2977 Tree Bend Cir Unit 45 Grove City, OH 43123

Estimated Value: $376,959 - $423,000

3

Beds

3

Baths

2,116

Sq Ft

$186/Sq Ft

Est. Value

About This Home

This home is located at 2977 Tree Bend Cir Unit 45, Grove City, OH 43123 and is currently estimated at $393,990, approximately $186 per square foot. 2977 Tree Bend Cir Unit 45 is a home located in Franklin County with nearby schools including Hayes Intermediate School, Jc Sommer Elementary School, and Jackson Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 8, 2009

Sold by

Deutsche Bank National Trust Company

Bought by

Ranke Vicki L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$103,500

Outstanding Balance

$67,585

Interest Rate

5.32%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$326,405

Purchase Details

Closed on

Feb 12, 2009

Sold by

Kalnins Edward C

Bought by

Deutsche Bank National Trust Company

Purchase Details

Closed on

Dec 13, 2005

Sold by

Kalnins Edward C and Kalnins Theresa M

Bought by

Et & & Properties Llc

Purchase Details

Closed on

May 10, 2005

Sold by

Beazer Homes Investments Llc

Bought by

Kalnins Edward C

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ranke Vicki L | $138,000 | None Available | |

| Deutsche Bank National Trust Company | $161,415 | None Available | |

| Et & & Properties Llc | -- | Lakeside Ti | |

| Kalnins Edward C | $234,500 | Lawyers Tit |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ranke Vicki L | $103,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,171 | $123,520 | $24,500 | $99,020 |

| 2023 | $5,127 | $123,515 | $24,500 | $99,015 |

| 2022 | $4,895 | $89,010 | $9,070 | $79,940 |

| 2021 | $4,989 | $89,010 | $9,070 | $79,940 |

| 2020 | $4,973 | $89,010 | $9,070 | $79,940 |

| 2019 | $4,818 | $80,890 | $8,230 | $72,660 |

| 2018 | $4,429 | $80,890 | $8,230 | $72,660 |

| 2017 | $4,419 | $80,890 | $8,230 | $72,660 |

| 2016 | $4,057 | $64,720 | $9,700 | $55,020 |

| 2015 | $4,058 | $64,720 | $9,700 | $55,020 |

| 2014 | $4,061 | $64,720 | $9,700 | $55,020 |

| 2013 | $1,811 | $61,635 | $9,240 | $52,395 |

Source: Public Records

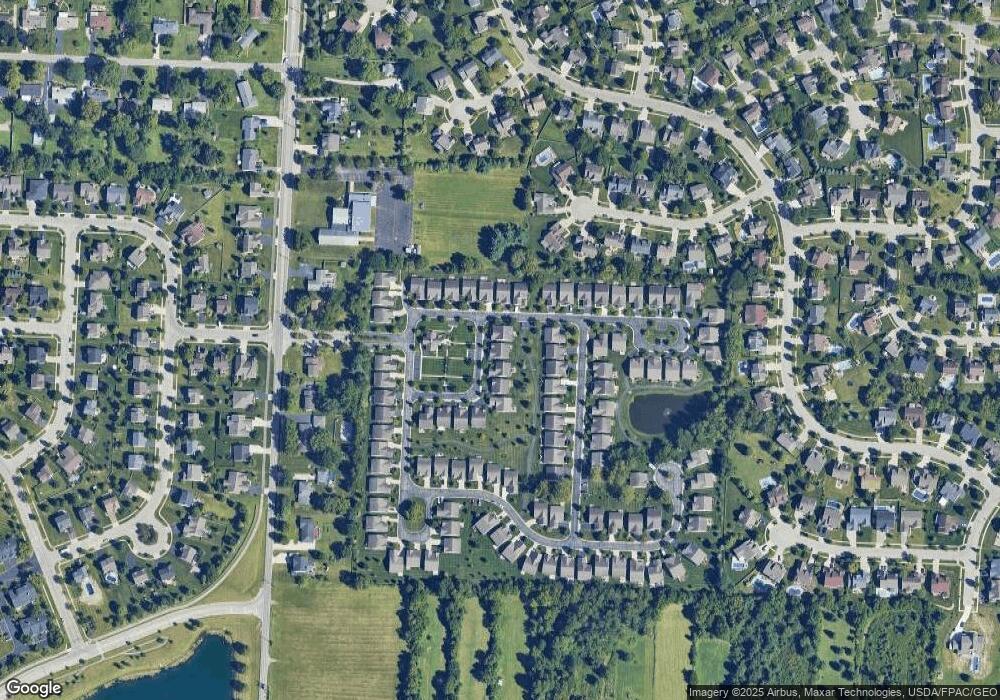

Map

Nearby Homes

- 4879 Blossom Way Unit 41

- 3022 Crabapple Place Unit 4

- 4838 Adwell Loop

- 2750 Longridge Way

- 4754 Glencross Ct

- 3234 Callie Marie Dr

- 3195 Longridge Way

- 5148 Keefer Ln

- 2720 Loris Way

- 5124 Keefer Ln

- 3300 Belgreen Dr

- 3027 Mckinney Rd

- 3057 Mckinney Rd

- 4208 Mayfair Ct N

- 2994 Darby Downs Rd

- 3171 Orders Rd

- 2997 Darby Downs Rd

- 3004 Darby Downs Rd

- 3215 Farmhouse Ln

- 3022 Darby Downs Rd

- 2983 Tree Bend Cir Unit 46

- 2971 Tree Bend Cir Unit 44

- 2995 Tree Bend Cir Unit 48

- 2969 Crabapple Place Unit 43

- 4873 Blossom Way Unit 42

- 2992 Crabapple Place Unit 9

- 2998 Crabapple Place Unit 8

- 2984 Crabapple Place Unit 10

- 4885 Blossom Way Unit 40

- 3004 Crabapple Place Unit 7

- 3004 Crabapple Place Unit HG007

- 3001 Tree Bend Cir Unit 49

- 2974 Crabapple Place Unit 11

- 3010 Crabapple Place Unit 6

- 3007 Tree Bend Cir Unit 50

- 2966 Crabapple Place Unit 12

- 4897 Blossom Way

- 4897 Blossom Way Unit 38

- 3016 Crabapple Place Unit 5

- 3016 Crabapple Place Unit HG05