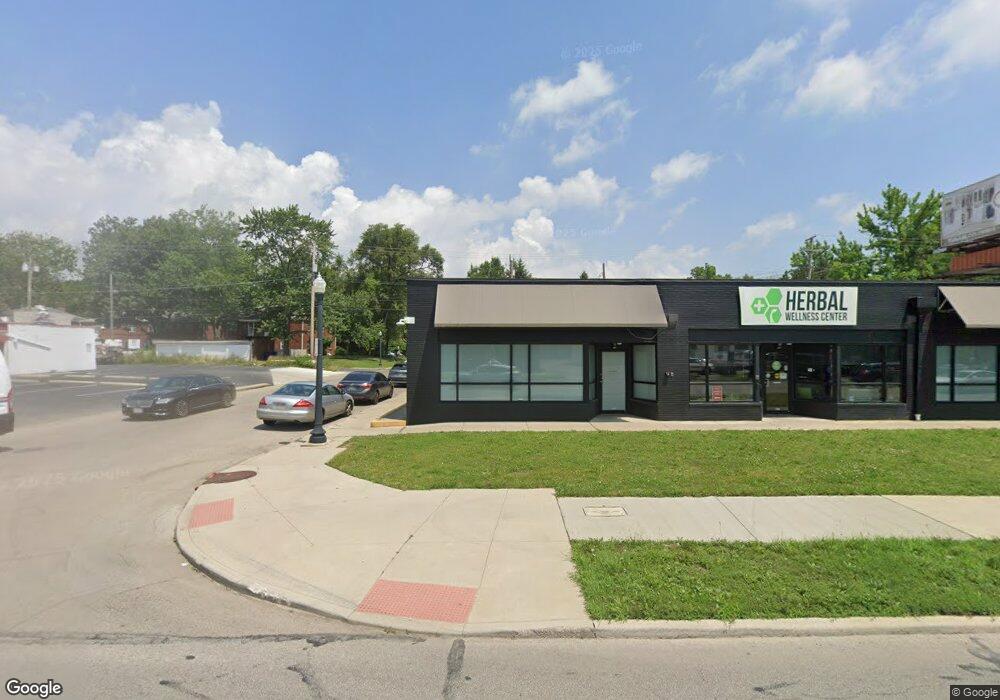

2946 E Main St Unit 954 Columbus, OH 43209

Eastmoor Neighborhood

--

Bed

--

Bath

2,120

Sq Ft

0.36

Acres

About This Home

This home is located at 2946 E Main St Unit 954, Columbus, OH 43209. 2946 E Main St Unit 954 is a home located in Franklin County with nearby schools including Fairmoor Elementary School, Johnson Park Middle School, and Walnut Ridge High School.

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Tax History Compared to Growth

Map

Nearby Homes

- 655 Brookside Dr

- 618 Eastmoor Blvd

- 3137 Fair Ave

- 789 Chelsea Ave

- 622 S Ashburton Rd

- 2877 Astor Ave

- 3160 Fair Ave

- 430 S James Rd

- 857 S Waverly St

- 2856 Eastminster Rd

- 1048 S James Rd

- 2963 Brownlee Ave

- 864 S Waverly St

- 891 S Weyant Ave Unit 893

- 2770 Eastminster Rd

- 2736 Eastminster Rd

- 891 Vernon Rd

- 1106 S James Rd

- 1042 S Hampton Rd

- 2753 Eastminster Rd

- 2946 E Main St

- 2924 E Main St

- 648 Enfield Rd Unit 650

- 675 Eastmoor Blvd

- 675 Eastmoor Blvd Unit 1

- 669 Eastmoor Blvd

- 669 Eastmoor Blvd Unit COLUMBUS

- 642 Enfield Rd

- 663 Eastmoor Blvd

- 634 Enfield Rd

- 647 Eastmoor Blvd

- 2938 Sherwood Rd

- 639 Eastmoor Blvd

- 626 Enfield Rd

- 2891 E Main St

- 3000 E Main St

- 3000 E Main St Unit A

- 619 Enfield Rd

- 670 Eastmoor Blvd

- 618 Enfield Rd