2876 Red Haven Ct Unit 2 Powder Springs, GA 30127

Estimated Value: $347,426 - $412,000

3

Beds

3

Baths

2,283

Sq Ft

$165/Sq Ft

Est. Value

About This Home

This home is located at 2876 Red Haven Ct Unit 2, Powder Springs, GA 30127 and is currently estimated at $376,607, approximately $164 per square foot. 2876 Red Haven Ct Unit 2 is a home located in Cobb County with nearby schools including Tapp Middle School, McEachern High School, and Grace Baptist Christian School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 29, 2000

Sold by

Farmington Homes Inc

Bought by

Tejada Anjel

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$121,150

Outstanding Balance

$44,308

Interest Rate

7.96%

Mortgage Type

New Conventional

Estimated Equity

$332,299

Purchase Details

Closed on

Sep 1, 2000

Sold by

Budwash David E and Budwash Deborah A

Bought by

Farmington Homes Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$121,150

Outstanding Balance

$44,308

Interest Rate

7.96%

Mortgage Type

New Conventional

Estimated Equity

$332,299

Purchase Details

Closed on

Mar 15, 1994

Sold by

Barber Steven N

Bought by

Budwash David E Deborah

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Tejada Anjel | $124,900 | -- | |

| Farmington Homes Inc | $115,000 | -- | |

| Budwash David E Deborah | $89,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Tejada Anjel | $121,150 | |

| Closed | Budwash David E Deborah | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,150 | $187,412 | $30,000 | $157,412 |

| 2023 | $2,374 | $130,544 | $16,000 | $114,544 |

| 2022 | $1,924 | $84,056 | $16,000 | $68,056 |

| 2021 | $1,924 | $84,056 | $16,000 | $68,056 |

| 2020 | $1,722 | $74,832 | $16,000 | $58,832 |

| 2019 | $1,659 | $71,968 | $16,000 | $55,968 |

| 2018 | $1,434 | $61,704 | $11,200 | $50,504 |

| 2017 | $1,386 | $61,704 | $11,200 | $50,504 |

| 2016 | $1,261 | $55,916 | $11,200 | $44,716 |

| 2015 | $1,289 | $55,916 | $11,200 | $44,716 |

| 2014 | $1,041 | $44,428 | $0 | $0 |

Source: Public Records

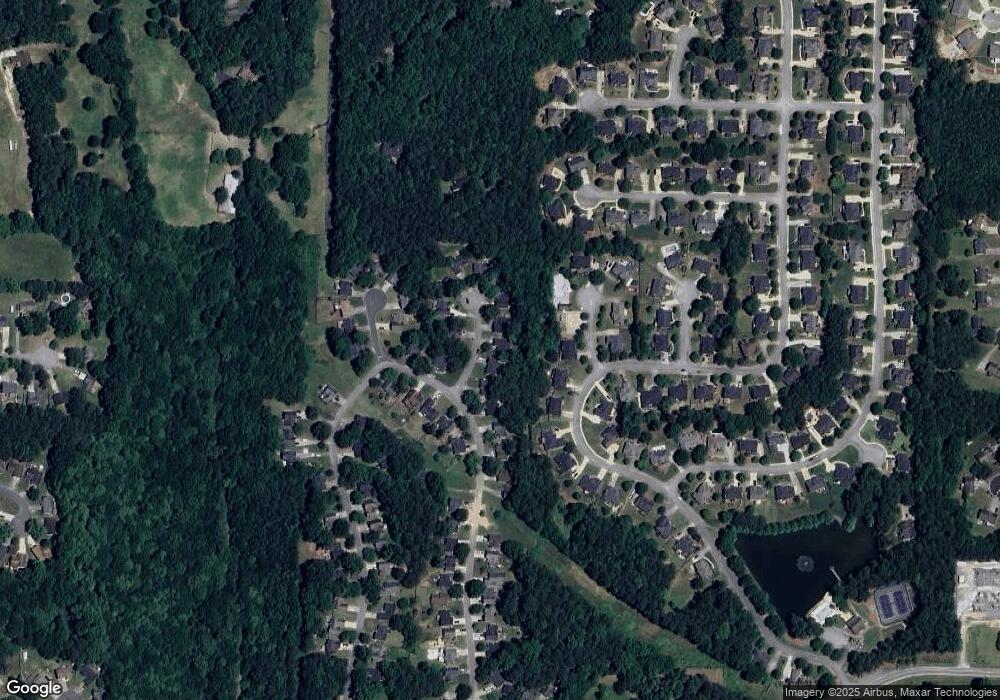

Map

Nearby Homes

- 2684 Mountain Oaks Ct

- 3130 Nectar Dr

- 3071 Nectar Dr

- 5069 Glendora Dr

- 4829 Moon Rd

- 4537 Rushing Wind Ct

- 6221 Honeybell Alley

- 2695 Moon Cabin Dr

- 2728 Warm Season Dr

- 4801 Deer Chase

- 742 Crossroad Ct SW

- 4548 Red Blossom Trail SW

- 3073 Hopeland Dr

- 4785 Country Cove Way

- 4956 Manna Ln

- 3383 Lochness Ln Unit 2

- 4772 Deer Chase

- 4808 Winding Ln

- 2874 Red Haven Ct

- 2878 Red Haven Ct

- 0 Red Haven Ct Unit 8711465

- 0 Red Haven Ct Unit 8681418

- 0 Red Haven Ct Unit 8849999

- 0 Red Haven Ct Unit 8864017

- 0 Red Haven Ct Unit 7081743

- 0 Red Haven Ct Unit 7333502

- 0 Red Haven Ct Unit 7443808

- 0 Red Haven Ct Unit 8191665

- 0 Red Haven Ct Unit 8264154

- 0 Red Haven Ct

- 2872 Red Haven Ct

- 2880 Red Haven Ct

- 2875 Red Haven Ct

- 2750 Lost Lakes Dr Unit 1

- 2660 Coolwood Cove

- 3114 Nectar Dr

- 3110 Nectar Dr

- 2873 Red Haven Ct