297 Cross Wind Loop Unit E Westerville, OH 43081

Estimated Value: $173,000 - $182,000

2

Beds

3

Baths

1,100

Sq Ft

$162/Sq Ft

Est. Value

About This Home

This home is located at 297 Cross Wind Loop Unit E, Westerville, OH 43081 and is currently estimated at $178,122, approximately $161 per square foot. 297 Cross Wind Loop Unit E is a home located in Franklin County with nearby schools including Pointview Elementary School, Genoa Middle School, and Westerville South High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 27, 2005

Sold by

Milliron Shawn J

Bought by

Fell James Ryan

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$65,920

Outstanding Balance

$34,856

Interest Rate

6.06%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$143,266

Purchase Details

Closed on

Jul 31, 1998

Sold by

Ritter Phyllis

Bought by

Milliron Shawn J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$56,150

Interest Rate

7.05%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Apr 23, 1990

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fell James Ryan | $82,400 | Northwest T | |

| Milliron Shawn J | $57,900 | -- | |

| -- | $43,700 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Fell James Ryan | $65,920 | |

| Previous Owner | Milliron Shawn J | $56,150 | |

| Closed | Fell James Ryan | $12,360 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,578 | $45,360 | $7,700 | $37,660 |

| 2023 | $2,523 | $45,360 | $7,700 | $37,660 |

| 2022 | $2,142 | $29,400 | $3,570 | $25,830 |

| 2021 | $2,160 | $29,400 | $3,570 | $25,830 |

| 2020 | $2,154 | $29,400 | $3,570 | $25,830 |

| 2019 | $1,902 | $24,510 | $2,980 | $21,530 |

| 2018 | $1,897 | $24,510 | $2,980 | $21,530 |

| 2017 | $1,932 | $24,510 | $2,980 | $21,530 |

| 2016 | $1,993 | $23,770 | $3,750 | $20,020 |

| 2015 | $1,930 | $23,770 | $3,750 | $20,020 |

| 2014 | $1,932 | $23,770 | $3,750 | $20,020 |

| 2013 | $1,071 | $26,390 | $4,165 | $22,225 |

Source: Public Records

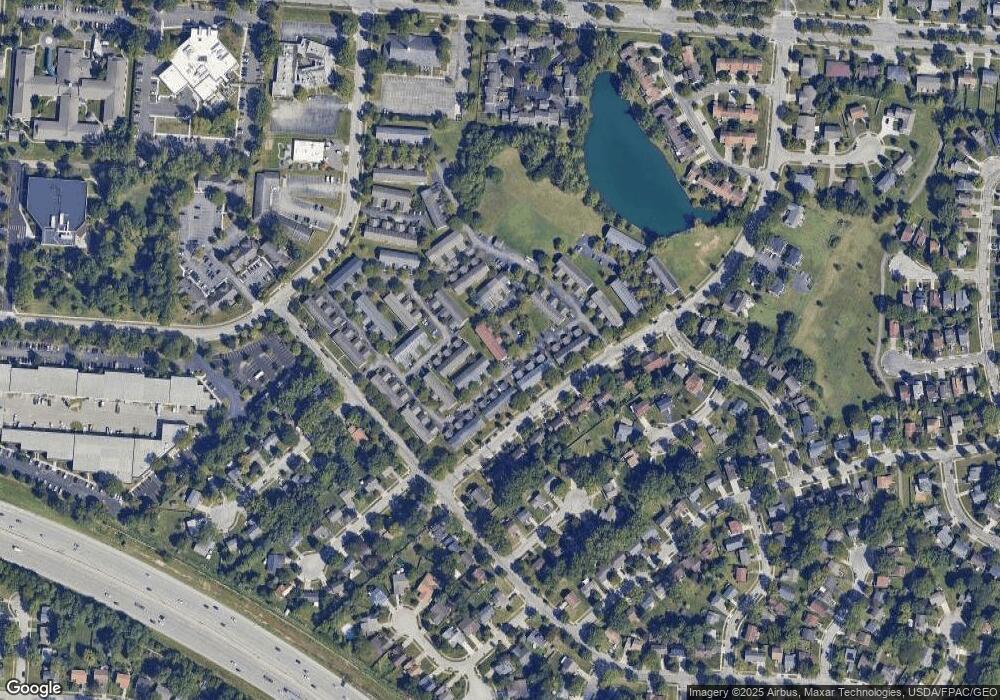

Map

Nearby Homes

- 255 Cross Wind Dr Unit B

- 6874 Flatlands Rd

- 1017 Newfields Ln

- 326 Peachtree Ct Unit 326D

- 810 Applewood Ln

- 800 S Spring Rd

- 3362 Reno Rd

- 640 Brook Run Dr

- 644 Vancouver Dr

- 3615 Makassar Dr

- 3390 Arnett Ct

- 3596 Manila Dr

- 3627 Manila Dr

- 3551 Manila Dr

- 85 Daleview Dr

- 3475 Brazzaville Rd

- 5769 Montevideo Rd

- 66 Daleview Dr

- 25 King Arthur Blvd

- 994 Autumn Lake Ct

- 293 Cross Wind Loop Unit C

- 295 Cross Wind Loop

- 299 Cross Wind Loop Unit F

- 963 Cross Country Dr E

- 963 Cross Country Dr E Unit A

- 291 Cross Wind Loop Unit B

- 965 Cross Country Dr E

- 289 Cross Wind Loop

- 289 Cross Wind Loop Unit A

- 967 Cross Country Dr E Unit C

- 282 Cross Country Loop

- 280 Cross Country Loop Unit AF

- 969 Cross Country Dr E Unit D

- 284 Cross Country Loop

- 280 Crosscountry Loop

- 956 Cross Country Dr E

- 286 Cross Country Loop

- 971 Cross Country Dr E

- 960 Cross Country Dr E Unit A

- 276 Cross Country Loop Unit F