30 Constitution Way Unit D3 Franklin, NJ 07416

Estimated Value: $284,000 - $370,000

2

Beds

3

Baths

1,268

Sq Ft

$244/Sq Ft

Est. Value

About This Home

This home is located at 30 Constitution Way Unit D3, Franklin, NJ 07416 and is currently estimated at $309,546, approximately $244 per square foot. 30 Constitution Way Unit D3 is a home located in Sussex County with nearby schools including Franklin Elementary School, Wallkill Valley Regional High School, and Immaculate Conception Regional School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 20, 2021

Sold by

Merring Amber

Bought by

Mincey Carolin C and Mincey Billy

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$265,109

Outstanding Balance

$242,416

Interest Rate

2.99%

Mortgage Type

FHA

Estimated Equity

$67,130

Purchase Details

Closed on

Oct 4, 2016

Sold by

Pelt Gary and Pelt Audrey

Bought by

Merring Amber

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$188,030

Interest Rate

3.5%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mincey Carolin C | $273,000 | Title Agency Of Nj Inc | |

| Merring Amber | $191,500 | Old Republic National Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mincey Carolin C | $265,109 | |

| Previous Owner | Merring Amber | $188,030 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,794 | $237,300 | $115,000 | $122,300 |

| 2024 | $5,611 | $218,300 | $100,000 | $118,300 |

| 2023 | $8,031 | $178,700 | $63,600 | $115,100 |

| 2022 | $8,063 | $178,700 | $63,600 | $115,100 |

| 2021 | $8,027 | $178,700 | $63,600 | $115,100 |

| 2020 | $7,904 | $178,700 | $63,600 | $115,100 |

| 2019 | $7,659 | $178,700 | $63,600 | $115,100 |

| 2018 | $7,618 | $178,700 | $63,600 | $115,100 |

| 2017 | $7,573 | $178,700 | $63,600 | $115,100 |

| 2016 | $7,452 | $178,700 | $63,600 | $115,100 |

| 2015 | $7,255 | $178,700 | $63,600 | $115,100 |

| 2014 | $7,105 | $178,700 | $63,600 | $115,100 |

Source: Public Records

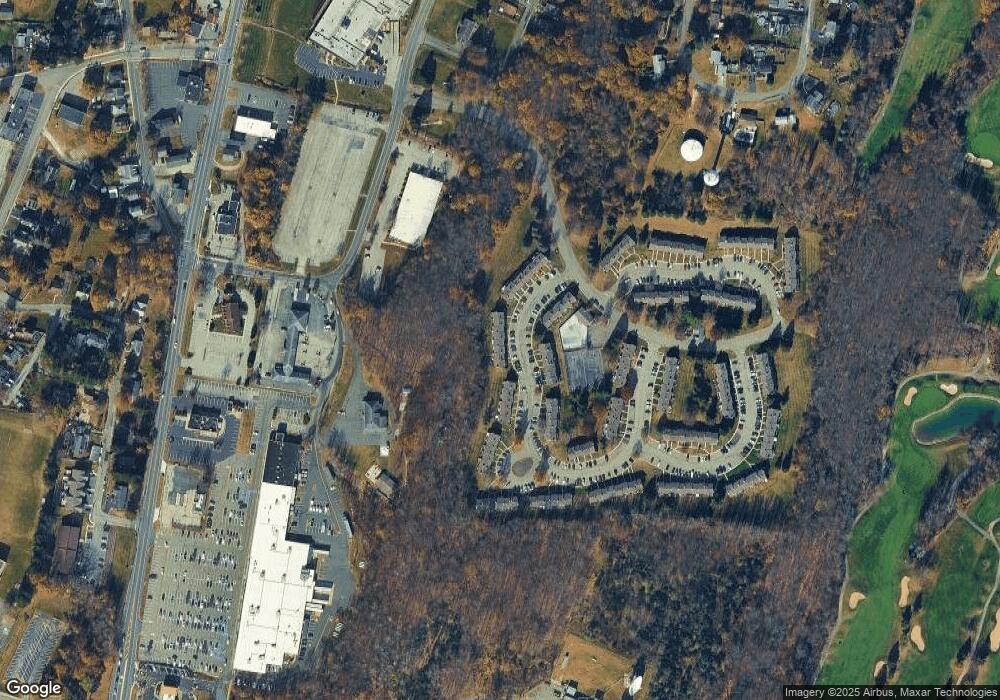

Map

Nearby Homes

- 68 Constitution Way Unit 15

- 35 Liberty Ln Unit Y2

- 63 Liberty Ln Unit 7

- 20 High Point CI

- 62 High St

- 52 High St

- 66 Nestor St

- 19 John Wilton St Unit 21

- 26 Wyker Rd Unit A

- 65 Buckwheat Rd

- 112 Scott Rd

- 580 State Rt 23

- 140 Wheatsworth Rd

- 6 Mulberry St

- 212 New Jersey 23

- 149 Maple Rd

- 11 Zimmer Dr

- 109 Munsonhurst Rd

- 111 Munsonhurst Rd

- 172 Maple Rd

- 28 Constitution Way Unit D4

- 32 Constitution Way Unit D2

- 34 Constitution Way Unit D1

- 24 Constitution Way Unit D6

- 22 Constitution Way Unit D7

- 20 Constitution Way Unit D8

- 38 Constitution Way Unit F6

- 15 Constitution Way Unit C1

- 17 Constitution Way

- 19 Constitution Way Unit C3

- 42 Constitution Way Unit F4

- 11 Constitution Way Unit A6

- 21 Constitution Way Unit C4

- 16 Constitution Way Unit 1

- 23 Constitution Way Unit C5

- 44 Constitution Way Unit F3

- 9 Constitution Way Unit 5

- 25 Constitution Way Unit C6

- 14 Constitution Way Unit B2

- 46 Constitution Way Unit F2

Your Personal Tour Guide

Ask me questions while you tour the home.