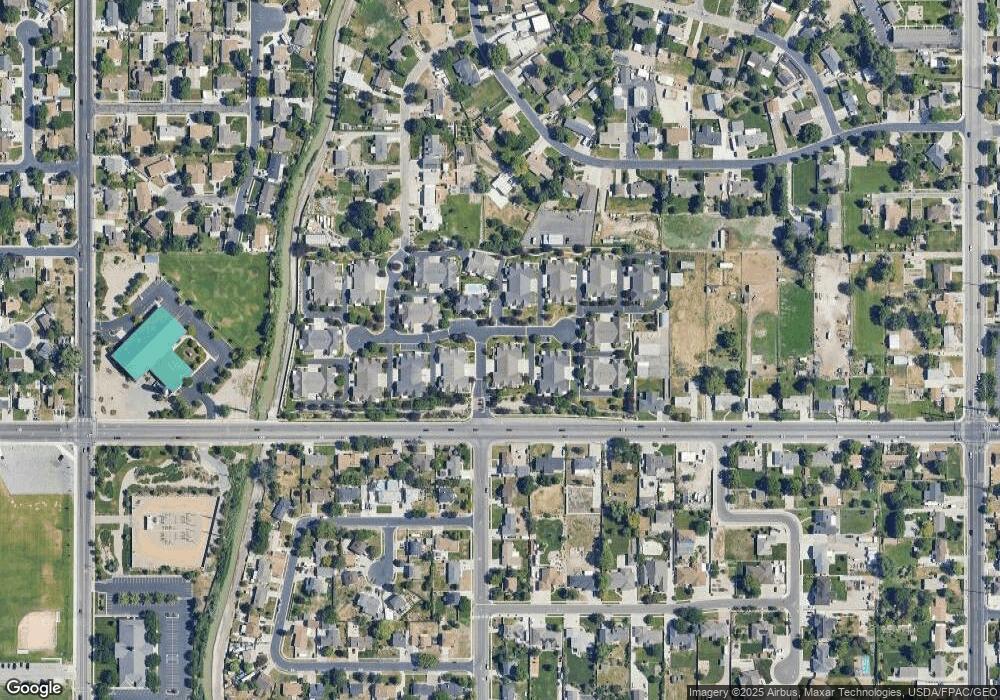

2971 W Abbey Springs Cir West Jordan, UT 84084

Estimated Value: $493,000 - $523,000

2

Beds

2

Baths

1,692

Sq Ft

$301/Sq Ft

Est. Value

About This Home

This home is located at 2971 W Abbey Springs Cir, West Jordan, UT 84084 and is currently estimated at $509,639, approximately $301 per square foot. 2971 W Abbey Springs Cir is a home located in Salt Lake County with nearby schools including West Jordan Middle School, West Jordan High School, and Learning Tree School - Southwest.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 9, 2024

Sold by

Jones Larue

Bought by

Larue Jones Living Trust and Jones

Current Estimated Value

Purchase Details

Closed on

May 31, 2024

Sold by

Newlon Kathleen

Bought by

Jones Larue

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$215,000

Interest Rate

7.1%

Mortgage Type

New Conventional

Purchase Details

Closed on

Nov 15, 2016

Sold by

Parker Linda

Bought by

Newlon Gerald and Newlon Kathleen

Purchase Details

Closed on

May 16, 2016

Sold by

Glade Carole

Bought by

Parker Linda and Roundy Dennis

Purchase Details

Closed on

May 13, 2016

Sold by

Roundy Dennis

Bought by

Parker Linda

Purchase Details

Closed on

Apr 16, 2007

Sold by

Leisure Villas Inc

Bought by

Glade Carole

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$244,000

Interest Rate

6.87%

Mortgage Type

Unknown

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Larue Jones Living Trust | -- | -- | |

| Jones Larue | -- | Integrated Title Services | |

| Newlon Gerald | -- | Northwest Title Agcy | |

| Parker Linda | -- | Richland Title Ins Agency In | |

| Parker Linda | -- | Richland Title Ins Agency In | |

| Glade Carole | -- | Equity Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Jones Larue | $215,000 | |

| Previous Owner | Glade Carole | $244,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,331 | $464,300 | $84,300 | $380,000 |

| 2024 | $2,331 | $448,500 | $81,500 | $367,000 |

| 2023 | $2,384 | $432,200 | $78,400 | $353,800 |

| 2022 | $2,481 | $442,600 | $76,800 | $365,800 |

| 2021 | $2,071 | $336,300 | $60,800 | $275,500 |

| 2020 | $2,111 | $321,800 | $56,800 | $265,000 |

| 2019 | $2,127 | $317,900 | $56,800 | $261,100 |

| 2018 | $2,010 | $297,900 | $53,600 | $244,300 |

| 2017 | $1,851 | $273,200 | $53,600 | $219,600 |

| 2016 | $1,892 | $262,400 | $48,300 | $214,100 |

| 2015 | $1,549 | $209,400 | $49,400 | $160,000 |

| 2014 | $1,476 | $196,400 | $47,100 | $149,300 |

Source: Public Records

Map

Nearby Homes

- 8524 S Michele River Ave W Unit 109

- 6893 S 3200 W

- 6918 S Harvest Cir

- 2683 W Carson Ln

- 3383 W 6880 S

- 6672 S 3335 W

- 2421 W 6900 S

- 6512 Timpanogos Way

- 6453 Fremont Peak Cir

- 7361 S 2700 W

- 6968 S 3535 W Unit 3

- 6980 S 3535 W Unit 2

- 3226 Tysonbrook Ct

- 2312 W Hidden Bend Cove Unit 107

- 3052 W Matterhorn Dr

- 6863 S Dixie Dr

- 3305 W Kingsbrook Ave

- 2573 Jordan Meadows Ln

- 6482 S Gold Medal Dr

- 2510 W Jordan Meadows Ln

- 2971 Abbey Springs Cir

- 2961 Abbey Springs Cir

- 2973 W Abbey Springs Cir

- 2973 Abbey Springs Cir

- 2973 W Abbey Springs

- 2963 Abbey Springs Cir

- 2991 Country Home Ln

- 2951 Abbey Springs Cir

- 2993 W Country Home Ln

- 2993 Country Home Ln

- 3001 Country Home Ln

- 3001 W Country Home Ln

- 2972 W Abbey Springs Cir

- 2972 Abbey Springs Cir

- 2941 Abbey Springs Cir

- 3003 Country Home Ln

- 3003 W Country Home Ln

- 2962 W Abbey Springs Cir

- 2962 Abbey Springs Cir

- 2943 Abbey Springs Cir