Estimated Value: $289,286 - $306,000

3

Beds

1

Bath

1,178

Sq Ft

$251/Sq Ft

Est. Value

About This Home

This home is located at 30190 Carl View, Yoder, CO 80864 and is currently estimated at $295,429, approximately $250 per square foot. 30190 Carl View is a home located in El Paso County with nearby schools including Edison Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 30, 2022

Sold by

Austin William D

Bought by

Johnson Jumoke

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$280,000

Outstanding Balance

$271,598

Interest Rate

6.95%

Mortgage Type

VA

Estimated Equity

$23,831

Purchase Details

Closed on

Aug 2, 2021

Sold by

Foxx Valley Ranch Homeowners Association

Bought by

Austin Angelika and Austin William D

Purchase Details

Closed on

Oct 27, 2020

Sold by

The Bank Of New York Mellon

Bought by

Austin William Douglas

Purchase Details

Closed on

Jun 19, 1998

Sold by

Foxx Valley Ranch

Bought by

Gist Harold

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$60,000

Interest Rate

9.75%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Johnson Jumoke | $280,000 | Stewart Title | |

| Austin William D | -- | Stewart Title | |

| Austin Angelika | -- | None Available | |

| Austin William Douglas | $58,000 | Legacy Title Group | |

| Gist Harold | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Johnson Jumoke | $280,000 | |

| Previous Owner | Gist Harold | $60,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $601 | $18,450 | -- | -- |

| 2024 | $508 | $16,380 | $570 | $15,810 |

| 2023 | $508 | $16,380 | $570 | $15,810 |

| 2022 | $638 | $13,100 | $580 | $12,520 |

| 2021 | $228 | $4,480 | $610 | $3,870 |

| 2020 | $424 | $7,440 | $930 | $6,510 |

| 2019 | $419 | $7,440 | $930 | $6,510 |

| 2018 | $350 | $6,080 | $680 | $5,400 |

| 2017 | $348 | $6,080 | $680 | $5,400 |

| 2016 | $301 | $5,240 | $710 | $4,530 |

| 2015 | $323 | $5,240 | $710 | $4,530 |

| 2014 | $264 | $4,540 | $690 | $3,850 |

Source: Public Records

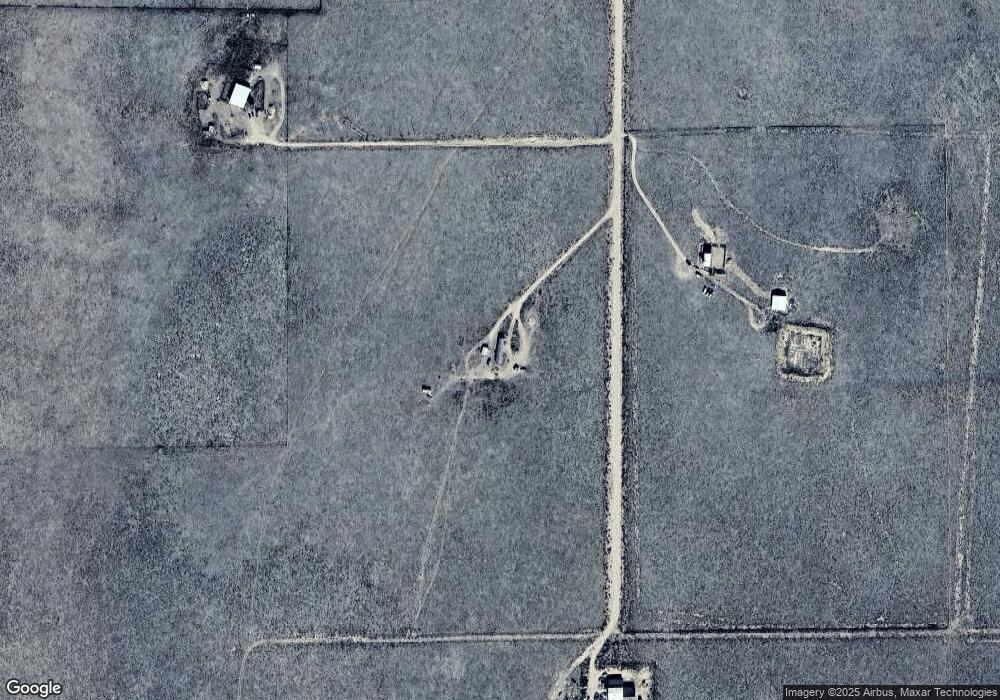

Map

Nearby Homes

- 30790 Darroll Rd

- 12495 Dan View

- 12595 Dan View

- 32290 N Neely Rd

- 31190 Lon View

- 0 Shear Rd

- 10450 S Squirrel Creek Rd

- 0 Edison Rd

- 6760 S Yoder Rd

- 37855 Shear Rd

- 7825 Boone Rd

- 24110 Mountain Prairie Dr

- 32775 Truckton Rd

- 33550 Truckton Rd

- 33670 Truckton Rd

- 6325 Night Train Ln

- 24555 Myers Rd

- 8450 Edison Rd

- 31495 Myers Rd

- 33455 Fossinger Rd

Your Personal Tour Guide

Ask me questions while you tour the home.