Estimated Value: $2,681,000 - $2,988,273

5

Beds

7

Baths

5,862

Sq Ft

$478/Sq Ft

Est. Value

About This Home

This home is located at 2933 W 110 N Unit 14, Lehi, UT 84043 and is currently estimated at $2,800,424, approximately $477 per square foot. 2933 W 110 N Unit 14 is a home located in Utah County with nearby schools including River Rock Elementary, Willowcreek Middle School, and Lehi High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 20, 2022

Sold by

Gregory Peterson Matthew

Bought by

Mcgulre Denlse

Current Estimated Value

Purchase Details

Closed on

Feb 26, 2019

Sold by

Peterson Matthew

Bought by

Peterson Matthew Gregory

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$188,000

Interest Rate

4.4%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 17, 2018

Sold by

Peteco Construction & Development Llc

Bought by

Peterson Matthew

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$160,000

Interest Rate

3.94%

Mortgage Type

Commercial

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mcgulre Denlse | -- | Key Land Title | |

| Peterson Matthew Gregory | -- | Stewart Ttl Ins Agcy Of Uta | |

| Peterson Matthew | -- | Meridian Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Peterson Matthew Gregory | $188,000 | |

| Previous Owner | Peterson Matthew | $160,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,860 | $1,214,495 | $379,200 | $1,828,400 |

| 2024 | $8,860 | $1,036,845 | $0 | $0 |

| 2023 | $7,862 | $999,005 | $0 | $0 |

| 2022 | $7,195 | $1,610,800 | $351,100 | $1,259,700 |

| 2021 | $4,767 | $887,200 | $219,600 | $667,600 |

| 2020 | $2,009 | $203,400 | $203,400 | $0 |

| 2019 | $1,933 | $203,400 | $203,400 | $0 |

| 2018 | $1,749 | $174,000 | $174,000 | $0 |

Source: Public Records

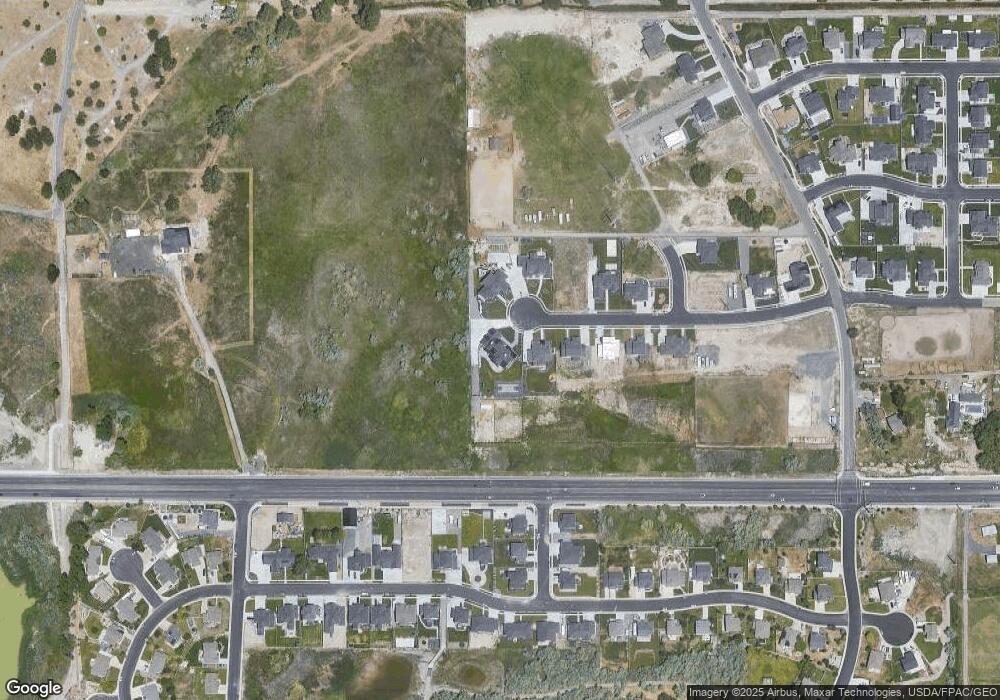

Map

Nearby Homes

- 2817 W Willow Dr

- The Roslyn Plan at Carla's Cove

- The Tracie Plan at Carla's Cove

- The Brooke Plan at Carla's Cove

- The Jackie Plan at Carla's Cove

- 105 N 2430 W

- 122 N 2430 W Unit 1

- 373 N Willow Haven Ave

- 3590 W Grassland Dr

- 2512 W 610 N Unit 99

- 472 S Olive Place

- 210 S Tamarak Cir

- 347 E Levengrove Dr Unit 1134

- 341 E Levengrove Dr Unit 1133

- 3452 W Pond Dr

- 335 E Levengrove Dr Unit 1132

- 410 S Olive Way

- 41 N 2150 W

- 1496 N June St

- 3716 Orinda Dr Unit 1573

- 2933 W 110 N

- 2917 W 110 N

- 2932 W 110 N

- 2889 W 110 N Unit 11

- 2889 W 110 N

- 2867 W 110 N

- 2870 W 110 N Unit 5

- 2844 W 110 N Unit 4

- 2844 W 110 N

- 2843 W 110 N Unit 11

- 2843 W 110 N

- 2821 W 110 N Unit 14

- 2821 W 110 N

- 18 S 2920 W

- 17 S 2920 W

- 46 S 2920 W

- 2992 W Willow Dr

- 45 S 2920 W

- 168 N Ivans Way

- 3028 W Willow Dr