2910 Dayton Xenia Rd Dayton, OH 45434

Estimated Value: $308,000 - $472,256

4

Beds

3

Baths

2,091

Sq Ft

$182/Sq Ft

Est. Value

About This Home

This home is located at 2910 Dayton Xenia Rd, Dayton, OH 45434 and is currently estimated at $379,564, approximately $181 per square foot. 2910 Dayton Xenia Rd is a home located in Greene County with nearby schools including Main Elementary School, Jacob Coy Middle School, and Beavercreek High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 30, 2024

Sold by

Kreill Randy and Kreill Megan

Bought by

Drager Brad L and Drager Laura J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$370,500

Outstanding Balance

$364,791

Interest Rate

6.38%

Mortgage Type

Credit Line Revolving

Estimated Equity

$14,773

Purchase Details

Closed on

Jun 9, 1998

Sold by

Miller Randy L

Bought by

Kreill Randy and Kreill Megan

Purchase Details

Closed on

Nov 28, 1995

Sold by

Anderson Marjorie A

Bought by

Miller Randy L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$76,000

Interest Rate

6.75%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Drager Brad L | $494,000 | None Listed On Document | |

| Kreill Randy | $120,000 | -- | |

| Miller Randy L | $95,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Drager Brad L | $370,500 | |

| Previous Owner | Miller Randy L | $76,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $8,260 | $126,270 | $39,240 | $87,030 |

| 2023 | $8,260 | $126,270 | $39,240 | $87,030 |

| 2022 | $6,854 | $92,470 | $32,700 | $59,770 |

| 2021 | $6,715 | $92,470 | $32,700 | $59,770 |

| 2020 | $5,810 | $92,470 | $32,700 | $59,770 |

| 2019 | $5,810 | $72,440 | $28,080 | $44,360 |

| 2018 | $5,130 | $72,440 | $28,080 | $44,360 |

| 2017 | $5,141 | $72,440 | $28,080 | $44,360 |

| 2016 | $5,142 | $70,330 | $28,080 | $42,250 |

| 2015 | $2,083 | $70,330 | $28,080 | $42,250 |

| 2014 | -- | $70,330 | $28,080 | $42,250 |

Source: Public Records

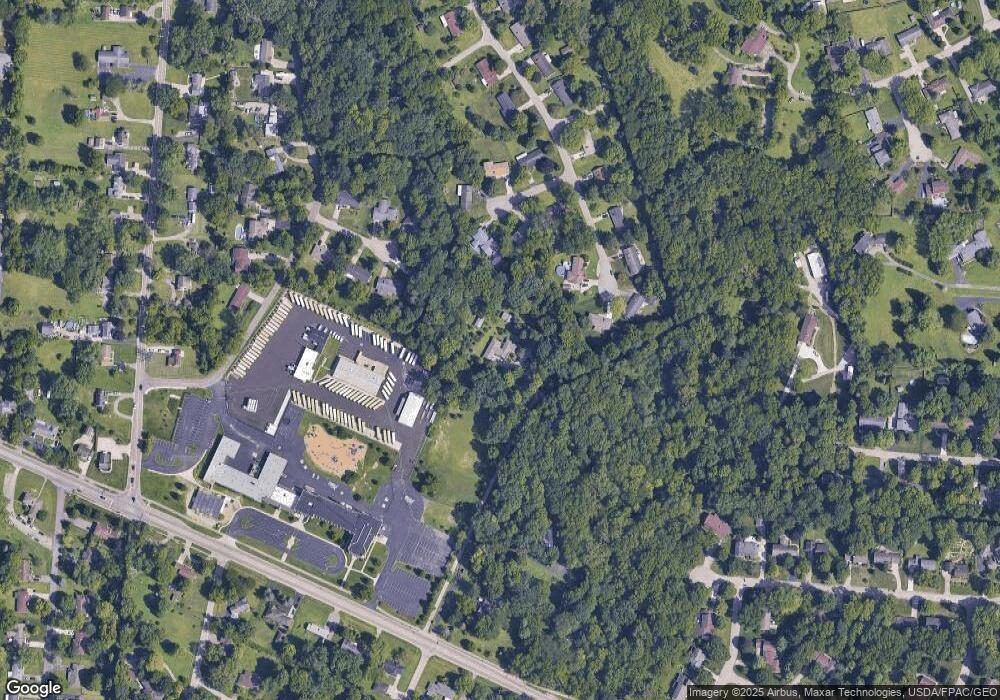

Map

Nearby Homes

- 2938 Bruce Ct

- 5 Hickory Dr

- 2853 Oriole Dr

- 1359 Fudge Dr

- 2851 Crone Rd

- 1482 Fudge Dr

- 3178 Lantz Rd

- 1210 Lomeda Ln

- 2507 Obetz Dr

- 3050 Viola Dr

- 3196 Suburban Dr

- 1051 Forest Dr

- 2570 Mardella Dr

- 825 Fawcett Dr

- 3330 Fair Oaks Dr

- 2162 Owen E

- 2418 Owen W

- 2715 Golden Leaf Dr

- 2707 Golden Leaf Dr

- 2649 Golden Leaf Dr Unit 16-300

- 2952 Persimmon Ct

- 1277 Eileen Dr

- 2944 Persimmon Ct

- 1265 Eileen Dr

- 2929 Bruce Ct

- 2982 Bruce Ct

- 2934 Persimmon Ct

- 2931 Bruce Ct

- 1266 Eileen Dr

- 2953 Persimmon Ct

- 1270 Eileen Dr

- 1284 Eileen Dr

- 2947 Persimmon Ct

- 2933 Bruce Ct

- 2935 Persimmon Ct

- 1296 Eileen Dr

- 2946 Bruce Ct

- 2906 Dayton Xenia Rd

- 2935 Bruce Ct

- 1308 Eileen Dr