304 3rd St N Deer Park, WI 54007

Cylon NeighborhoodEstimated Value: $229,294 - $288,000

2

Beds

2

Baths

--

Sq Ft

0.43

Acres

About This Home

This home is located at 304 3rd St N, Deer Park, WI 54007 and is currently estimated at $262,824. 304 3rd St N is a home located in St. Croix County with nearby schools including Lien Elementary School, Amery Intermediate School, and Amery Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 28, 2018

Sold by

Miller Kari

Bought by

Bryant James Norman

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$142,590

Outstanding Balance

$124,347

Interest Rate

4.5%

Mortgage Type

New Conventional

Estimated Equity

$138,477

Purchase Details

Closed on

Aug 31, 2016

Sold by

Schwanke Ethan D and Schwanke Caitlin

Bought by

Miller Kari and Miller Mark

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$127,546

Interest Rate

3.25%

Mortgage Type

FHA

Purchase Details

Closed on

Feb 9, 2015

Sold by

Wells Fargo Bank Na

Bought by

Schwanke Ethan D and Schwanke Caitlin J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$76,500

Interest Rate

3.64%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 6, 2013

Sold by

Pankonien Dell R and Pankonien Lesley L

Bought by

Wells Fargo Bank Na

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bryant James Norman | $147,000 | None Available | |

| Miller Kari | $129,900 | Westconsin Title | |

| Schwanke Ethan D | $75,000 | Stewart Title Company | |

| Wells Fargo Bank Na | $73,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bryant James Norman | $142,590 | |

| Previous Owner | Miller Kari | $127,546 | |

| Previous Owner | Schwanke Ethan D | $76,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $22 | $173,100 | $6,800 | $166,300 |

| 2023 | $2,118 | $173,100 | $6,800 | $166,300 |

| 2022 | $1,753 | $173,100 | $6,800 | $166,300 |

| 2021 | $1,379 | $112,100 | $5,500 | $106,600 |

| 2020 | $1,500 | $112,100 | $5,500 | $106,600 |

| 2019 | $1,505 | $112,100 | $5,500 | $106,600 |

| 2018 | $1,790 | $112,100 | $5,500 | $106,600 |

| 2017 | $1,637 | $112,100 | $5,500 | $106,600 |

| 2016 | $1,637 | $100,600 | $5,500 | $95,100 |

| 2015 | $1,608 | $100,600 | $5,500 | $95,100 |

| 2014 | $1,774 | $100,600 | $5,500 | $95,100 |

| 2013 | -- | $124,000 | $7,500 | $116,500 |

Source: Public Records

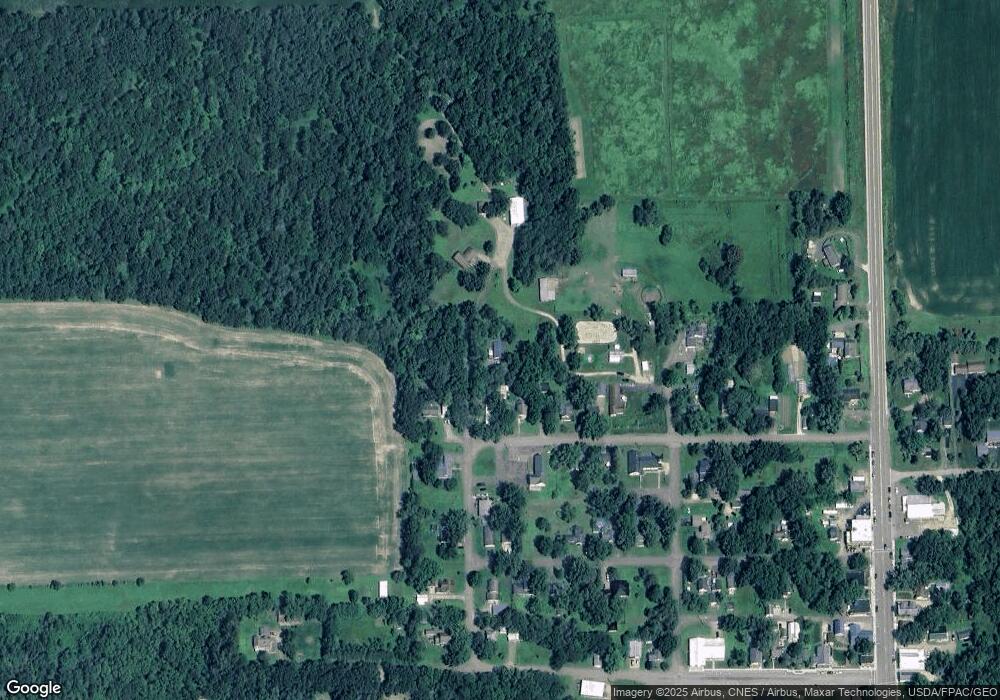

Map

Nearby Homes

- 1131 County Line Ave

- xxx Lot 3 County Line Ave

- XXX 3rd Ave

- 2150 220th St

- 143 Highway 46

- 1797 County Road H

- Lot 1 20th Ave

- 1719 County Road H

- 1909 Hwy 64

- 1909 Highway 64

- XXXX 363rd St

- Lot 2 30th Ave

- 157 153 St

- 2389 Us Highway 63

- 1735 Highway 63

- 1735 Hwy 63

- TBD Hwy 63

- 1779 176th St

- 160 US Highway 63

- TBD 155th St