2969 E Desert Moon Trail San Tan Valley, AZ 85143

Estimated Value: $369,000 - $445,000

4

Beds

2

Baths

2,045

Sq Ft

$199/Sq Ft

Est. Value

About This Home

This home is located at 2969 E Desert Moon Trail, San Tan Valley, AZ 85143 and is currently estimated at $407,103, approximately $199 per square foot. 2969 E Desert Moon Trail is a home located in Pinal County with nearby schools including Magma Ranch K8 School, Poston Butte High School, and Champion Schools San Tan Valley.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 19, 2021

Sold by

Medina Robert R and Medina Priscilla F

Bought by

Yarbro William Sylvester and Yarbro Merna

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$117,000

Outstanding Balance

$106,257

Interest Rate

2.96%

Mortgage Type

New Conventional

Estimated Equity

$300,846

Purchase Details

Closed on

Jun 8, 2021

Sold by

Yarbro William Sylvester and Yarbro Merna

Bought by

Yarbro Merna

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$117,000

Outstanding Balance

$106,257

Interest Rate

2.96%

Mortgage Type

New Conventional

Estimated Equity

$300,846

Purchase Details

Closed on

Feb 11, 2009

Sold by

Richmond American Homes Of Arizona Inc

Bought by

Medina Robert R and Medina Priscilla F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$157,789

Interest Rate

4.91%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Yarbro William Sylvester | -- | Pioneer Title Agency Inc | |

| Yarbro Merna | -- | Pioneer Title Agency Inc | |

| Medina Robert R | -- | Pioneer Title | |

| Medina Robert R | $160,701 | Fidelity Natl Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Yarbro William Sylvester | $117,000 | |

| Previous Owner | Medina Robert R | $157,789 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,227 | $35,271 | -- | -- |

| 2024 | $1,209 | $36,506 | -- | -- |

| 2023 | $1,230 | $27,141 | $1,250 | $25,891 |

| 2022 | $1,209 | $20,828 | $1,250 | $19,578 |

| 2021 | $1,344 | $18,653 | $0 | $0 |

| 2020 | $1,210 | $17,931 | $0 | $0 |

| 2019 | $1,211 | $16,967 | $0 | $0 |

| 2018 | $1,160 | $14,774 | $0 | $0 |

| 2017 | $1,090 | $14,718 | $0 | $0 |

| 2016 | $1,106 | $13,978 | $1,250 | $12,728 |

| 2014 | $1,083 | $8,919 | $1,000 | $7,919 |

Source: Public Records

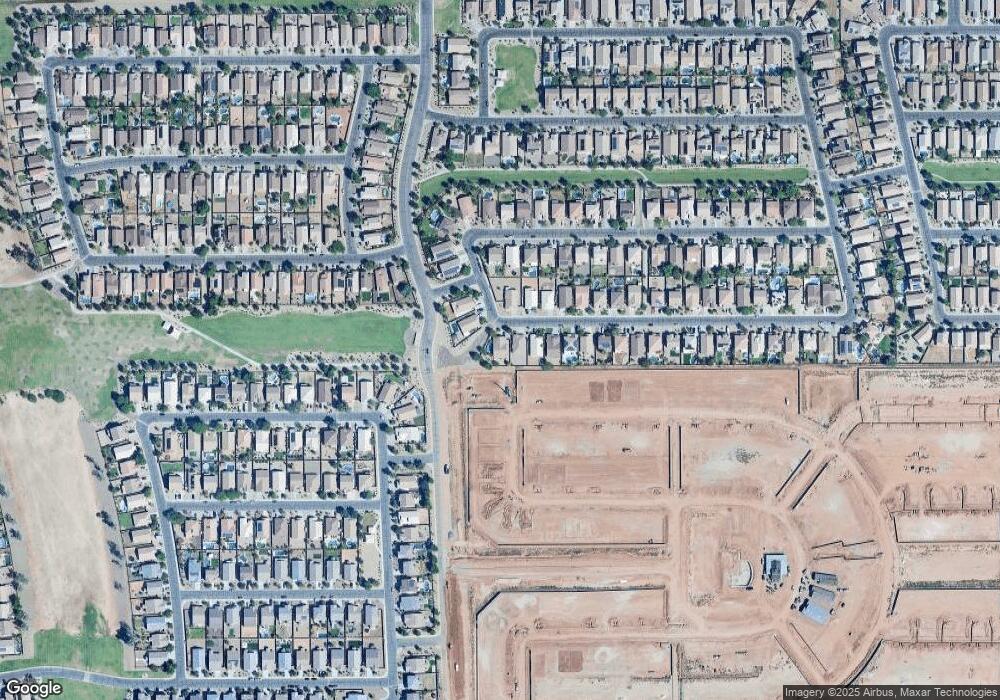

Map

Nearby Homes

- 3077 E Desert Moon Trail

- 3019 E Denim Trail

- 3104 Bee Trail

- 3099 Bee Trail

- 2698 E Denim Trail

- Mason Plan at Bella Vista Trails - Estate Series

- Ezra Select Plan at Bella Vista Trails - Classic Series

- Jubilee Plan at Bella Vista Trails - Estate Series

- 30529 Anderson Dr

- 30491 Anderson Dr

- 2720 E Omega Dr

- 30944 N Bramwell Ave

- 2738 E Silversmith Trail

- 3356 E Cowboy Cove Trail

- 3507 E Denim Trail

- 3450 Ellie Trail

- 3464 Ellie Trail

- 3539 E Desert Moon Trail

- 3476 Ellie Trail

- 3492 Ellie Trail

- 2987 E Desert Moon Trail

- 30758 N Obsidian Dr

- 3005 E Desert Moon Trail

- 3023 E Desert Moon Trail

- 30776 N Obsidian Dr

- 2974 E Desert Moon Trail

- 3002 E Desert Moon Trail

- 3041 E Desert Moon Trail

- 3020 E Desert Moon Trail

- 30654 Emma Dr

- 3038 E Desert Moon Trail

- 3059 E Desert Moon Trail

- 3020 Bee Trail

- 2965 E Denim Trail

- 2983 E Denim Trail

- 30814 N Obsidian Dr

- 3001 E Denim Trail

- 2973 Bee Trail

- 3056 E Desert Moon Trail

- 2987 Bee Trail