304 Piedmont G Unit 3040 Delray Beach, FL 33484

Kings Point NeighborhoodEstimated Value: $76,019 - $117,000

1

Bed

1

Bath

760

Sq Ft

$120/Sq Ft

Est. Value

About This Home

This home is located at 304 Piedmont G Unit 3040, Delray Beach, FL 33484 and is currently estimated at $91,505, approximately $120 per square foot. 304 Piedmont G Unit 3040 is a home located in Palm Beach County with nearby schools including Orchard View Elementary School, Spanish River Community High School, and Carver Community Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 11, 2014

Sold by

Dimarsico Judith B

Bought by

Dimarsico Judith B and Judith B Dimarsico Living Trust

Current Estimated Value

Purchase Details

Closed on

Nov 8, 2012

Sold by

Clancy Timothy R

Bought by

Dimarsico Judith B

Purchase Details

Closed on

Aug 8, 2011

Sold by

Deangelis Robert

Bought by

Clancy Timothy R

Purchase Details

Closed on

Feb 10, 2011

Sold by

Luckette Rachelle

Bought by

Deangelis Robert

Purchase Details

Closed on

Feb 9, 2009

Sold by

Abrahams Miriam

Bought by

Abrahams Miriam

Purchase Details

Closed on

Mar 16, 2005

Sold by

Abrahams Sanford and Luckette Rachelle

Bought by

Abrahams Sanford

Purchase Details

Closed on

Apr 13, 2001

Sold by

Sanford Abrahams M and Sanford Barbara Abrahams

Bought by

Abrahams Sanford

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dimarsico Judith B | -- | Attorney | |

| Dimarsico Judith B | $20,000 | None Available | |

| Clancy Timothy R | $12,000 | None Available | |

| Deangelis Robert | $12,000 | Direct Title Ins Agency Ltd | |

| Abrahams Miriam | -- | Attorney | |

| Abrahams Sanford | -- | -- | |

| Abrahams Sanford | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $256 | $20,479 | -- | -- |

| 2023 | $248 | $19,883 | $0 | $0 |

| 2022 | $246 | $19,304 | $0 | $0 |

| 2021 | $231 | $18,742 | $0 | $0 |

| 2020 | $227 | $18,483 | $0 | $0 |

| 2019 | $230 | $18,067 | $0 | $0 |

| 2018 | $247 | $17,730 | $0 | $0 |

| 2017 | $233 | $17,365 | $0 | $0 |

| 2016 | $231 | $17,008 | $0 | $0 |

| 2015 | $228 | $16,890 | $0 | $0 |

| 2014 | $230 | $16,756 | $0 | $0 |

Source: Public Records

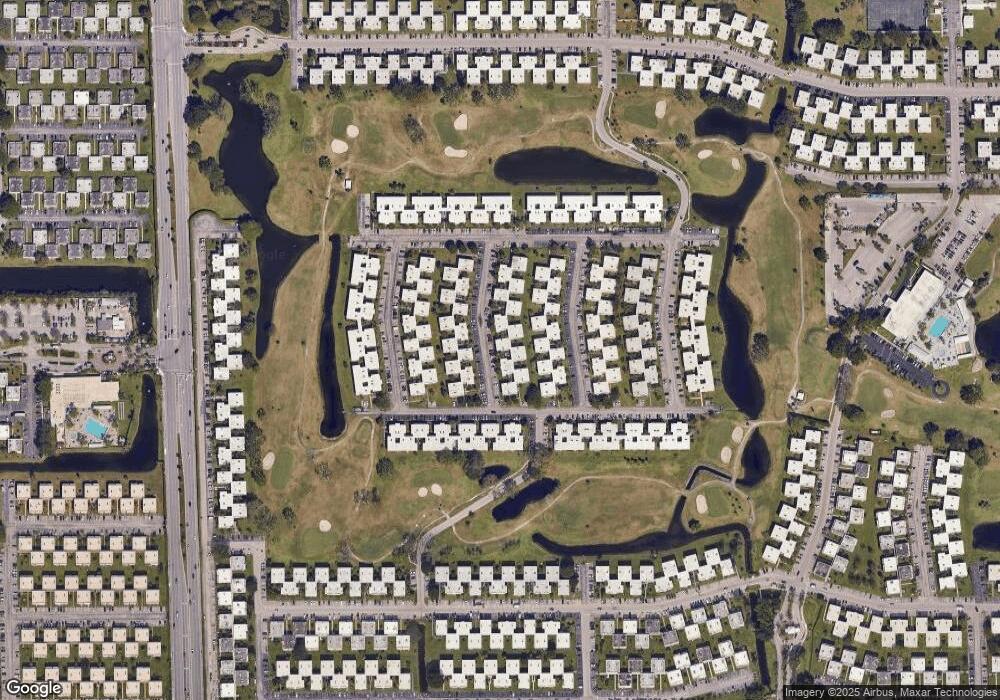

Map

Nearby Homes

- 357 Piedmont H Unit 357

- 292 Piedmont G Unit 292

- 498 Piedmont K Unit 4980

- 269 Piedmont F Unit F

- 523 Piedmont K Unit 5230

- 497 Piedmont K Unit 4970

- 400 Piedmont I

- 514 Piedmont K Unit k

- 222 Piedmont E

- 450 Piedmont J Unit J

- 191 Piedmont D

- 475 Piedmont J Unit 4750

- 54 Piedmont B

- 459 Piedmont J

- 62 Piedmont B

- 9 Piedmont A

- 464 Piedmont J Unit 4640

- 126 Piedmont C

- 122 Piedmont C Unit 122

- 605 Flanders M

- 328 Piedmont G Unit 328

- 328 Piedmont G Unit G

- 328 Piedmont G Unit 3280

- 327 Piedmont G

- 305 Piedmont G Unit 3050

- 303 Piedmont G Unit 3030

- 302 Piedmont G Unit 3020

- 331 Piedmont G

- 306 Piedmont G

- 307 Piedmont G Unit 3070

- 329 Piedmont G Unit 3290

- 326 Piedmont G

- 300 Piedmont G Unit G

- 300 Piedmont G

- 301 Piedmont G Unit 3010

- 330 Piedmont G Unit 3300

- 324 Piedmont G

- 332 Piedmont G Unit 3320

- 308 Piedmont G Unit 3080

- 325 Piedmont G