308 E Pace Ln Unit 1810 North Salt Lake, UT 84054

Estimated Value: $760,000 - $1,171,749

4

Beds

3

Baths

2,300

Sq Ft

$440/Sq Ft

Est. Value

About This Home

This home is located at 308 E Pace Ln Unit 1810, North Salt Lake, UT 84054 and is currently estimated at $1,011,187, approximately $439 per square foot. 308 E Pace Ln Unit 1810 is a home located in Davis County with nearby schools including Orchard School, South Davis Junior High School, and Woods Cross High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 10, 2020

Sold by

Lawrence Christopher John

Bought by

Lawrence Christopher John and Lawrence Lisa T

Current Estimated Value

Purchase Details

Closed on

Oct 6, 2020

Sold by

Eaglepointe Development Lc

Bought by

Lawrence Christopher John

Purchase Details

Closed on

Aug 12, 2016

Sold by

Eaglepointe Development Lc

Bought by

Lawrence Christopher John

Purchase Details

Closed on

May 21, 2014

Sold by

Eaglepointe Development Lc

Bought by

South Davis Sewer District

Purchase Details

Closed on

Apr 9, 2014

Sold by

B & E Pace Investments Llc

Bought by

Eagelpointe Development Lc

Purchase Details

Closed on

Dec 23, 2013

Sold by

Eaglepointe Development Lc

Bought by

B & E Pace Investment Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lawrence Christopher John | -- | None Available | |

| Lawrence Family Revocable Living Trust | -- | Dopp Scott | |

| Lawrence Christopher John | -- | First American Title | |

| Lawrence Christopher John | -- | First American Title | |

| South Davis Sewer District | -- | None Available | |

| Eagelpointe Development Lc | -- | First American Title | |

| B & E Pace Investment Llc | -- | First American Title |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,392 | $572,550 | $225,917 | $346,633 |

| 2024 | $2,392 | $543,950 | $239,798 | $304,152 |

| 2023 | $2,507 | $979,000 | $313,844 | $665,156 |

| 2022 | $3,637 | $533,500 | $174,293 | $359,207 |

| 2021 | $3,566 | $841,000 | $261,068 | $579,932 |

| 2020 | $2,987 | $744,000 | $223,713 | $520,287 |

| 2019 | $2,943 | $721,000 | $216,580 | $504,420 |

| 2018 | $2,691 | $673,000 | $194,951 | $478,049 |

| 2016 | $969 | $74,481 | $74,481 | $0 |

| 2015 | $1,009 | $74,481 | $74,481 | $0 |

| 2014 | $989 | $74,481 | $74,481 | $0 |

Source: Public Records

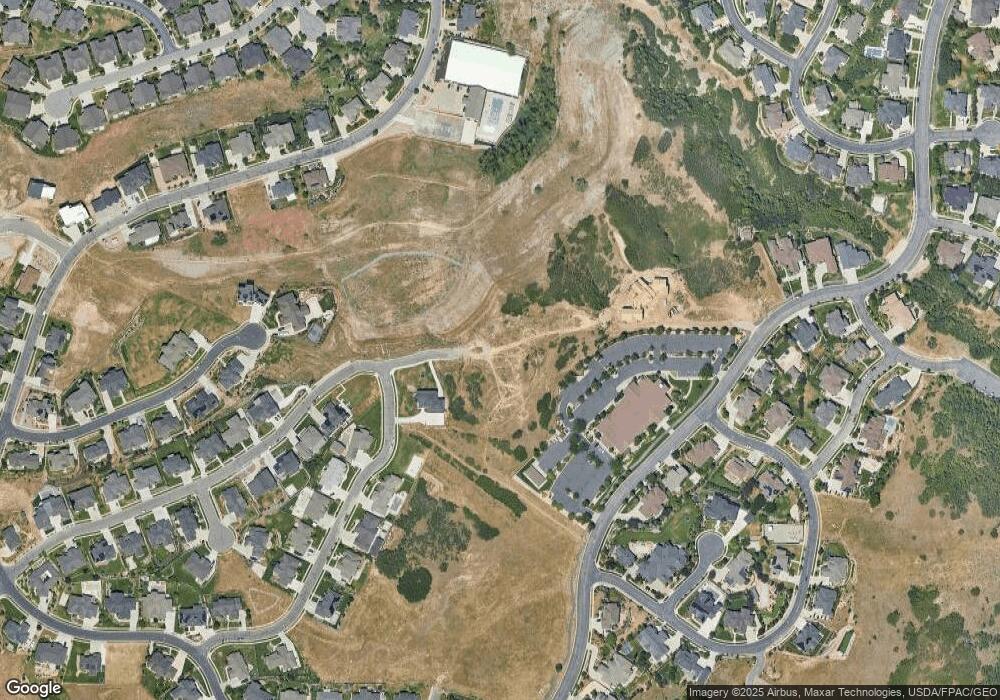

Map

Nearby Homes

- 928 S Pace Place

- 755 Parkway Dr

- 871 S Winter Ln

- 733 Eagle Pass

- 886 S Winter Ln

- 837 S Finley Cir

- 311 Edgemont Dr

- 985 Plum Tree Ct Unit 1

- 715 S Miller Ave

- 1045 Plum Tree Ct Unit 4B

- 460 S Sunset Ridge Dr

- 271 E Eagle Ridge Dr

- 398 Lofty Ln

- 285 Constitution Way

- 720 Freedom Cir

- 520 Lacey Way

- 585 Marialana Way

- 151 S Bernice Way

- 55 W Center St Unit 206

- 55 W Center St Unit 331

- 909 S Pace Place

- 324 E Pace Ln Unit 1809

- 309 E Pace Ln Unit 1811

- 309 E Pace Ln

- 917 S Pace Place

- 332 E Pace Ln

- 293 E Pace Ln

- 293 E Pace Ln

- 914 S Silvertree Ln

- 205 E Pace Ln Unit 1401

- 932 S Silvertree Ln Unit 1803

- 884 S Silvertree Ln Unit 1805

- 329 E Pace Ln

- 910 S Pace Place

- 279 E Pace Ln

- 280 Parkway Cir Unit 1610

- 282 Parkway Cir Unit 1610

- 266 Parkway Cir Unit 1611

- 922 S Pace Place

- 342 E Pace Ln Unit 1807