305 County Road 2627 Decatur, TX 76234

Estimated Value: $444,101 - $933,000

4

Beds

2

Baths

2,112

Sq Ft

$326/Sq Ft

Est. Value

About This Home

This home is located at 305 County Road 2627, Decatur, TX 76234 and is currently estimated at $688,551, approximately $326 per square foot. 305 County Road 2627 is a home located in Wise County with nearby schools including Decatur High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 3, 2024

Sold by

Sowder Shawn R and Sowder Angela

Bought by

Whitted Robert P and Whitted Lora D

Current Estimated Value

Purchase Details

Closed on

May 8, 2010

Sold by

Bennett James G and Bennett Ruth

Bought by

Sowder Shawn R and Sowder Angela

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$197,341

Interest Rate

5.25%

Mortgage Type

FHA

Purchase Details

Closed on

Oct 3, 2006

Sold by

Low Sandra

Bought by

Sowder Shawn and Sowder Angela

Purchase Details

Closed on

Nov 4, 2005

Sold by

Bennett James G and Bennett Rhonda J

Bought by

Low Sandra K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$153,000

Interest Rate

5.92%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 24, 2003

Sold by

Seraiah Chori and Seraiah Catherine

Bought by

Sowder Shawn and Sowder Angela

Purchase Details

Closed on

Oct 5, 2000

Sold by

Pemberton Danny L

Bought by

Sowder Shawn and Sowder Angela

Purchase Details

Closed on

Jan 1, 1901

Bought by

Sowder Shawn and Sowder Angela

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Whitted Robert P | -- | None Listed On Document | |

| Sowder Shawn R | -- | -- | |

| Sowder Shawn | -- | -- | |

| Low Sandra K | -- | Standard Land Title Company | |

| Sowder Shawn | -- | -- | |

| Sowder Shawn | -- | -- | |

| Sowder Shawn | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Sowder Shawn R | $197,341 | |

| Previous Owner | Low Sandra K | $153,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $402 | $49,061 | $24,464 | $24,597 |

| 2024 | $402 | $40,599 | $15,720 | $24,879 |

| 2023 | $390 | $29,372 | $0 | $0 |

| 2022 | $382 | $26,623 | $0 | $0 |

| 2021 | $369 | $258,640 | $244,810 | $13,830 |

| 2020 | $353 | $179,950 | $164,750 | $15,200 |

| 2019 | $295 | $175,090 | $164,750 | $10,340 |

| 2018 | $5,338 | $365,390 | $148,730 | $216,660 |

| 2017 | $4,710 | $306,050 | $126,660 | $179,390 |

| 2016 | $4,267 | $271,760 | $115,980 | $155,780 |

| 2015 | -- | $273,600 | $115,980 | $157,620 |

| 2014 | -- | $252,270 | $94,630 | $157,640 |

Source: Public Records

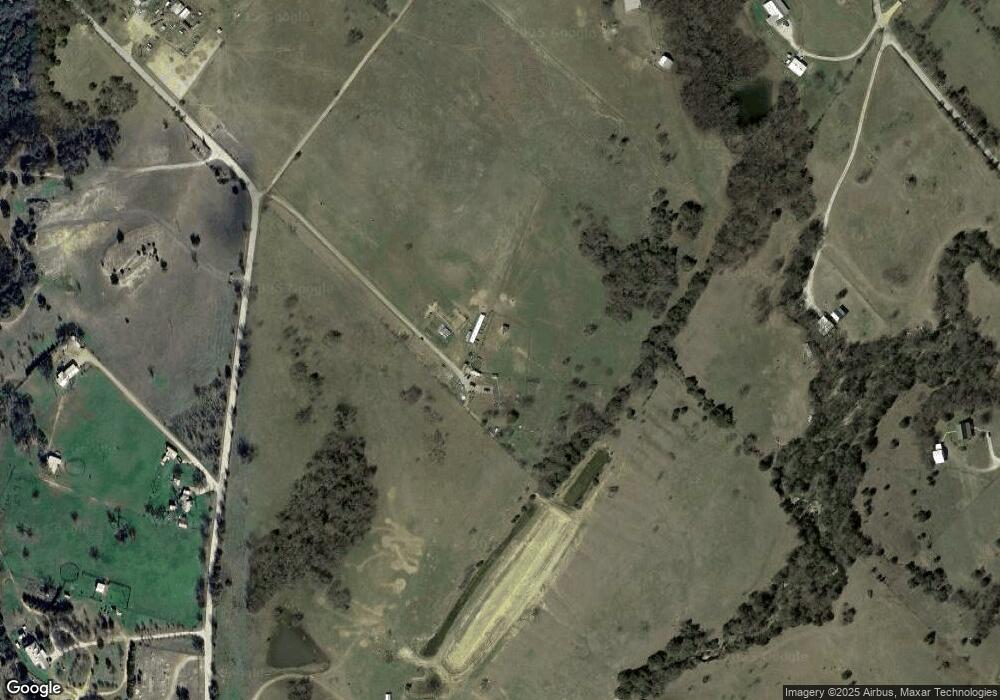

Map

Nearby Homes

- 1430 County Road 2735

- 392 Pr Road 2625

- 200 Pr 2462

- TBD County Road 2740

- 459 Private Road 2625

- 2591 Fm 1204

- 117 County Road 2646

- Lot 4 Pr 4460

- TBD 7 County Road 2830

- Tract 2 County Rd 2745

- 145 County Road 2327

- 171 Cr-2825

- 123 El Dorado St

- 196 El Dorado St

- 204 El Dorado St

- 620 County Road 2937

- TBD Pr 2454

- 2454 Private Rd

- 755 County Road 2845

- 12370 Fortenberry Rd

- 483 County Road 2627

- 426 County Road 2627

- 1363 County Road 2625

- 797 County Road 2627

- 1609 County Road 2625

- 406 County Road 2627

- 269 County Road 2627

- 1349 County Road 2625

- 1405 County Road 2625

- 474 County Road 2627

- 1501 County Road 2625

- 2625 Cr

- 1562 County Road 2625

- 219 County Road 2937 Unit 2553

- 1773 County Road 2625

- 237 County Road 2627

- 670 County Road 2627

- 148 County Road 2627

- 1337 County Road 2625

- 1612 County Road 2625