300 N Highway A1a Unit H-105 Jupiter, FL 33477

Jupiter Dunes NeighborhoodEstimated Value: $512,927

2

Beds

2

Baths

1,430

Sq Ft

$359/Sq Ft

Est. Value

About This Home

This home is located at 300 N Highway A1a Unit H-105, Jupiter, FL 33477 and is currently priced at $512,927, approximately $358 per square foot. 300 N Highway A1a Unit H-105 is a home located in Palm Beach County with nearby schools including Jupiter Elementary School, Jupiter Middle School, and Jupiter High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 2, 2021

Sold by

Brewster Rob

Bought by

Shepard Reynolds Gerda

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$256,900

Outstanding Balance

$228,718

Interest Rate

2.7%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 13, 2018

Sold by

Rob Brewster Llc

Bought by

Browster Rob

Purchase Details

Closed on

Apr 24, 2007

Sold by

White Linda Dee Holcomb

Bought by

Rob Drewster Llc

Purchase Details

Closed on

Apr 15, 1997

Sold by

Pacelli Philip

Bought by

Holcomb Carlton C and Holcomb Jane C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$60,000

Interest Rate

7.69%

Mortgage Type

New Conventional

Purchase Details

Closed on

Nov 2, 1995

Sold by

Pacelli Philip and Pacelli Rosalie

Bought by

Pacelli Philip

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Shepard Reynolds Gerda | $367,000 | Attorney | |

| Shepard-Reynolds Gerda | $367,000 | None Listed On Document | |

| Browster Rob | -- | Attorney | |

| Rob Drewster Llc | $225,000 | Attorney | |

| Holcomb Carlton C | $100,000 | -- | |

| Pacelli Philip | $100 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Shepard-Reynolds Gerda | $256,900 | |

| Closed | Shepard-Reynolds Gerda | $256,900 | |

| Previous Owner | Pacelli Philip | $60,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,800 | $305,769 | -- | -- |

| 2024 | $4,800 | $321,551 | -- | -- |

| 2023 | $4,725 | $312,185 | $0 | $0 |

| 2022 | $4,796 | $303,092 | $0 | $0 |

| 2021 | $3,470 | $223,797 | $0 | $0 |

| 2020 | $3,466 | $220,707 | $0 | $220,707 |

| 2019 | $3,535 | $221,764 | $0 | $221,764 |

| 2018 | $3,908 | $211,764 | $0 | $211,764 |

| 2017 | $3,667 | $196,764 | $0 | $0 |

| 2016 | $3,414 | $168,509 | $0 | $0 |

| 2015 | $3,364 | $153,190 | $0 | $0 |

| 2014 | $3,003 | $139,264 | $0 | $0 |

Source: Public Records

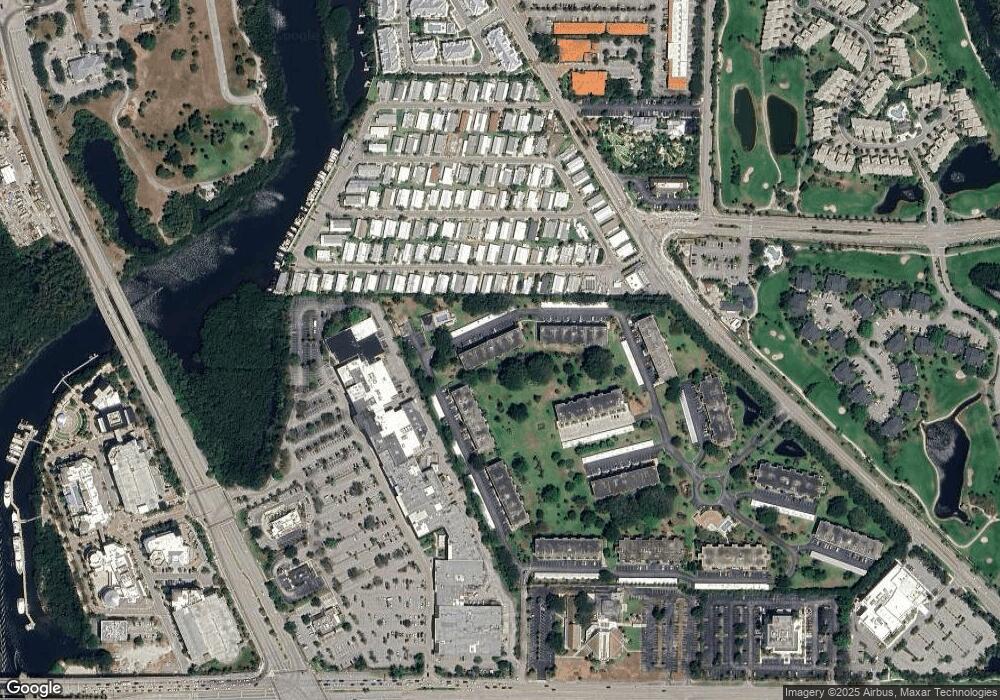

Map

Nearby Homes

- 300 N Highway A1a Unit 203c

- 300 N Highway A1a Unit 104o

- 300 N Highway A1a Unit C-405

- 300 N Highway A1a Unit A201

- 300 N Highway A1a Unit 204a

- 300 N Highway A1a Unit 103m

- 300 N Highway A1a Unit 303-G

- 300 N Highway A1a Unit 103e

- 300 N Highway A1a Unit 304 B

- 400 N Highway A1a Unit 47

- 400 N Highway A1a Unit 29

- 400 N Highway A1a Unit 117

- 704 Clubhouse Cir Unit A704

- 401 Clubhouse Cir

- 2608 Fairway Dr N

- 3003 Fairway Dr N

- 102 Clubhouse Cir

- 0 E Indiantown Rd

- 901 Sandy Oaks Dr

- 1 S Coastal Way Unit 205

- 300 N Highway A1a Unit 102

- 300 N Highway A1a Unit 106-B

- 300 N Highway A1a Unit J103

- 300 N Highway A1a Unit 106N

- 300 N Highway A1a Unit A 106

- 300 N Highway A1a Unit 201m

- 300 N Highway A1a Unit 406i

- 300 N Highway A1a Unit 302b

- 300 N Highway A1a Unit A107

- 300 N Highway A1a Unit 108e

- 300 N Highway A1a Unit J-202

- 300 N Highway A1a Unit 307-E

- 300 N Highway A1a Unit 403m

- 300 N Highway A1a Unit J-304

- 300 N Highway A1a Unit 305c

- 300 N Highway A1a Unit 403 Bldg D

- 300 N Highway A1a Unit J-203

- 300 N Highway A1a Unit 405D

- 300 N Highway A1a Unit F-301

- 300 N Highway A1a Unit E302