2939 S Bay Dr Unit G2 Westlake, OH 44145

Estimated Value: $176,000 - $189,000

2

Beds

2

Baths

1,225

Sq Ft

$150/Sq Ft

Est. Value

About This Home

This home is located at 2939 S Bay Dr Unit G2, Westlake, OH 44145 and is currently estimated at $183,443, approximately $149 per square foot. 2939 S Bay Dr Unit G2 is a home located in Cuyahoga County with nearby schools including Dover Intermediate School, Lee Burneson Middle School, and Westlake High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 6, 2011

Sold by

Esterly David B and Esterly John Mark

Bought by

Piotrowski Kerry A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$51,450

Outstanding Balance

$35,596

Interest Rate

4.63%

Mortgage Type

New Conventional

Estimated Equity

$147,847

Purchase Details

Closed on

Jun 7, 2002

Sold by

Thomas Reta Jean

Bought by

Esterly Marcia L and Marcia L Easterly Trust

Purchase Details

Closed on

Dec 28, 1993

Sold by

Thomas Reta J

Bought by

Thomas, Reta Jean - Trs

Purchase Details

Closed on

Mar 19, 1992

Sold by

Thomas Rudolph H

Bought by

Thomas Reta J

Purchase Details

Closed on

Apr 21, 1989

Sold by

Ederle Robert H and R E

Bought by

Thomas Rudolph H

Purchase Details

Closed on

Jan 1, 1987

Bought by

Ederle Robert H and R E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Piotrowski Kerry A | $73,500 | Guardian Title | |

| Esterly Marcia L | $110,000 | Prospect Title Agency Inc | |

| Thomas, Reta Jean - Trs | -- | -- | |

| Thomas Reta J | -- | -- | |

| Thomas Rudolph H | $77,500 | -- | |

| Ederle Robert H | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Piotrowski Kerry A | $51,450 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,950 | $50,960 | $5,110 | $45,850 |

| 2023 | $1,780 | $41,300 | $4,130 | $37,170 |

| 2022 | $1,775 | $41,300 | $4,130 | $37,170 |

| 2021 | $2,255 | $41,300 | $4,130 | $37,170 |

| 2020 | $1,744 | $29,300 | $2,940 | $26,360 |

| 2019 | $1,691 | $83,700 | $8,400 | $75,300 |

| 2018 | $1,698 | $29,300 | $2,940 | $26,360 |

| 2017 | $1,825 | $29,620 | $3,330 | $26,290 |

| 2016 | $1,816 | $29,620 | $3,330 | $26,290 |

| 2015 | $1,806 | $29,620 | $3,330 | $26,290 |

| 2014 | $2,033 | $32,550 | $3,640 | $28,910 |

Source: Public Records

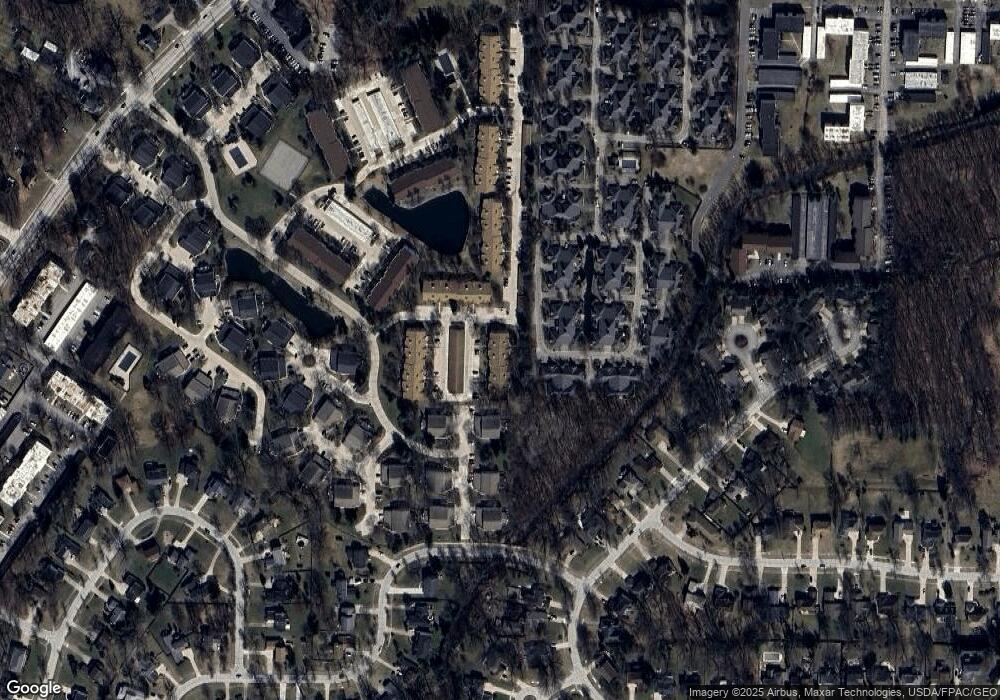

Map

Nearby Homes

- 3263 Bay Landing Dr Unit 27

- 2995 N Bay Dr Unit I14

- 3247 Bay Landing Dr Unit 31

- 2820 N Bay Dr

- 3115 Bay Landing Dr Unit 3115

- 26814 Center Ridge Rd

- 28080 Center Ridge Rd

- 28340 Center Ridge Rd Unit 123

- 27120 Rose Rd

- 3450 Briar Ridge Ct Unit F

- 28276 Hallberg Dr

- 28282 Hallberg Dr

- 28264 Hallberg Dr

- 3107 Clark Pkwy

- 29053 W Brockway Dr

- #1 Fifth Ave

- 3781 Dover Center Rd

- 2965 Creekside Dr

- 3732 Greenbriar Cir

- #3 Fifth Ave

- 2939 S Bay Dr Unit G1

- 2939 S Bay Dr Unit G4

- 2939 S Bay Dr Unit G3

- 2939 S Bay Dr Unit G8

- 2939 S Bay Dr Unit G6

- 2939 S Bay Dr

- 2939 S Bay Dr Unit G5

- 2939 S Bay Dr Unit G7

- 2959 S Bay Dr Unit G9

- 2959 S Bay Dr Unit G14

- 2959 S Bay Dr Unit G13

- 2959 S Bay Dr Unit G16

- 2959 S Bay Dr Unit G12

- 2959 S Bay Dr Unit G15

- 2959 S Bay Dr

- 2959 S Bay Dr Unit G10

- 2959 S Bay Dr Unit G-11

- 3295 Orchard Way

- 2960 S Bay Dr Unit J14

- 2960 S Bay Dr Unit J10