2869 Golden Club Bend Austell, GA 30106

Estimated Value: $287,000 - $317,000

3

Beds

2

Baths

1,330

Sq Ft

$226/Sq Ft

Est. Value

About This Home

This home is located at 2869 Golden Club Bend, Austell, GA 30106 and is currently estimated at $300,922, approximately $226 per square foot. 2869 Golden Club Bend is a home located in Cobb County with nearby schools including Clarkdale Elementary School, Cooper Middle School, and South Cobb High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 12, 2020

Sold by

Franklin James V and Franklin Terri A

Bought by

Franklin James V

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$127,844

Outstanding Balance

$112,955

Interest Rate

3.6%

Mortgage Type

New Conventional

Estimated Equity

$187,967

Purchase Details

Closed on

Jul 22, 2014

Sold by

Franklin James V

Bought by

Franklin James and Franklin Terri A

Purchase Details

Closed on

Jun 1, 2004

Sold by

Buzza Susan G

Bought by

Franklin James V

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$155,000

Interest Rate

6.6%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 30, 1999

Sold by

Dr Horton Inc - Torrey

Bought by

Buzza Susan G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

7.79%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Franklin James V | -- | Amrock Inc | |

| Franklin James | -- | -- | |

| Franklin James V | $155,000 | -- | |

| Buzza Susan G | $125,100 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Franklin James V | $127,844 | |

| Previous Owner | Franklin James V | $155,000 | |

| Previous Owner | Buzza Susan G | $100,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | -- | $106,852 | $20,000 | $86,852 |

| 2024 | -- | $106,852 | $20,000 | $86,852 |

| 2023 | $0 | $106,852 | $20,000 | $86,852 |

| 2022 | $0 | $85,424 | $20,000 | $65,424 |

| 2021 | $2,239 | $73,764 | $16,000 | $57,764 |

| 2020 | $1,899 | $62,560 | $16,000 | $46,560 |

| 2019 | $1,899 | $62,560 | $16,000 | $46,560 |

| 2018 | $1,663 | $54,792 | $12,800 | $41,992 |

| 2017 | $1,575 | $54,792 | $12,800 | $41,992 |

| 2016 | $1,575 | $54,792 | $12,800 | $41,992 |

| 2015 | $1,220 | $41,404 | $12,800 | $28,604 |

| 2014 | $1,230 | $41,404 | $0 | $0 |

Source: Public Records

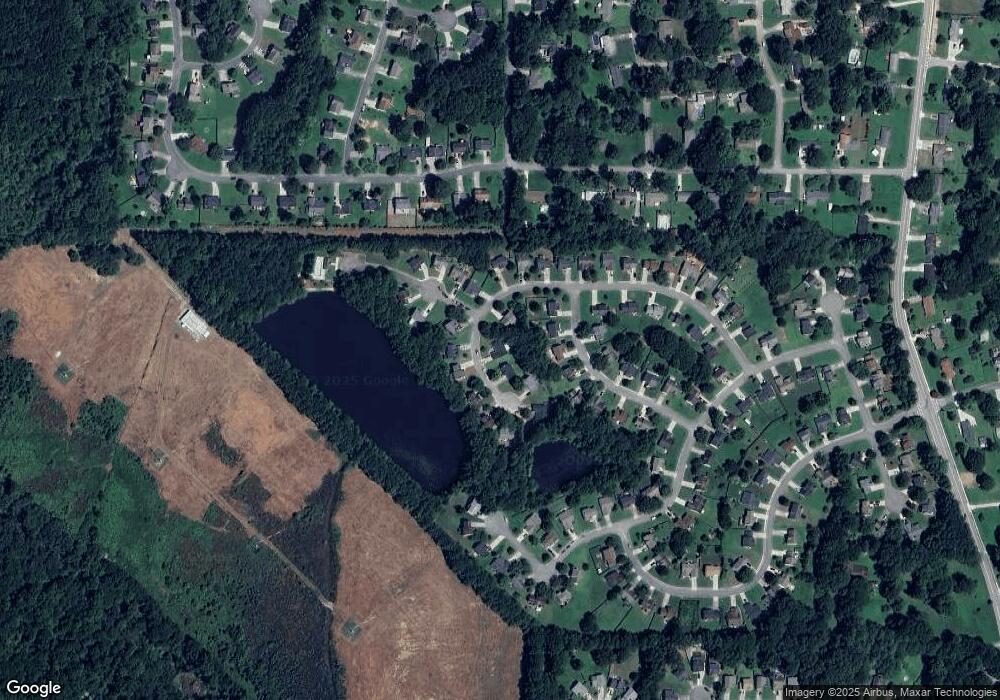

Map

Nearby Homes

- 2881 Golden Club Bend

- 2774 Eloquent Ln

- 2965 Dr

- 4099 Bunker Dr SW

- 4160 Ewing Rd

- 4550 Glory Dr

- 4280 Creek Crest Trail

- 3989 Flint Hill Rd

- 2473 Greenside Ct

- 4462 Wesley Way

- 2867 Ash St SW

- 2539 Dogwood Hills Ct

- 2711 Greystone Ct

- 3916 Abbott Way Unit 2

- 2402 Greenside Ct

- 3832 Abbott Ln Unit 1

- 3807 Abbott Ln SW Unit 15

- 3237 Abbott Dr SW Unit 7

- 3235 Abbott Dr Unit 7

- 3233 Abbott Dr Unit 7

- 2873 Golden Club Bend Unit 2

- 2857 Golden Club Bend

- 4204 Arrowhead Pointe

- 2877 Golden Club Bend

- 4208 Arrowhead Pointe Unit 2

- 2876 Golden Club Bend Unit II

- 2880 Golden Club Bend Unit 2

- 2903 Water Lily Ct

- 2872 Golden Club Bend Unit 2

- 2860 Golden Club Bend

- 4200 Arrowhead Pointe Unit 1

- 4212 Arrowhead Pointe

- 4212 Arrowhead Pte

- 2856 Golden Club Bend Unit 1

- 2884 Golden Club Bend Unit 2

- 2892 Golden Club Bend Unit 2

- 2906 Water Lily Ct Unit 1

- 4216 Arrowhead Pointe Unit 45

- 4216 Arrowhead Pointe

- 2852 Golden Club Bend