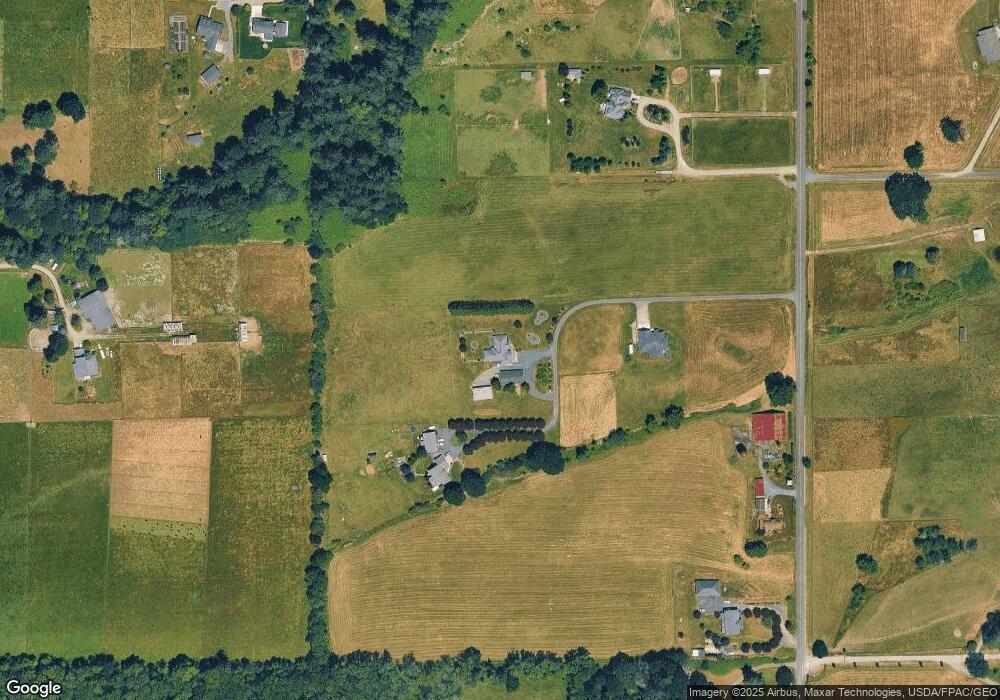

29300 NE 112th Ave Battle Ground, WA 98604

Estimated Value: $864,000 - $1,026,000

3

Beds

2

Baths

2,667

Sq Ft

$359/Sq Ft

Est. Value

About This Home

This home is located at 29300 NE 112th Ave, Battle Ground, WA 98604 and is currently estimated at $957,919, approximately $359 per square foot. 29300 NE 112th Ave is a home located in Clark County with nearby schools including Daybreak Primary School, Daybreak Middle School, and Battle Ground High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 16, 2006

Sold by

Christiansen Robert D and Christiansen Danielle R

Bought by

Trumpf Rodney C and Trumpf Denise J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$78,300

Interest Rate

6.52%

Mortgage Type

Stand Alone Second

Purchase Details

Closed on

Apr 19, 2004

Sold by

Daybreak Homes Inc

Bought by

Christiansen Robert D and Christiansen Danielle R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$296,000

Interest Rate

5.39%

Mortgage Type

Construction

Purchase Details

Closed on

Sep 2, 2003

Sold by

Ritzau Karl P and Ritzau Linda

Bought by

Daybreak Homes Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Trumpf Rodney C | $522,000 | First American Title | |

| Christiansen Robert D | $130,000 | Stewart Title | |

| Daybreak Homes Inc | -- | Stewart Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Trumpf Rodney C | $78,300 | |

| Open | Trumpf Rodney C | $417,000 | |

| Previous Owner | Christiansen Robert D | $296,000 | |

| Closed | Christiansen Robert D | $37,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,213 | $855,946 | $270,100 | $585,846 |

| 2024 | $6,592 | $825,481 | $270,100 | $555,381 |

| 2023 | $7,250 | $791,058 | $221,889 | $569,169 |

| 2022 | $6,248 | $848,327 | $217,412 | $630,915 |

| 2021 | $6,355 | $677,999 | $185,483 | $492,516 |

| 2020 | $5,899 | $629,966 | $177,546 | $452,420 |

| 2019 | $5,260 | $573,047 | $170,586 | $402,461 |

| 2018 | $5,855 | $585,266 | $0 | $0 |

| 2017 | $5,023 | $498,089 | $0 | $0 |

| 2016 | $4,757 | $463,978 | $0 | $0 |

| 2015 | $4,641 | $404,869 | $0 | $0 |

| 2014 | -- | $376,229 | $0 | $0 |

| 2013 | -- | $347,410 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 28900 NE 112th Ave

- 9827 NE 299th St

- 9701 NE 299th St

- 11221 NE 279th St

- 11700 NE 279th St

- 29311 NE 124th Ave

- 27203 NE 103rd Ave

- 0 NE 279th St Unit 717779825

- 0 NE 279th St Unit 24075001

- 0 NE 279th St Unit 24073819

- 0 NE 279th St Unit 24101609

- 31305 NE 95th Ave

- 13706 NE River Bend Rd

- 28108 NE 82nd Ave

- 30108 NE Mcbride Rd

- 8110 NE 272nd Cir

- 8300 NE 316th St

- 7500 NE 299th St

- 11200 NE Gren Fels Dr

- 9606 NE 255th Cir

- 29202 NE 112th Ave

- 29306 NE 112th Ave

- 29500 NE 112th Ave

- 29006 NE 112th Ave

- 29620 NE 107th Ave

- 10703 NE 299th St

- 29626 NE 107th Ave

- 29700 NE 112th Ave

- 29710 NE 112th Ave

- 10803 NE 299th St

- 29401 NE 112th Ave

- 10900 NE 285th St

- 10800 NE 285th St

- 11014 NE 285th St

- 29911 NE 108th Ave

- 29403 NE 112th Ave

- 29403 NE 112th Ave

- 10413 NE 299th St

- 10417 NE 299th St

- 28901 NE 112th Ave