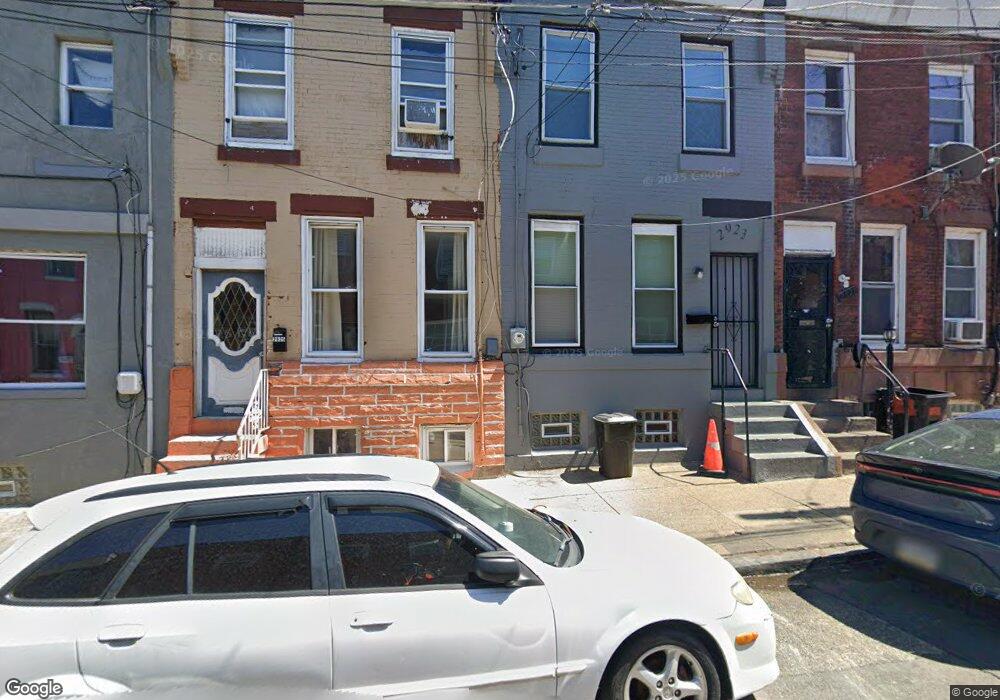

2923 Kip St Philadelphia, PA 19134

Upper Kensington NeighborhoodEstimated Value: $57,000 - $80,842

3

Beds

1

Bath

1,054

Sq Ft

$68/Sq Ft

Est. Value

About This Home

This home is located at 2923 Kip St, Philadelphia, PA 19134 and is currently estimated at $71,461, approximately $67 per square foot. 2923 Kip St is a home located in Philadelphia County with nearby schools including Elkin Lewis School, Thomas Alva Edison High School/Fareira Skills Center, and John B. Stetson Charter School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 15, 2019

Sold by

Citimortgage Inc

Bought by

Aisha Smith Properties Llc

Current Estimated Value

Purchase Details

Closed on

May 17, 2018

Sold by

Secretary Of Housing & Urban Development

Bought by

Citimortgage Inc

Purchase Details

Closed on

Apr 21, 2014

Sold by

Cltlmortgage Inc

Bought by

Secretary Of Hud

Purchase Details

Closed on

May 25, 1995

Sold by

Mellon Bank East Na

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

May 10, 1995

Sold by

Federal National Mortgage Association

Bought by

Ruiz David and Rivera Luis

Purchase Details

Closed on

Jul 18, 1994

Sold by

Green John D

Bought by

Mellon Bank East N A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Aisha Smith Properties Llc | $16,000 | Servicelink Llc | |

| Citimortgage Inc | -- | None Available | |

| Secretary Of Hud | -- | None Available | |

| Federal National Mortgage Association | -- | -- | |

| Ruiz David | $2,700 | Commonwealth Land Title Ins | |

| Mellon Bank East N A | $2,400 | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $864 | $70,200 | $14,000 | $56,200 |

| 2024 | $864 | $70,200 | $14,000 | $56,200 |

| 2023 | $864 | $61,700 | $12,340 | $49,360 |

| 2022 | $382 | $61,700 | $12,340 | $49,360 |

| 2021 | $382 | $0 | $0 | $0 |

| 2020 | $382 | $0 | $0 | $0 |

| 2019 | $0 | $0 | $0 | $0 |

| 2018 | $0 | $0 | $0 | $0 |

| 2017 | $549 | $0 | $0 | $0 |

| 2016 | $549 | $0 | $0 | $0 |

| 2015 | $662 | $0 | $0 | $0 |

| 2014 | -- | $49,400 | $4,410 | $44,990 |

| 2012 | -- | $2,496 | $401 | $2,095 |

Source: Public Records

Map

Nearby Homes