3041 Westminster Dr Unit 205 Beavercreek, OH 45431

Estimated Value: $186,000 - $245,000

3

Beds

2

Baths

1,580

Sq Ft

$131/Sq Ft

Est. Value

About This Home

This home is located at 3041 Westminster Dr Unit 205, Beavercreek, OH 45431 and is currently estimated at $206,546, approximately $130 per square foot. 3041 Westminster Dr Unit 205 is a home located in Greene County with nearby schools including Shaw Elementary School, Jacob Coy Middle School, and Beavercreek High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 22, 2021

Sold by

Etheredge Robert Ms

Bought by

Coleman Juliana M and Coleman Alyssa M

Current Estimated Value

Purchase Details

Closed on

Jul 15, 2016

Sold by

Addy Ingrid L and Addy Steven K

Bought by

Etheredge Robert M S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$115,696

Interest Rate

3.54%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 9, 2015

Sold by

Haynes Addison G and Haynes Kali

Bought by

Addy Ingrid L

Purchase Details

Closed on

Mar 4, 2013

Sold by

Alsup James R

Bought by

Haynes Addison G and Haynes Kali

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$103,500

Interest Rate

3.5%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 16, 2012

Sold by

Hayne Stephen P and Hayne Stacie E

Bought by

Alsup James R

Purchase Details

Closed on

May 15, 2012

Sold by

Hayne Stephen P and Hayne Stacie E

Bought by

Alsup James R

Purchase Details

Closed on

Mar 12, 2004

Sold by

Hills Communities Inc

Bought by

Hayne Stephen P and Hayne Stacie E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$121,560

Interest Rate

5.74%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Coleman Juliana M | $140,000 | None Available | |

| Etheredge Robert M S | $112,000 | Attorney | |

| Addy Ingrid L | $112,000 | First Ohio Title Agency | |

| Haynes Addison G | $115,000 | None Available | |

| Alsup James R | $115,000 | None Available | |

| Alsup James R | $115,000 | None Available | |

| Hayne Stephen P | $125,400 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Etheredge Robert M S | $115,696 | |

| Previous Owner | Haynes Addison G | $103,500 | |

| Previous Owner | Hayne Stephen P | $121,560 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,568 | $53,590 | $7,000 | $46,590 |

| 2023 | $3,568 | $53,590 | $7,000 | $46,590 |

| 2022 | $3,061 | $39,180 | $7,000 | $32,180 |

| 2021 | $1,618 | $38,370 | $7,000 | $31,370 |

| 2020 | $1,629 | $38,370 | $7,000 | $31,370 |

| 2019 | $1,915 | $40,120 | $10,500 | $29,620 |

| 2018 | $2,938 | $40,120 | $10,500 | $29,620 |

| 2017 | $3,046 | $40,120 | $10,500 | $29,620 |

| 2016 | $3,046 | $39,360 | $10,500 | $28,860 |

| 2015 | $2,965 | $39,360 | $10,500 | $28,860 |

| 2014 | $2,919 | $39,360 | $10,500 | $28,860 |

Source: Public Records

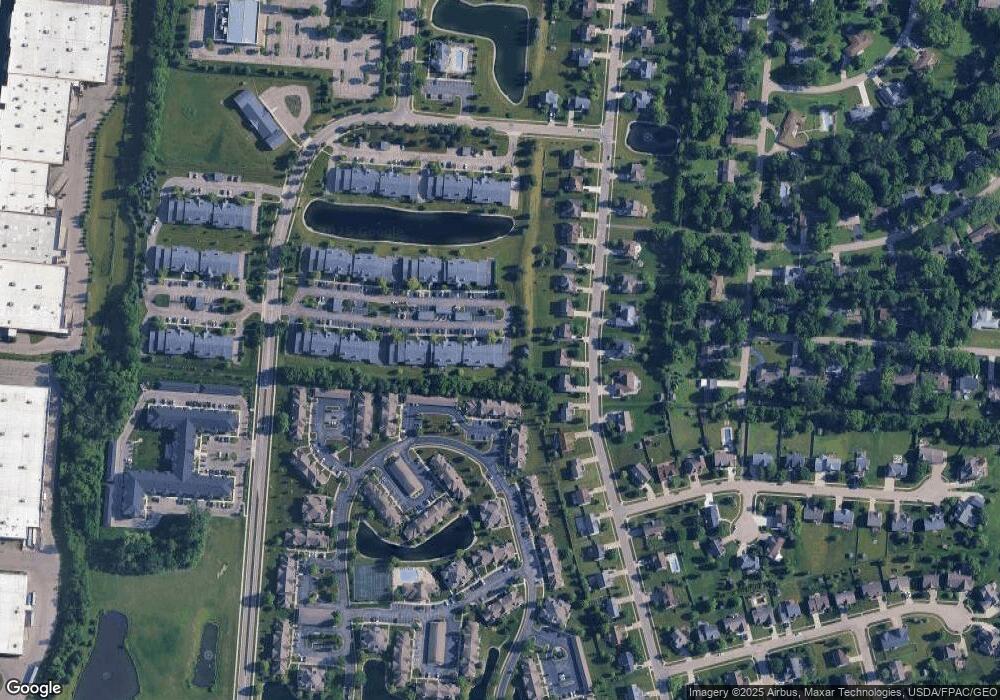

Map

Nearby Homes

- 2548 Hillsdale Dr

- 2982 Idaho Falls Dr

- 2629 Morning Sun Dr

- 2930 Coldwater Ct

- 2886 Kemp Rd

- 2821 Varsity Dr

- 2507 Bent Grass Dr

- 2490 Bent Grass Dr

- 2481 Bent Grass Dr

- 2510 Bent Grass Dr

- 2478 Bent Grass Dr

- 2504 Bent Grass Dr

- 2415 New Germany Trebein Rd

- 2639 Golden Leaf Dr

- 2715 Golden Leaf Dr Unit 19-204

- 2727 Golden Leaf Dr Unit 18-300

- 2735 Golden Leaf Dr Unit 18-202

- 2741 Golden Leaf Dr Unit 18-203

- Beckett Plan at Bent Creek Woods - Masterpiece Collection

- Margot Plan at Bent Creek Woods - Masterpiece Collection

- 3041 Westminster Dr Unit 208

- 3041 Westminster Dr Unit 207

- 3041 Westminster Dr Unit 206

- 3041 Westminster Dr Unit 103

- 3041 Westminster Dr Unit 102

- 3041 Westminster Dr Unit 101

- 3041 Westminster Dr

- 3041 Westminster Dr Unit 208

- 3041 Westminster Dr Unit 207

- 3041 Westminster Dr Unit 206

- 3041 Westminster Dr

- 3041 Westminster Dr Unit 104

- 3041 Westminster Dr Unit 120

- 3041 Westminster Dr Unit 101

- 3045 Westminster Dr Unit 207

- 3045 Westminster Dr Unit 312

- 3045 Westminster Dr Unit 311

- 3045 Westminster Dr Unit 310

- 3045 Westminster Dr Unit 104

- 3045 Westminster Dr Unit 102