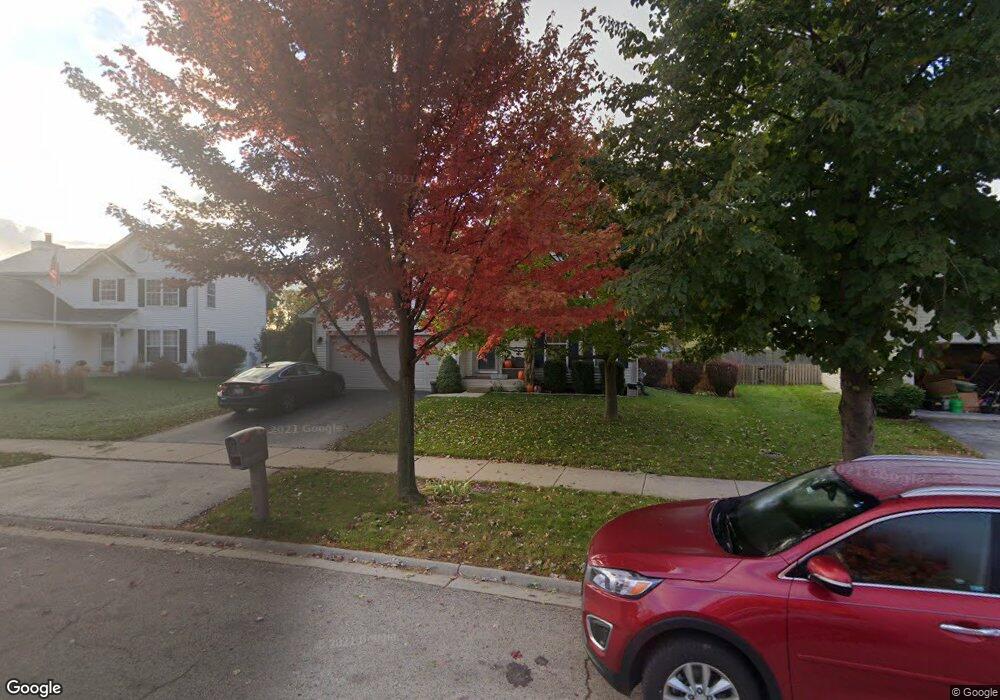

2971 Carlsbad Cir Unit 6 Aurora, IL 60503

Far Southeast NeighborhoodEstimated Value: $345,797 - $483,000

--

Bed

1

Bath

1,652

Sq Ft

$248/Sq Ft

Est. Value

About This Home

This home is located at 2971 Carlsbad Cir Unit 6, Aurora, IL 60503 and is currently estimated at $409,449, approximately $247 per square foot. 2971 Carlsbad Cir Unit 6 is a home located in Will County with nearby schools including Wolfs Crossing Elementary School, Bednarcik Jr. High School, and Oswego East High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 28, 2004

Sold by

Fawver John E and Fawver Michelle M

Bought by

Marruffo Cyndi L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$185,600

Outstanding Balance

$138,306

Interest Rate

6.1%

Mortgage Type

Credit Line Revolving

Estimated Equity

$271,143

Purchase Details

Closed on

Aug 9, 2001

Sold by

Lakewood Valley Phase Ii Llc

Bought by

Fawyer John E and Smith Michelle M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$173,300

Interest Rate

7.28%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Marruffo Cyndi L | $232,000 | -- | |

| Fawyer John E | $182,500 | Chicago Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Marruffo Cyndi L | $185,600 | |

| Previous Owner | Fawyer John E | $173,300 | |

| Closed | Marruffo Cyndi L | $46,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $7,847 | $98,025 | $23,259 | $74,766 |

| 2023 | $7,847 | $86,595 | $20,547 | $66,048 |

| 2022 | $6,677 | $73,091 | $19,437 | $53,654 |

| 2021 | $6,626 | $69,610 | $18,511 | $51,099 |

| 2020 | $6,340 | $68,507 | $18,218 | $50,289 |

| 2019 | $6,401 | $66,577 | $17,705 | $48,872 |

| 2018 | $5,990 | $60,753 | $17,315 | $43,438 |

| 2017 | $5,922 | $59,185 | $16,868 | $42,317 |

| 2016 | $6,067 | $57,911 | $16,505 | $41,406 |

| 2015 | $6,188 | $55,683 | $15,870 | $39,813 |

| 2014 | $6,188 | $53,160 | $15,870 | $37,290 |

| 2013 | $6,188 | $53,160 | $15,870 | $37,290 |

Source: Public Records

Map

Nearby Homes

- 9836 S Carls Dr

- 2895 Lahinch Ct Unit 6

- 2969 Francis Ct

- 2532 Sagamore Cir

- 2413 Dickens Dr

- 4308 Fraser Cir

- 3218 Lincoln Prairie Blvd

- 3258 Mirehaven Ct

- 3274 Mirehaven Ct

- 3106 Adelwood Cir

- 3150 Adelwood Cir

- 3120 Adelwood Dr

- 3152 Adelwood Cir

- 3156 Adelwood Dr

- 3273 Mirehaven Dr

- 3146 Bellwether Dr

- 3144 Bellwether Dr

- 3150 Bellwether Dr

- 3168 Bellwether Dr

- 3148 Bellwether Dr

- 2975 Carlsbad Cir Unit 6

- 2967 Carlsbad Cir

- 2979 Carlsbad Cir

- 2963 Carlsbad Cir

- 2970 Carlsbad Cir

- 2959 Carlsbad Cir Unit 6

- 2983 Carlsbad Cir Unit 6

- 2978 Carlsbad Cir

- 2962 Carlsbad Cir

- 10022 Bode St

- 10022 Bode St Unit A

- 10022 Bode St Unit 1C

- 10022 Bode St Unit 3-4

- 10022 Bode St Unit 5

- 2982 Carlsbad Cir

- 2955 Carlsbad Cir

- 2958 Carlsbad Cir Unit 6

- 2987 Carlsbad Cir

- 2847 Lindgren Trail Unit 6

- 2951 Carlsbad Cir