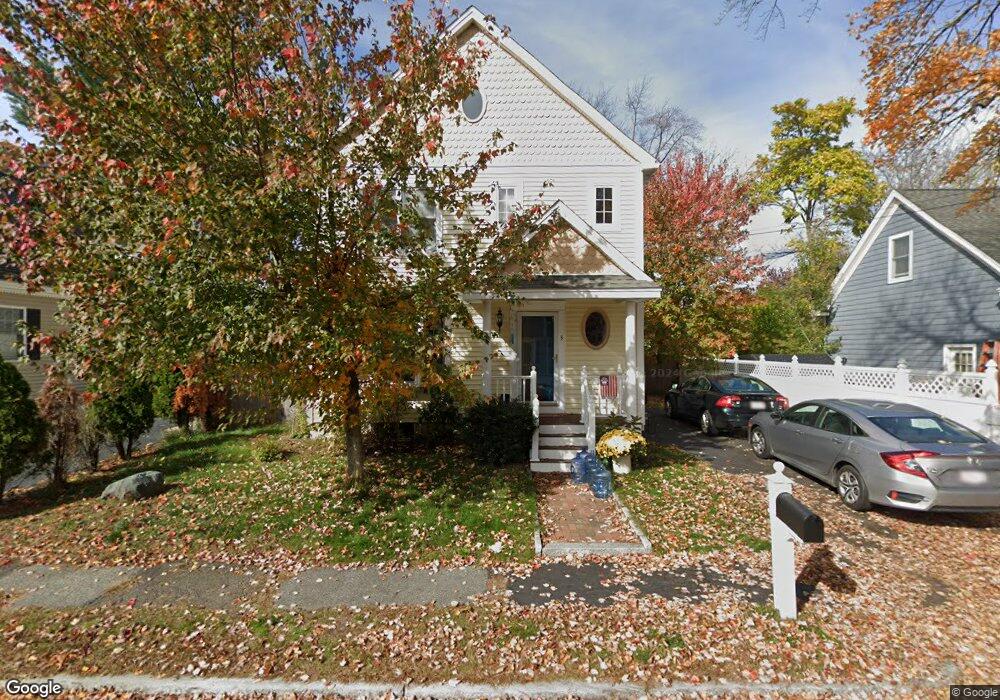

3 Line Rd Reading, MA 01867

Estimated Value: $795,000 - $1,041,000

3

Beds

3

Baths

1,920

Sq Ft

$466/Sq Ft

Est. Value

About This Home

This home is located at 3 Line Rd, Reading, MA 01867 and is currently estimated at $895,237, approximately $466 per square foot. 3 Line Rd is a home located in Middlesex County with nearby schools including J. Warren Killam Elementary School, Walter S. Parker Middle School, and Reading Memorial High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 25, 2000

Sold by

Lane Patrick J

Bought by

Leona Debra A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$120,600

Outstanding Balance

$40,461

Interest Rate

8.15%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$854,776

Purchase Details

Closed on

Jul 30, 1993

Sold by

Broadway Eugene H and Broadway Jill H

Bought by

Lane Patrick J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$81,200

Interest Rate

7.32%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Leona Debra A | $127,000 | -- | |

| Lane Patrick J | $85,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lane Patrick J | $120,600 | |

| Previous Owner | Lane Patrick J | $81,200 | |

| Previous Owner | Lane Patrick J | $77,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,893 | $780,800 | $347,700 | $433,100 |

| 2024 | $8,628 | $736,200 | $327,800 | $408,400 |

| 2023 | $8,581 | $681,600 | $303,500 | $378,100 |

| 2022 | $8,261 | $619,700 | $275,900 | $343,800 |

| 2021 | $7,628 | $586,700 | $247,700 | $339,000 |

| 2020 | $7,785 | $558,100 | $235,600 | $322,500 |

| 2019 | $7,698 | $541,000 | $228,400 | $312,600 |

| 2018 | $7,081 | $510,500 | $215,500 | $295,000 |

| 2017 | $6,694 | $477,100 | $201,400 | $275,700 |

| 2016 | $6,679 | $460,600 | $200,700 | $259,900 |

| 2015 | $6,343 | $431,500 | $188,000 | $243,500 |

| 2014 | $6,117 | $415,000 | $180,800 | $234,200 |

Source: Public Records

Map

Nearby Homes

- 50 Quannapowitt Pkwy

- 41 Winter St

- 270 Lowell St

- 48 Village St Unit 1001

- 141 Belmont St

- 25 Juniper Ave

- 17 Wakefield St

- 29 Cordis St

- 395 Vernon St

- 347 Ash St

- 27 Audubon Rd

- 269 Main St Unit 4001

- 44 Grandview Rd

- 22 Wayland Rd

- 0 Charles St Unit 72374573

- 20 Pinevale Ave

- 2 Summit Dr Unit 18

- 90 Sunnyside Ave

- 5 Washington St Unit A5

- 129 High St