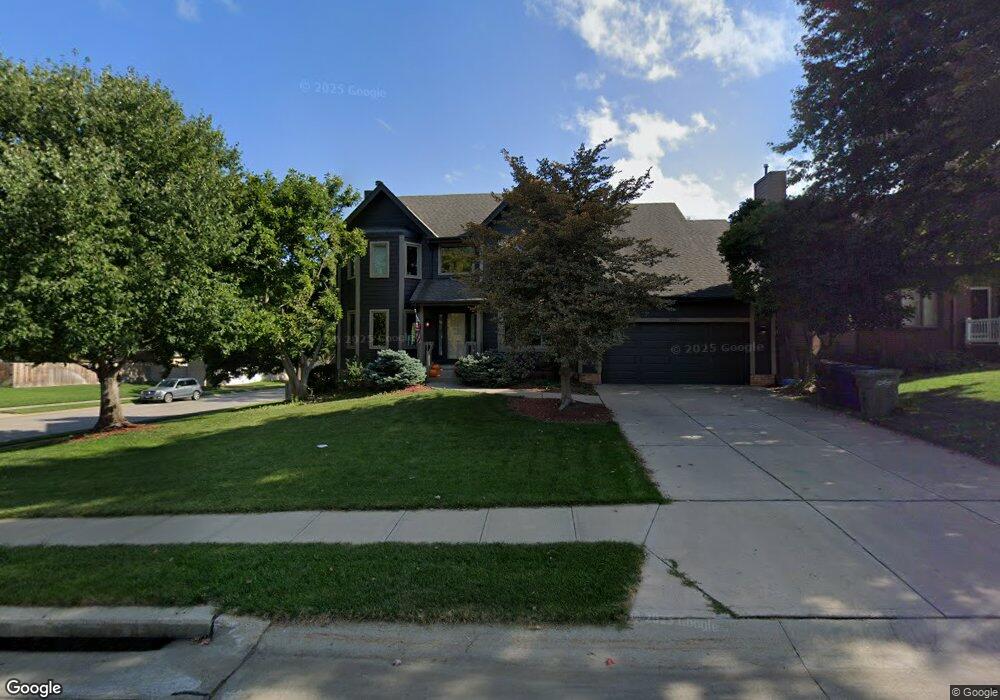

2901 Sheridan Rd Bellevue, NE 68123

Estimated Value: $431,000 - $437,736

4

Beds

3

Baths

2,514

Sq Ft

$173/Sq Ft

Est. Value

About This Home

This home is located at 2901 Sheridan Rd, Bellevue, NE 68123 and is currently estimated at $435,184, approximately $173 per square foot. 2901 Sheridan Rd is a home located in Sarpy County with nearby schools including Leonard Lawrence Elementary School, Lewis & Clark Middle School, and Bellevue West High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 17, 2025

Sold by

Pryor Paul T and Pryor Pamela M

Bought by

Snyder Garrett and Snyder Celeste

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$120,000

Outstanding Balance

$119,794

Interest Rate

6.77%

Mortgage Type

New Conventional

Estimated Equity

$315,390

Purchase Details

Closed on

Apr 14, 2023

Sold by

Gabriel Christian Michael and Kelly Ann

Bought by

Pryor Paul T and Pryor Pamela M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$328,000

Interest Rate

6.42%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 29, 2018

Sold by

White Terry L and White Gail S

Bought by

Gabriel Christian Michael and Gabriel Kelly Ann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$247,429

Interest Rate

4.6%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Snyder Garrett | $435,000 | Rts Title & Escrow | |

| Pryor Paul T | $410,000 | Green Title & Escrow | |

| Gabriel Christian Michael | $288,000 | Titlecore National Llc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Snyder Garrett | $120,000 | |

| Previous Owner | Pryor Paul T | $328,000 | |

| Previous Owner | Gabriel Christian Michael | $247,429 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,996 | $426,862 | $55,000 | $371,862 |

| 2024 | $7,813 | $401,296 | $50,000 | $351,296 |

| 2023 | $7,813 | $369,990 | $44,000 | $325,990 |

| 2022 | $7,049 | $327,573 | $44,000 | $283,573 |

| 2021 | $6,731 | $309,435 | $44,000 | $265,435 |

| 2020 | $6,422 | $294,302 | $38,000 | $256,302 |

| 2019 | $5,734 | $264,403 | $38,000 | $226,403 |

| 2018 | $6,051 | $261,105 | $36,000 | $225,105 |

| 2017 | $5,801 | $247,269 | $36,000 | $211,269 |

| 2016 | $5,722 | $248,637 | $32,000 | $216,637 |

| 2015 | $5,536 | $245,342 | $30,000 | $215,342 |

| 2014 | $5,384 | $239,385 | $30,000 | $209,385 |

| 2012 | -- | $225,161 | $30,000 | $195,161 |

Source: Public Records

Map

Nearby Homes

- 2923 Blackhawk Dr

- 13403 S 28th St

- 2939 Lone Tree Rd

- 13211 S 26th Ave

- 2512 Nottingham Dr

- 3105 Mirror Cir

- 3309 Lookingglass Dr

- 2810 Bar Harbor Dr

- 12901 S 29th Place

- 12722 S 28th Ave

- 3102 Redwing Dr

- 2940 Leawood Dr

- 3105 Leawood Dr

- 3504 Sheridan Cir

- 14002 Tregaron Ridge Ave Unit B

- 3113 Tammy St

- 3508 Jason Cir

- 3506 Lynnwood Dr

- 13602 S 36th St

- 14112 S 22nd St

- 2903 Sheridan Rd

- 2902 Blackhawk Dr

- 2905 Sheridan Rd

- 2807 Sheridan Rd

- 2904 Blackhawk Dr

- 2902 Sheridan Rd

- 2904 Sheridan Rd

- 2906 Blackhawk Dr

- 2806 Blackhawk Dr

- 2906 Sheridan Rd

- 13411 S 29th St

- 2907 Sheridan Rd

- 2805 Sheridan Rd

- 2908 Blackhawk Dr

- 2901 Schuemann Dr

- 2804 Blackhawk Dr

- 2908 Sheridan Rd

- 2903 Schuemann Dr

- 13409 S 29th St

- 2803 Sheridan Rd