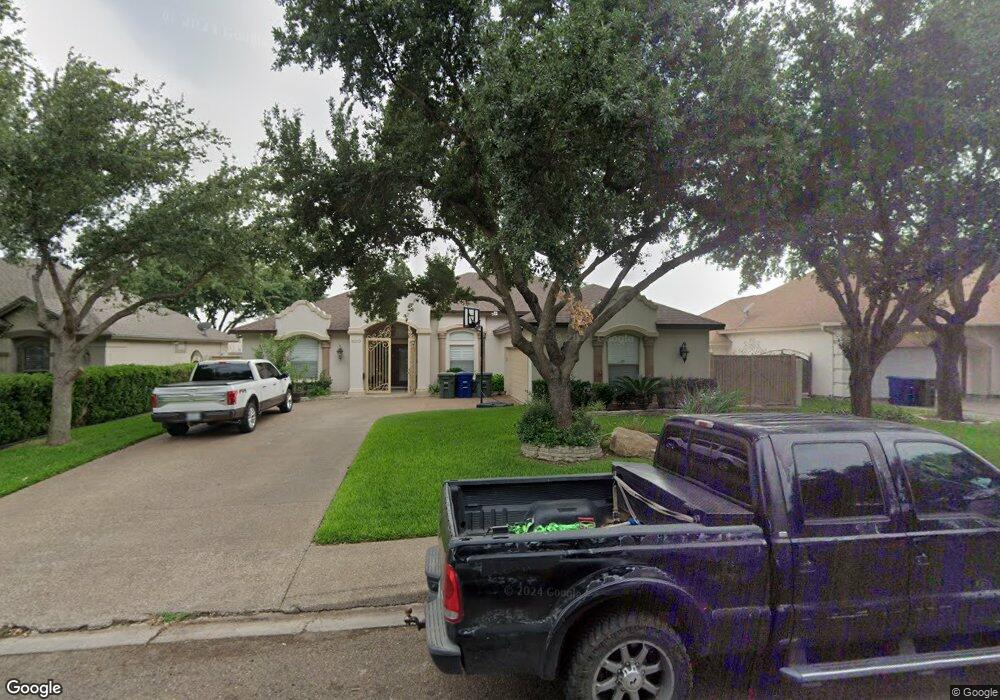

3010 Edgar Allen Poe Loop Laredo, TX 78041

Estimated Value: $340,997 - $502,000

--

Bed

--

Bath

2,150

Sq Ft

$193/Sq Ft

Est. Value

About This Home

This home is located at 3010 Edgar Allen Poe Loop, Laredo, TX 78041 and is currently estimated at $414,249, approximately $192 per square foot. 3010 Edgar Allen Poe Loop is a home located in Webb County with nearby schools including Col. Santos Benavides Elementary School, United Middle School, and John B. Alexander High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 23, 2018

Sold by

Gonzalez Ricardo R and Gonzalez Linda Maribel

Bought by

Rodriguez Ricardo and Rodriguez Isabel Zamarripa

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$234,800

Outstanding Balance

$198,854

Interest Rate

3.99%

Mortgage Type

New Conventional

Estimated Equity

$215,395

Purchase Details

Closed on

Aug 16, 2005

Sold by

Weichert Relocation Resources Inc

Bought by

Gonzalez Ricardo R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$185,600

Interest Rate

5.81%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rodriguez Ricardo | -- | Laredo Title & Abstract Ltd | |

| Gonzalez Ricardo R | -- | Webb County Title & Abstract | |

| Weichert Relocation Resources Inc | -- | Webb County Title & Abstract |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Rodriguez Ricardo | $234,800 | |

| Previous Owner | Gonzalez Ricardo R | $185,600 | |

| Previous Owner | Weichert Relocation Resources Inc | $185,600 | |

| Previous Owner | Gonzalez Ricardo R | $46,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,771 | $362,856 | $139,950 | $222,906 |

| 2024 | $1,771 | $348,875 | $139,950 | $208,925 |

| 2023 | $6,707 | $337,938 | $101,070 | $236,868 |

| 2022 | $7,023 | $309,340 | $0 | $0 |

| 2021 | $7,228 | $281,218 | $73,872 | $207,346 |

| 2020 | $6,613 | $256,950 | $73,890 | $183,060 |

| 2019 | $6,800 | $259,060 | $73,890 | $185,170 |

| 2018 | $7,109 | $267,240 | $67,860 | $199,380 |

| 2017 | $6,730 | $256,930 | $67,860 | $189,070 |

| 2016 | $6,594 | $251,740 | $60,120 | $191,620 |

| 2015 | $5,546 | $249,390 | $56,250 | $193,140 |

| 2014 | $5,546 | $240,520 | $49,100 | $191,420 |

Source: Public Records

Map

Nearby Homes

- 3022 Edgar Allen Poe Dr

- 7622 R W Emerson Loop

- 3103 Dante Loop

- 7617 Agatha Christie Dr

- 3111 Persimmon Ct

- 3004 Crest Oak Cir

- 7415 Stephen King Loop

- 2701 Els Ct

- 3717 Josefina Dr

- 2811 O Henry Dr

- 7506 Raymond Chandler Dr

- 3905 Aidin St

- 2801 Mario Puzo Dr

- 9906 Natalia Dr

- 4014 Shahram Dr

- 2120 Bermuda Dr

- 3816 Winrock Dr

- 9813 Sandhill Unit 67

- 9813 Sandhill Unit 18

- 9813 Sandhill Unit 62

- 3012 Edgar Allen Poe Loop

- 3012 Edgar Allan Poe Lp

- 3008 Edgar Allen Poe Loop

- 3014 Edgar Allen Poe Loop

- 3014 Edgar Allen Poe Dr

- 3006 Edgar Allen Poe Loop

- 3011 Edgar Allen Poe Loop

- 3009 Edgar Allen Poe Loop

- 3013 Edgar Allen Poe Loop

- 3009 Edgar Allen Poe Dr

- 3007 Edgar Allen Poe Loop

- 3016 Edgar Allen Poe Loop

- 3004 Edgar Allen Poe Loop

- 3015 Edgar Allen Poe Loop

- 3017 Edgar Allen Poe Loop

- 2918 Hemingway Loop

- 2916 Hemingway Loop

- 3018 Edgar Allen Poe Loop

- 2920 Hemingway Loop

- 3002 Edgar Allen Poe Loop