2904 Lloyd Ct Temple Hills, MD 20748

Estimated Value: $279,798 - $368,000

--

Bed

3

Baths

1,280

Sq Ft

$250/Sq Ft

Est. Value

About This Home

This home is located at 2904 Lloyd Ct, Temple Hills, MD 20748 and is currently estimated at $320,200, approximately $250 per square foot. 2904 Lloyd Ct is a home located in Prince George's County with nearby schools including Panorama Elementary School, Benjamin Stoddert Middle School, and Potomac High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 28, 2005

Sold by

Miller Celestine K

Bought by

Miller Celestine K

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$173,800

Outstanding Balance

$111,307

Interest Rate

8.85%

Mortgage Type

Adjustable Rate Mortgage/ARM

Estimated Equity

$208,893

Purchase Details

Closed on

Oct 31, 2005

Sold by

Miller Celestine K

Bought by

Miller Celestine K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$173,800

Outstanding Balance

$111,307

Interest Rate

8.85%

Mortgage Type

Adjustable Rate Mortgage/ARM

Estimated Equity

$208,893

Purchase Details

Closed on

Jun 5, 1996

Sold by

Charles Burton Builders Inc

Bought by

Miller Celestine K and Miller Mamie S

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Miller Celestine K | -- | -- | |

| Miller Celestine K | -- | -- | |

| Miller Celestine K | $130,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Miller Celestine K | $173,800 | |

| Previous Owner | Miller Celestine K | $173,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,550 | $255,467 | -- | -- |

| 2024 | $3,550 | $252,633 | $0 | $0 |

| 2023 | $3,479 | $249,800 | $60,000 | $189,800 |

| 2022 | $3,334 | $238,267 | $0 | $0 |

| 2021 | $3,193 | $226,733 | $0 | $0 |

| 2020 | $3,120 | $215,200 | $60,000 | $155,200 |

| 2019 | $3,032 | $203,933 | $0 | $0 |

| 2018 | $2,929 | $192,667 | $0 | $0 |

| 2017 | $2,843 | $181,400 | $0 | $0 |

| 2016 | -- | $171,800 | $0 | $0 |

| 2015 | $3,268 | $162,200 | $0 | $0 |

| 2014 | $3,268 | $152,600 | $0 | $0 |

Source: Public Records

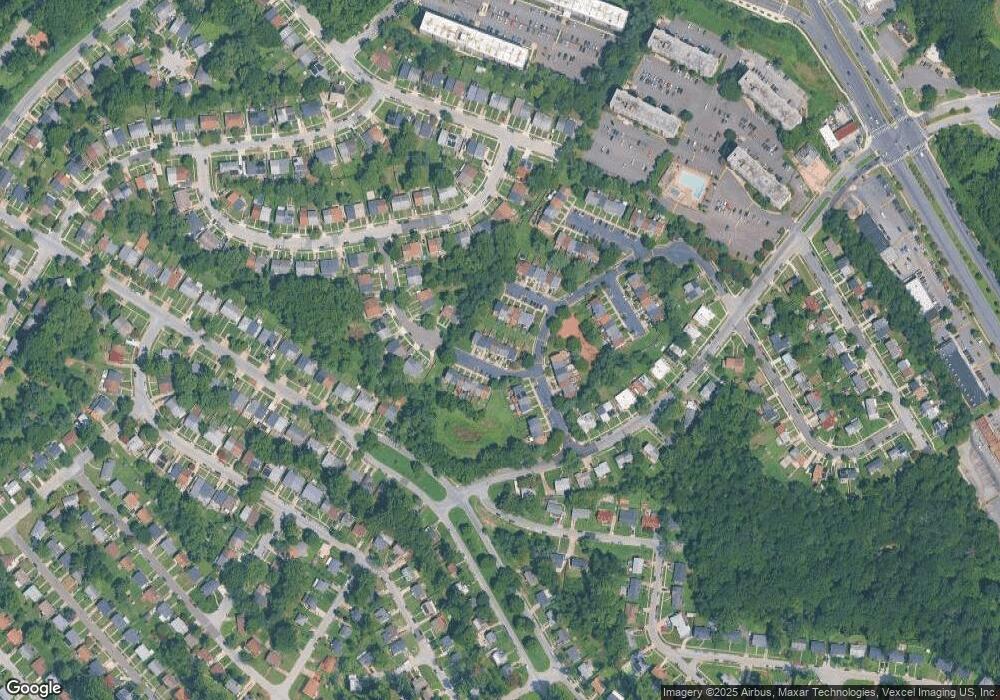

Map

Nearby Homes

- 2807 Curtis Dr

- 3303 30th Ave

- 2509 Afton St

- 3604 23rd Pkwy

- 2402 Fairlawn St

- 3109 Naylor Rd SE Unit 103

- 3109 Naylor Rd SE Unit 301

- 3109 Naylor Rd SE Unit 302

- 3802 26th Ave Unit 16

- 2627 Colebrooke Dr Unit 31

- 3107 Naylor Rd SE Unit 302

- 3130 Buena Vista Terrace SE

- 3105 Naylor Rd SE Unit 104

- 3105 Naylor Rd SE Unit 101

- 3126 Buena Vista Terrace SE

- 3840 26th Ave

- 3716 Hill Park Dr

- 2825 31st St SE Unit A489

- 2834 Iverson St Unit 101

- 3317 Gainesville St SE