300 Apex Ave Banning, CA 92220

Estimated payment $10,171/month

Total Views

5,703

3.18

Acres

$522,721

Price per Acre

138,521

Sq Ft Lot

Highlights

- 3.18 Acre Lot

- No HOA

- Bike Trail

- Property is near a park

About This Lot

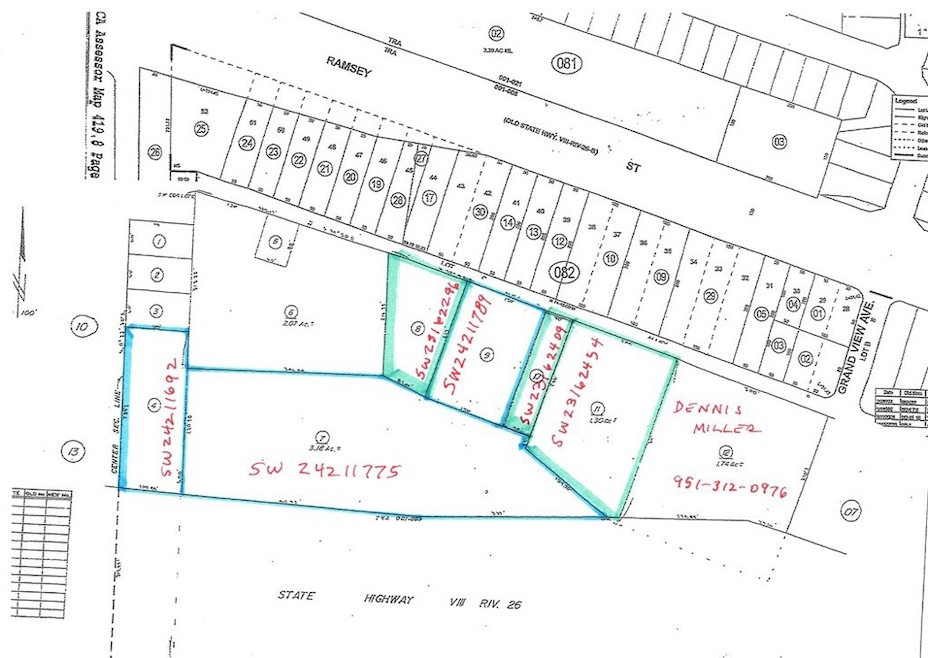

Property ready to develop. Auto mall, RV sales, Furniture and any commercial use. See other listings in area for a title of 10 acres of Interstate 10 freeway frontage property. See photo for parcel map showing available properties.

Listing Agent

Rise Realty Brokerage Email: larrysl@msn.com License #02123359 Listed on: 10/11/2024

Property Details

Property Type

- Land

Est. Annual Taxes

- $12,841

Lot Details

- 3.18 Acre Lot

- Density is 2-5 Units/Acre

- 419-090-004, 419-090-009

- Property is zoned CPS

Location

- Property is near a park

Utilities

- 220 Volts

- Phone Available

Listing and Financial Details

- Assessor Parcel Number 419090007

- $61 per year additional tax assessments

Community Details

Overview

- No Home Owners Association

Recreation

- Bike Trail

Map

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $12,841 | $1,005,114 | $1,005,114 | -- |

| 2023 | $12,890 | $966,085 | $966,085 | $0 |

| 2022 | $12,642 | $947,143 | $947,143 | $0 |

| 2021 | $12,399 | $928,572 | $928,572 | $0 |

| 2020 | $12,277 | $919,051 | $919,051 | $0 |

| 2019 | $12,085 | $901,031 | $901,031 | $0 |

| 2018 | $12,042 | $883,364 | $883,364 | $0 |

| 2017 | $11,857 | $866,044 | $866,044 | $0 |

| 2016 | $11,545 | $849,063 | $849,063 | $0 |

| 2015 | $11,353 | $836,310 | $836,310 | $0 |

| 2014 | $11,362 | $819,929 | $819,929 | $0 |

Source: Public Records

Property History

| Date | Event | Price | Change | Sq Ft Price |

|---|---|---|---|---|

| 03/01/2025 03/01/25 | Price Changed | $1,662,252 | 0.0% | -- |

| 10/11/2024 10/11/24 | For Sale | $1,662,240 | -- | -- |

Source: California Regional Multiple Listing Service (CRMLS)

Purchase History

| Date | Type | Sale Price | Title Company |

|---|---|---|---|

| Grant Deed | $1,070,000 | Commonwealth Land Title Co | |

| Corporate Deed | -- | -- | |

| Grant Deed | $40,000 | Northern Counties Title | |

| Grant Deed | $25,500 | Northern Counties Title | |

| Grant Deed | $25,000 | Northern Counties Title | |

| Grant Deed | $14,000 | Northern Counties Title | |

| Grant Deed | $12,000 | Northern Counties Title |

Source: Public Records

Source: California Regional Multiple Listing Service (CRMLS)

MLS Number: SW24211775

APN: 419-090-007

Nearby Homes

- 5700 W Wilson St Unit 3

- 5700 W Wilson St Unit 42

- 5700 W Wilson St Unit 86

- 5700 W Wilson St Unit 99

- 5700 W Wilson St Unit 102

- 5700 W Wilson St Unit 25

- 178 Janan Ct

- 298 Apex Ave

- 204 Beverly Dr

- 234 Beverly Dr

- 5302 C St

- 5238 Spring View Dr

- 178 Clair Ct

- 916 Aloe Way

- 5242 C St

- 5908 Raven Way

- 98 Lori Way

- 5388 C St

- 5366 C St

- 5388 Echo Dr

- 5001-5099 W Wilson St

- 5168 W Pinehurst Dr

- 36 Cold Spring Ave

- 170 Potter Creek

- 1643 Beaver Creek

- 2141 Birdie Dr

- 1585 Park Haven Dr

- 726 Chestnut Ave

- 1248 Massachusetts Ave

- 2890 Summer Set Cir

- 1473 Peters Canyon

- 142 Diego Rd

- 174 Maple Ave

- 835 Brownie Way

- 15135 Del Rita Rd

- 1145 Orange Ave

- 1664 Milford Way

- 35286 Sorenstam Dr Unit A

- 315 N 12th St

- 10433 Overland Trail