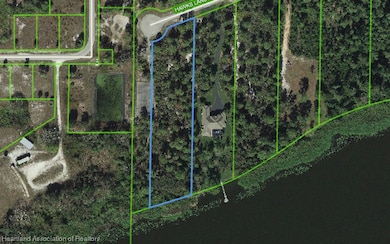

3005 Hawks Landing Cir Sebring, FL 33875

Estimated payment $1,136/month

Total Views

8,507

2.11

Acres

$85,308

Price per Acre

91,912

Sq Ft Lot

Highlights

- Lake Front

- Wooded Lot

- Cul-De-Sac

- 2.11 Acre Lot

About This Lot

This lot is located inside of one of Highlands County's most private gated communities, Hawks Landing. This 2 acre lot sits on the shores of Lake Huckleberry and has 150 ft of lake frontage. Inside you will only find luxury homes built in this community and no other homes on the cul-de-sac. This makes for a perfect location for your future home.

Property Details

Property Type

- Land

Est. Annual Taxes

- $1,043

Lot Details

- 2.11 Acre Lot

- Lake Front

- Cul-De-Sac

- Wooded Lot

- Zoning described as R1AA

HOA Fees

- $100 Monthly HOA Fees

Listing and Financial Details

- Assessor Parcel Number S-06-35-29-100-0000-0140

Map

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,210 | $60,135 | $60,135 | -- |

| 2023 | $1,210 | $60,135 | $60,135 | $0 |

| 2022 | $1,131 | $60,135 | $60,135 | $0 |

| 2021 | $1,035 | $50,112 | $50,112 | $0 |

| 2020 | $1,020 | $50,112 | $0 | $0 |

| 2019 | $1,023 | $50,112 | $0 | $0 |

| 2018 | $1,033 | $50,112 | $0 | $0 |

| 2017 | $1,044 | $50,112 | $0 | $0 |

| 2016 | $1,661 | $80,180 | $0 | $0 |

| 2015 | $1,680 | $80,180 | $0 | $0 |

| 2014 | $1,703 | $0 | $0 | $0 |

Source: Public Records

Property History

| Date | Event | Price | List to Sale | Price per Sq Ft |

|---|---|---|---|---|

| 03/07/2024 03/07/24 | For Sale | $179,999 | -- | -- |

Source: Heartland Association of REALTORS®

Purchase History

| Date | Type | Sale Price | Title Company |

|---|---|---|---|

| Warranty Deed | $159,300 | -- |

Source: Public Records

Mortgage History

| Date | Status | Loan Amount | Loan Type |

|---|---|---|---|

| Closed | $143,325 | Purchase Money Mortgage |

Source: Public Records

Source: Heartland Association of REALTORS®

MLS Number: 302104

APN: S-06-35-29-100-0000-0140

Nearby Homes

- 3000 Hawks Landing Cir

- 3029 Hawks Landing Cir

- 4500 Del Rio Ct

- 4310 Medina Way

- 5200 Diamond Dr

- 505 Barcelona Dr

- 600 Dozier Ave

- 601 Maravilla Ave

- 5400 Lafayette Ave

- 611 Barcelona Dr

- 5324 Lafayette Ave

- 202 S Huckleberry Lake Dr

- 5306 Ivory Dr

- 5314 Ivory Dr

- 611 Entrada Ave

- 5517 N Huckleberry Lake Dr

- 1005 Hawks Landing Dr

- 5541 N Huckleberry Lake Dr

- 4086 Santa Barbara Dr

- 4106 Santa Barbara Dr

- 5201 Diamond Dr

- 4620 Lafayette Ave

- 4534 Lafayette Ave

- 4615 Lake Haven Blvd

- 3505 Golfview Rd

- 1417 Kerry Dr

- 4044 Leaf Rd

- 4125 Mandarin Rd Unit 4125

- 4123 Mandarin Rd

- 4503 Sebring Ave

- 1741 Kent Dr

- 1801 Kent Dr

- 30424 Francis St Unit 30424 Francis

- 3320 Albatross Ave

- 3303 Astoria Ave

- 1001 Lakeview Dr

- 1011 Lakeview Dr

- 1025 Lakeview Dr

- 1025 Lakeview Dr Unit 1

- 307 U S Highway 27 S