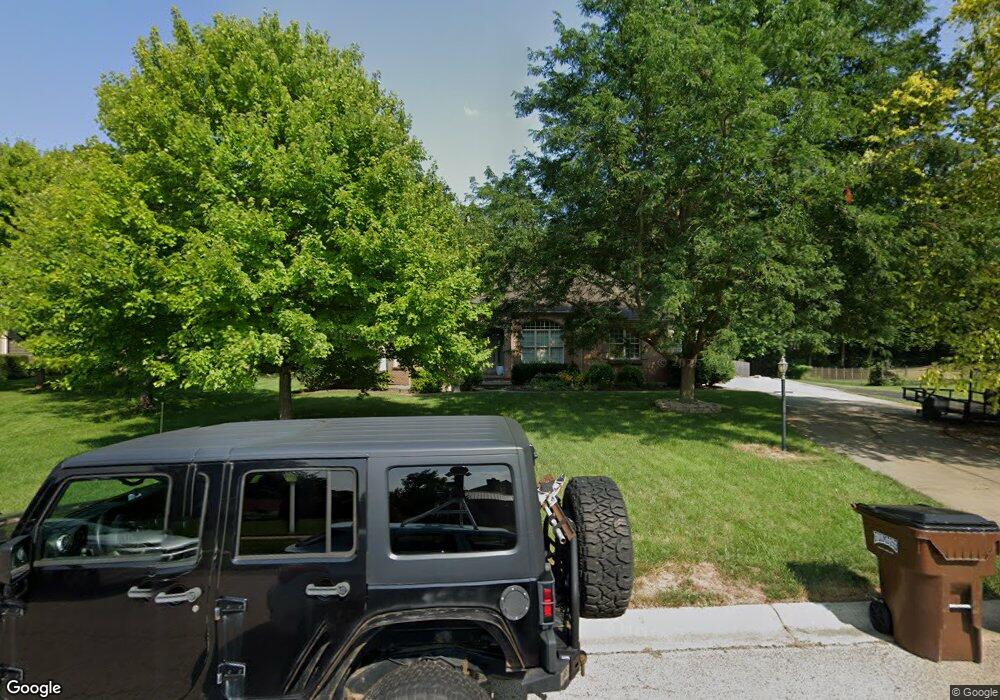

2880 Denham Ct Dayton, OH 45458

Estimated Value: $511,000 - $610,000

4

Beds

4

Baths

2,840

Sq Ft

$199/Sq Ft

Est. Value

About This Home

This home is located at 2880 Denham Ct, Dayton, OH 45458 and is currently estimated at $565,040, approximately $198 per square foot. 2880 Denham Ct is a home located in Montgomery County with nearby schools including Primary Village South, Weller Elementary School, and Tower Heights Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 31, 2020

Sold by

Chou Barbara and Powlette Barbara

Bought by

Orenbaun Robert C

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$465,000

Outstanding Balance

$414,207

Interest Rate

2.6%

Mortgage Type

VA

Estimated Equity

$150,833

Purchase Details

Closed on

May 5, 2006

Sold by

Willow Creek Farm Ii Llc

Bought by

Powlette Barbara

Purchase Details

Closed on

Sep 21, 2004

Sold by

Cole Joseph W and Thomas Lisa R

Bought by

Willow Creek Farm Ii Llc

Purchase Details

Closed on

May 28, 2001

Sold by

Cole Joseph W

Bought by

Cole Joseph W and Thomas Lisa R

Purchase Details

Closed on

May 1, 2000

Sold by

Hanauer Douglas E and Hanauer Laura A

Bought by

Cole Joseph W

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$275,000

Interest Rate

7.02%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Orenbaun Robert C | $465,000 | Capital Title | |

| Powlette Barbara | $60,000 | None Available | |

| Willow Creek Farm Ii Llc | $300,000 | None Available | |

| Cole Joseph W | -- | Midwest Abstract Company | |

| Cole Joseph W | $44,000 | Midwest Abstract Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Orenbaun Robert C | $465,000 | |

| Previous Owner | Cole Joseph W | $275,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $10,318 | $167,630 | $25,030 | $142,600 |

| 2023 | $10,318 | $167,630 | $25,030 | $142,600 |

| 2022 | $9,120 | $117,220 | $17,500 | $99,720 |

| 2021 | $9,146 | $117,220 | $17,500 | $99,720 |

| 2020 | $8,453 | $117,220 | $17,500 | $99,720 |

| 2019 | $7,987 | $100,320 | $17,500 | $82,820 |

| 2018 | $7,133 | $100,320 | $17,500 | $82,820 |

| 2017 | $7,056 | $100,320 | $17,500 | $82,820 |

| 2016 | $6,997 | $94,330 | $17,500 | $76,830 |

| 2015 | $6,884 | $94,330 | $17,500 | $76,830 |

| 2014 | $6,884 | $94,330 | $17,500 | $76,830 |

| 2012 | -- | $87,650 | $19,600 | $68,050 |

Source: Public Records

Map

Nearby Homes

- 3110 Beech Hill Dr

- 3076 Beech Hill Dr

- 0 Rooks Rd

- 2780 E Spring Valley Pike

- 9101 Rooks Rd

- 2037 Stablehand Dr

- 8730 Dowd Ct

- 9266 Ridings Blvd

- 9424 Clyo Rd

- 9863 Fairwater Springs Dr

- 2211 E Social Row Rd

- 8695 Dijon Ct

- 9354 Buckboard Dr

- 9850 Fairwater Springs Dr

- 8754 Elysee Cir

- 9882 Saddle Creek Trail

- 1943 Horseshoe Bend

- 1947 Horseshoe Bend

- 1890 Horseshoe Bend

- 1886 Horseshoe Bend

- 2890 Denham Ct

- 2860 Denham Ct

- 2861 Denham Ct

- 2900 Denham Ct

- 2850 Denham Ct

- 2891 Denham Ct

- 2910 Denham Ct

- 2840 Denham Ct

- 2901 Denham Ct

- 9714 Feather Wood Ln

- 2905 Cobblestone Crossing Ct

- 2918 Ramblingwood Ln

- 9706 Feather Wood Ln

- 2830 Denham Ct

- 2910 Ramblingwood Ln

- 2915 Cobblestone Crossing Ct

- 9696 Feather Wood Ln

- 2895 Cobblestone Crossing Ct

- 2898 Ramblingwood Ln

- 2820 Denham Ct