island Hwy

- 3215 E Crandell Dr Unit 2932

- 0 Nicholas Ln

- 1013 E Broadway Hwy

- 1877 Packard Hwy

- 302 Vansickle Dr Unit 35

- 432 Prairie St

- 431 E Seminary St

- 335 Pleasant St

- 1470 Nicholas Ln

- 1470 Nicholas Ln Unit 13

- 340 Horatio St

- 429 Sumpter St

- 2867 Twelve Oaks Dr

- 2865 Twelve Oaks Dr Unit 2

- 2869 Twelve Oaks Dr

- 2867 Twelve Unit 3

- 2867 Twelve

- 2883 Twelve Oaks Dr Unit 5

- 1065 Eaton Green Dr

- 2883 Twelve

- 2885 Twelve Oaks Dr Unit 6

- 2885 Twelve Oaks Dr

- 2889 Twelve Oaks Dr Unit 8

- 1061 Eaton Green Dr

- 2887 Twelve Oaks Dr Unit 7

- 2887 Twelve Oaks Dr

- 1075 Eaton Green Dr

- 2854 Twelve Oaks Dr

- 2858 Twelve Oaks Dr

- 2852 Twelve Oaks Dr

- 1079 Eaton Green Dr

- 0 Snowy Pine Dr Unit 218005922