294 Progress Rd Dayton, OH 45449

Estimated Value: $149,000 - $162,000

3

Beds

2

Baths

1,227

Sq Ft

$126/Sq Ft

Est. Value

About This Home

This home is located at 294 Progress Rd, Dayton, OH 45449 and is currently estimated at $154,360, approximately $125 per square foot. 294 Progress Rd is a home located in Montgomery County with nearby schools including West Carrollton High School, Miami Valley Academies, and Bethel Baptist School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 29, 2017

Sold by

Buckeye Capital Investments Llc

Bought by

Kapoor Sunita

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$52,000

Outstanding Balance

$42,957

Interest Rate

3.86%

Mortgage Type

New Conventional

Estimated Equity

$111,403

Purchase Details

Closed on

Feb 8, 2016

Sold by

Lazorski Paula D

Bought by

Buckeye Capital Investments Llc

Purchase Details

Closed on

May 16, 1994

Sold by

Durig Martin

Bought by

Lazorski Paula D

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kapoor Sunita | $65,000 | None Available | |

| Buckeye Capital Investments Llc | $47,000 | None Available | |

| Lazorski Paula D | $68,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kapoor Sunita | $52,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,143 | $34,520 | $6,230 | $28,290 |

| 2024 | $2,097 | $34,520 | $6,230 | $28,290 |

| 2023 | $2,097 | $34,520 | $6,230 | $28,290 |

| 2022 | $2,066 | $26,690 | $4,830 | $21,860 |

| 2021 | $2,069 | $26,690 | $4,830 | $21,860 |

| 2020 | $2,070 | $26,690 | $4,830 | $21,860 |

| 2019 | $1,790 | $21,270 | $4,200 | $17,070 |

| 2018 | $1,907 | $21,270 | $4,200 | $17,070 |

| 2017 | $1,970 | $21,270 | $4,200 | $17,070 |

| 2016 | $1,768 | $22,100 | $4,200 | $17,900 |

| 2015 | $1,624 | $22,100 | $4,200 | $17,900 |

| 2014 | $1,624 | $22,100 | $4,200 | $17,900 |

| 2012 | -- | $27,680 | $7,000 | $20,680 |

Source: Public Records

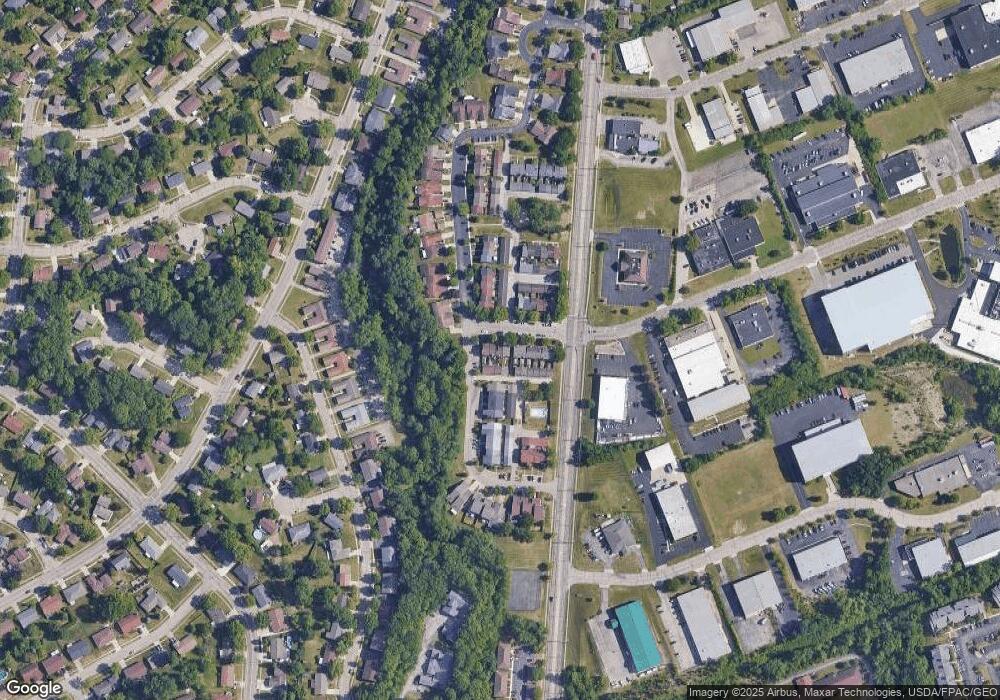

Map

Nearby Homes

- 1596 Longbow Ln

- 1153 King Richard Pkwy

- 319 Hillhaven Dr

- 1100 S Elm St

- 1570 Cedar Bark Trail Unit 5

- 818 Sir Guy Ct

- 1100 Eagle Nest Ct Unit 1

- 2117 Robinhood Dr

- 1109 Arrowhead Crossing Unit A

- 1104 Arrowhead Crossing Unit A

- 1008 Lookout Trail Unit D

- 1008 Lookout Trail Unit C

- 1010 Lookout Trail Unit E

- 1124 Eagle Feather Cir Unit 161

- 1122 Eagle Feather Cir Unit C

- 1118 Eagle Feather Cir Unit D

- 1927 Robinhood Dr

- 1792 Cherokee Dr Unit F

- 1000 Skyview Dr

- 949 Primrose Dr

- 296 Progress Rd

- 292 Progress Rd

- 298 Progress Rd

- 290 Progress Rd

- 288 Progress Rd

- 1662 Longbow Ln

- 1662 Longbow Ln

- 1662 Longbow Ln

- 1662 Longbow Ln

- 1662 Longbow Ln

- 1662 Longbow Ln Unit A

- 1662 Longbow Ln Unit D

- 286 Progress Rd

- 284 Progress Rd

- 598 Crossing Ln Unit 8292

- 282 Progress Rd

- 280 Progress Rd

- 1648 Longbow Ln

- 299 Progress Rd

- 1646 Longbow Ln

Your Personal Tour Guide

Ask me questions while you tour the home.