29588 NW Olson Rd Gaston, OR 97119

Estimated Value: $284,000 - $780,000

3

Beds

2

Baths

1,404

Sq Ft

$421/Sq Ft

Est. Value

About This Home

This home is located at 29588 NW Olson Rd, Gaston, OR 97119 and is currently estimated at $591,609, approximately $421 per square foot. 29588 NW Olson Rd is a home located in Yamhill County with nearby schools including Gaston Elementary School and Gaston Junior/Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 23, 2018

Sold by

Davis Drew

Bought by

Keane Erich and Keane Natalia

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$210,000

Outstanding Balance

$180,293

Interest Rate

4.46%

Mortgage Type

New Conventional

Estimated Equity

$411,316

Purchase Details

Closed on

Jun 20, 2013

Sold by

Wilcox Heather M

Bought by

Davis Drew

Purchase Details

Closed on

Jul 27, 2005

Sold by

Carter Don and Carter Jacqueline

Bought by

Wilcox Heather M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$270,900

Interest Rate

5.56%

Mortgage Type

Construction

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Keane Erich | $460,000 | Ticor Title | |

| Davis Drew | $290,000 | Multiple | |

| Wilcox Heather M | $200,000 | Ticor Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Keane Erich | $210,000 | |

| Previous Owner | Wilcox Heather M | $270,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,278 | $178,773 | -- | -- |

| 2024 | $2,215 | $173,566 | -- | -- |

| 2023 | $2,098 | $168,511 | $0 | $0 |

| 2022 | $2,040 | $163,603 | $0 | $0 |

| 2021 | $1,992 | $158,838 | $0 | $0 |

| 2020 | $1,938 | $154,211 | $0 | $0 |

| 2019 | $1,880 | $149,720 | $0 | $0 |

| 2018 | $2,678 | $145,359 | $0 | $0 |

| 2017 | $1,682 | $133,111 | $0 | $0 |

| 2016 | $1,712 | $129,234 | $0 | $0 |

| 2015 | $1,399 | $125,472 | $0 | $0 |

| 2014 | $1,357 | $121,819 | $0 | $0 |

Source: Public Records

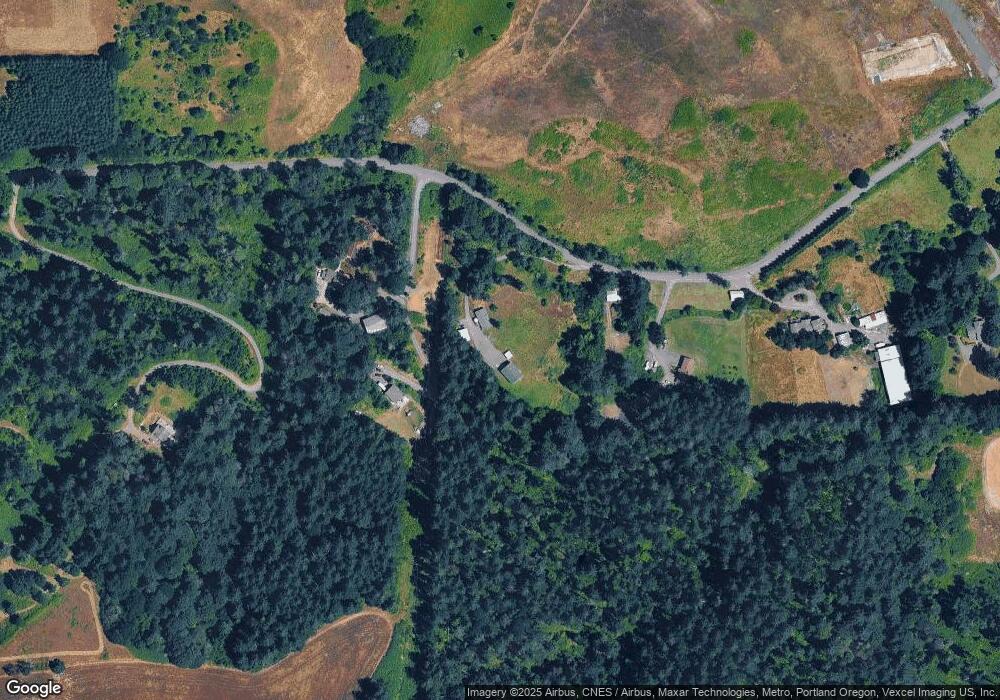

Map

Nearby Homes

- 414 Hedin Terrace

- 413 3rd St

- 0 X Unit 420758805

- 0 Xx Unit 777688956

- 0 NW Williams Canyon Rd Unit 24564627

- 45500 SW Seghers Rd

- 7022 SW Old Highway 47

- 0 SW Mill Rd

- 12595 SW Moreno Dr

- 45245 SW Saddleback Dr

- 5673 SW Old Highway 47

- 38830 SW Hartley Rd

- 0 Washington St Unit 376330996

- 7755 SW Bracken Dr

- 38353 SW Laurelwood Rd

- 54839 SW South Rd

- 37251 SW Thimbleberry Dr

- 55308 SW Lovegren Dr

- 0 NW Bishop Scott Rd Unit 227451145

- 55563 SW Cherry Grove Dr

- 29570 NW Olson Rd

- 29600 NW Olson Rd

- 29624 NW Olson Rd

- 29560 NW Olson Rd

- 29650 NW Olson Rd

- 29700 NW Olson Rd

- 00001 NW Olson Rd

- 29500 NW Olson Rd

- 29460 NW Olson Rd

- 29250 NW Olson Rd

- 410 Costello Dr

- 410 Costello Dr

- 410 Costello Dr Unit 1

- 410 Costello Dr Unit 1

- 432 Hedin Terrace Unit 2

- 29292 NW Olson Rd

- 428 Hedin Terrace Unit 3

- 420 Costello Dr

- 424 Hedin Terrace Unit 4

- 424 Hedin Terrace