303 Avatar Ct Havre de Grace, MD 21078

Estimated Value: $571,000 - $673,000

--

Bed

3

Baths

2,400

Sq Ft

$253/Sq Ft

Est. Value

About This Home

This home is located at 303 Avatar Ct, Havre de Grace, MD 21078 and is currently estimated at $607,205, approximately $253 per square foot. 303 Avatar Ct is a home located in Harford County with nearby schools including Havre de Grace Elementary School, Havre de Grace Middle School, and Havre de Grace High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 21, 2019

Sold by

Mcfadden Leo and Mcfadden Deborah

Bought by

Mcfadden Leo Edward and Mcfadden Shaun Jean

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$356,000

Outstanding Balance

$311,735

Interest Rate

3.9%

Mortgage Type

New Conventional

Estimated Equity

$295,470

Purchase Details

Closed on

Jun 23, 2006

Sold by

Nvr Inc

Bought by

Leo Mc Fadden and Mc Fadden Deborah

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$360,000

Interest Rate

6.55%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 19, 2006

Sold by

Nvr Inc

Bought by

Leo Mc Fadden and Mc Fadden Deborah

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$360,000

Interest Rate

6.55%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mcfadden Leo Edward | $445,000 | Lawyers Trust Title Company | |

| Leo Mc Fadden | $531,665 | -- | |

| Leo Mc Fadden | $531,665 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mcfadden Leo Edward | $356,000 | |

| Previous Owner | Leo Mc Fadden | $360,000 | |

| Previous Owner | Leo Mc Fadden | $360,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,117 | $469,233 | $0 | $0 |

| 2024 | $4,117 | $431,900 | $117,100 | $314,800 |

| 2023 | $4,026 | $422,333 | $0 | $0 |

| 2022 | $3,935 | $412,767 | $0 | $0 |

| 2021 | $2,016 | $403,200 | $117,100 | $286,100 |

| 2020 | $2,016 | $400,867 | $0 | $0 |

| 2019 | $4,008 | $398,533 | $0 | $0 |

| 2018 | $3,949 | $396,200 | $102,100 | $294,100 |

| 2017 | $3,926 | $396,200 | $0 | $0 |

| 2016 | -- | $391,533 | $0 | $0 |

| 2015 | $4,393 | $389,200 | $0 | $0 |

| 2014 | $4,393 | $389,200 | $0 | $0 |

Source: Public Records

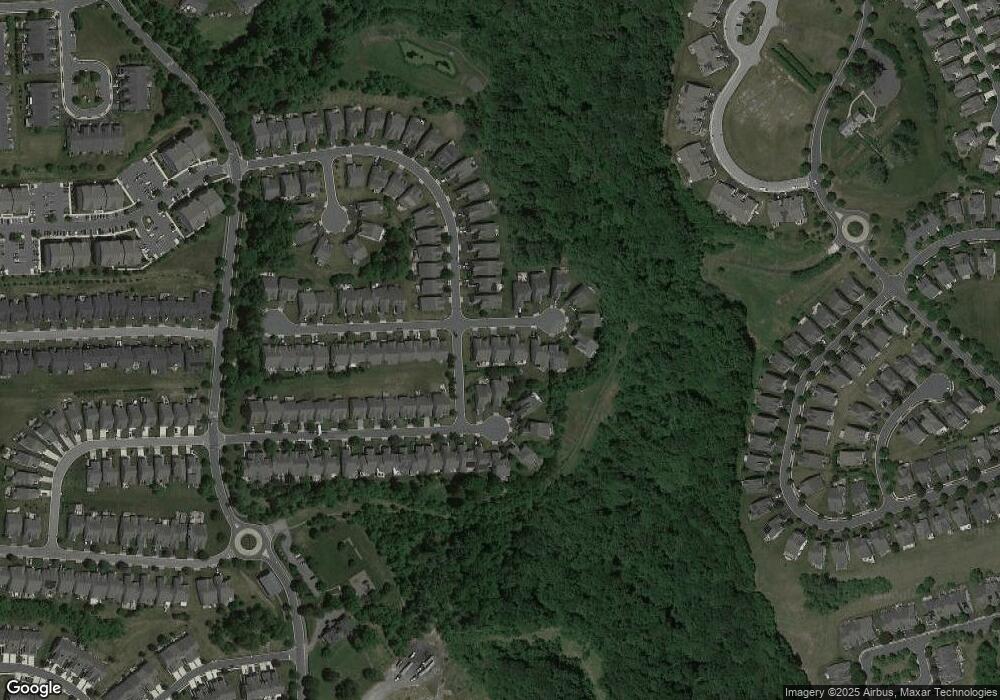

Map

Nearby Homes

- 314 Victory Gallop Ct

- 217 Smarty Jones Terrace

- 200 Smarty Jones Terrace

- TBB-JORDAN III Justify Cir

- 203 Smarty Jones Terrace

- 204 Secretariat Dr Unit G

- TBB-SOPHIA Justify Cir

- 417 Azra Ct

- TBB-JORDAN II Justify Cir

- 146 Snow Chief Dr

- 103 Flying Ebony Place

- 126 A Snow Chief Dr

- 304 Cigar Loop

- 502 Counterpoint Cir

- 513 Majestic Prince Cir

- 551 Majestic Prince Cir

- 202 Man o War Place

- 221 War Admiral Way

- 311 Sunrise Ct

- 302 Friar Rock Cir

- 305 Avatar Ct

- 301 Avatar Ct

- 326 Seattle Slew Place

- 307 Avatar Ct

- 324 Seattle Slew Place

- 236 Spectacular Bid Dr

- 301 Victory Gallop Ct

- 328 Seattle Slew Place

- 309 Avatar Ct

- 304 Avatar Ct

- 322 Seattle Slew Place

- 303 Victory Gallop Ct

- 306 Avatar Ct

- 232 Spectacular Bid Dr

- 225 Spectacular Bid Dr

- 311 Avatar Ct

- 330 Seattle Slew Place

- 320 Seattle Slew Place

- 305 Victory Gallop Ct

- 308 Avatar Ct