Estimated Value: $290,000 - $341,000

1

Bed

1

Bath

837

Sq Ft

$383/Sq Ft

Est. Value

About This Home

This home is located at 293 Deep Creek Rd, Arabi, GA 31712 and is currently estimated at $320,641, approximately $383 per square foot. 293 Deep Creek Rd is a home with nearby schools including Crisp County Primary School, Crisp County Elementary School, and Crisp County Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 30, 2018

Sold by

Hickey Robin

Bought by

Swain Larry C

Current Estimated Value

Purchase Details

Closed on

Jan 1, 2012

Sold by

Dickerson Dewey W and Dickerson Vicki W

Bought by

Dickerson Dewey W and Dickerson Vicki W

Purchase Details

Closed on

Apr 12, 2006

Sold by

Woodroof W Cole

Bought by

Dickerson Dewey W

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$253,459

Interest Rate

6.31%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 16, 1998

Sold by

Nix Ruth

Bought by

Woodruff W Cole

Purchase Details

Closed on

Oct 7, 1992

Sold by

Ross J E

Bought by

Nix Ruth

Purchase Details

Closed on

Jan 29, 1958

Bought by

Ross J E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Swain Larry C | $175,000 | -- | |

| Dickerson Dewey W | $199,000 | -- | |

| Dickerson Dewey W | $250,000 | -- | |

| Woodruff W Cole | $165,000 | -- | |

| Nix Ruth | -- | -- | |

| Ross J E | $1,600 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Dickerson Dewey W | $253,459 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,840 | $67,949 | $30,306 | $37,643 |

| 2023 | $1,890 | $67,288 | $30,702 | $36,586 |

| 2022 | $1,445 | $51,458 | $15,453 | $36,005 |

| 2021 | $1,470 | $49,585 | $15,453 | $34,132 |

| 2020 | $1,473 | $49,585 | $15,453 | $34,132 |

| 2019 | $1,463 | $49,585 | $15,453 | $34,132 |

| 2018 | $1,340 | $47,193 | $13,488 | $33,705 |

| 2017 | $1,451 | $47,193 | $13,488 | $33,705 |

| 2016 | $1,255 | $45,851 | $13,488 | $32,363 |

| 2015 | -- | $33,954 | $13,488 | $20,466 |

| 2014 | -- | $33,954 | $13,488 | $20,466 |

| 2013 | -- | $33,953 | $13,487 | $20,466 |

Source: Public Records

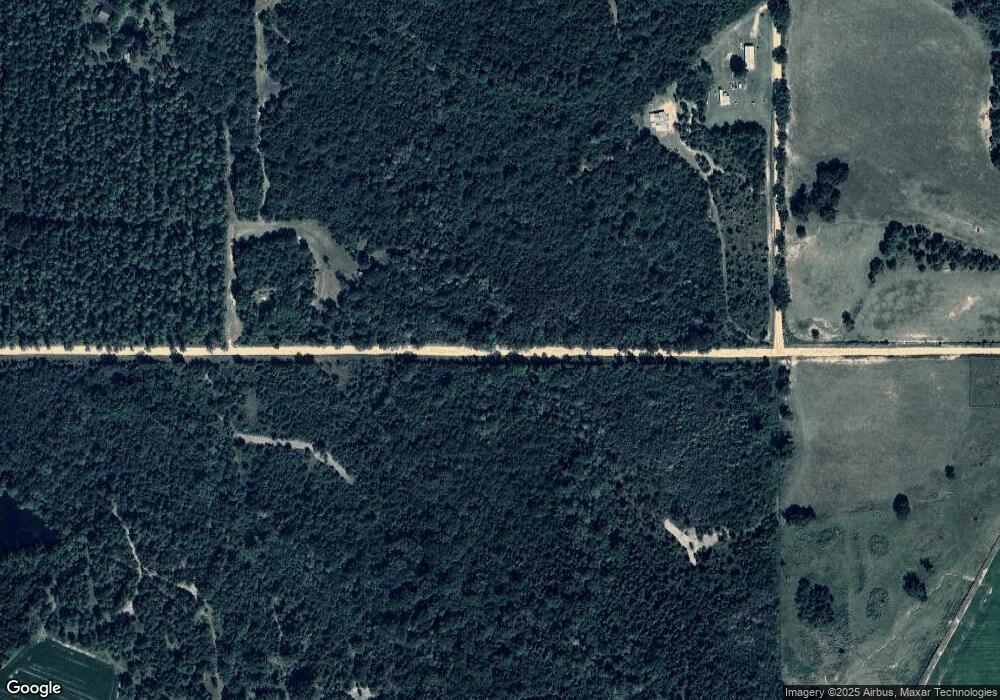

Map

Nearby Homes

- 672 Brock Rd

- 846 Hawpond Rd

- 2453 Georgia 90

- 0 Lost Rd

- 114 Brier Patch Rd

- 3113 Old Hatley Rd

- 1806 Georgia 90

- 2905 Old Hatley Rd

- 2413 Old Hatley Rd

- 0 Aberdeen Circle Lt# 28

- 104 4th St

- TBD Aberdeen Circle Lot#28

- 68 Aberdeen Cir

- 104 Aberdeen Cir

- 49 Aberdeen Cir

- 221 1st St W

- 000 Brady Rd

- 56 Aberdeen Cir

- 11 Lochridge Way

- Tract 8 Deep Creek Rd

- Tract 4 Deep Creek Rd

- Tract #8 Deep Creek Rd

- Tract 7 Deep Creek Rd

- Tract 6 Deep Creek Rd

- Tract 5 Deep Creek Rd

- 0 Deep Creek Rd

- 293 Deep Creek Rd

- Lot 7 Deep Creek Rd

- 0 Deep Creek Rd Unit TRACT 7 20011366

- 0 Deep Creek Rd Unit 8711955

- 0 Deep Creek Rd

- 353 Deep Creek Rd

- 210 Deep Creek Rd

- 800 Deep Creek Rd

- 407 Brock Rd

- 3163 Ga Highway 90

- 436 Brock Rd

- 463 Brock Rd

- 3171 S Ga Highway 90 Hwy